General Motors announced indefinite layoffs affecting approximately 1,750 workers across Michigan and Ohio in late October 2025.

The Detroit area’s all-electric Factory Zero will operate with a single shift instead of two, eliminating 1,200 positions. Concurrently, Ultium Cells battery facility in Ohio cuts 550 jobs. This restructuring reflects GM’s response to slower-than-expected electric vehicle adoption and regulatory uncertainty following the September 2025 expiration of federal EV tax credits.

What’s Closing and Where

The primary closures include Factory Zero in Detroit’s all-electric production facility and Ultium Cells in Warren, Ohio. Additionally, temporary production halts begin January 2026 at Ultium Cells facilities in both Ohio and Spring Hill, Tennessee, with 850 temporary layoffs in Ohio and 700 in Tennessee.

A Michigan stamping and components facility faces 120 temporary layoffs. These facilities will remain offline through mid-2026 while GM upgrades infrastructure and reassesses EV production capacity alignment with actual market demand.

The Tax Credit Cliff and Market Timing

GM’s announcement follows Congress and President Trump’s termination of the $7,500 federal EV tax credit on September 30, 2025. This incentive had driven consumer purchasing urgency before expiration. With the credit eliminated, prospective buyers lost both the $7,500 incentive for new vehicles and $4,000 for used EVs.

GM recorded a $16 billion impairment charge related to declining EV plant valuations and workforce restructuring costs. The company cited “evolving regulatory landscape” and slower near-term EV adoption in justifying capacity reductions.

Financial Impact on Manufacturing Operations

GM reported a $16 billion special charge to account for decreased EV plant valuations and restructuring expenses including workforce reductions and supplier agreement cancellations. The company acknowledged that its electric vehicle business segment lost $16 billion in value as tax incentives eroded and emission regulatory expectations shifted.

Despite these structural headwinds, GM maintains official commitment to U.S. manufacturing presence. However, impacted workers and communities face immediate economic disruption, with eligibility for temporary wage continuation and benefits through union protections.

Permanent vs. Temporary Layoffs—What Workers Face

Of approximately 1,750 total job reductions, 1,200 at Factory Zero face indefinite layoffs after single-shift operations begin. At Ultium Cells Ohio, 550 workers are indefinitely laid off while 850 experience temporary furloughs. In Tennessee, 700 workers face temporary layoffs.

The company states affected employees “may be eligible to continue receiving a significant portion of their regular wages or salary, plus benefits” during temporary closures. However, indefinite layoffs provide no guaranteed recall date, creating long-term uncertainty for 1,750 workers and their families.

Why Is EV Adoption Slowing?

GM cited “slower near-term EV adoption and evolving regulatory landscape” for capacity reductions. The September 2025 expiration of the $7,500 federal tax credit removed a significant purchase incentive. Additionally, regulatory uncertainty—including changing emission standards and potential policy reversals—created hesitation among consumers and manufacturers.

Vehicle prices remain elevated due to battery costs and supply chain pressures. Consumer surveys indicate many buyers are waiting for cheaper EV models and improved charging infrastructure before committing to electric purchases.

Post-UAW Contract Shock

These layoffs arrive just months after GM ratified a contentious 2023 UAW contract that delivered significant wage gains, cost-of-living adjustments, and improved job security language following a high-profile strike. Workers and union leadership had celebrated job protection provisions.

However, contract language protecting workers at specific plants did not prevent facility restructuring or capacity reductions at plants operating below target volumes. This contradiction—union victory followed by major layoffs—undermines confidence in contract protections and raises questions about manufacturing durability in the Midwest.

Direct Economic Impact on Communities

The 1,750 indefinite layoffs represent direct income loss for affected workers and families. Using conservative $50,000-60,000 annual wage-and-benefits estimates for UAW workers, the direct annual payroll loss reaches approximately $87-105 million. Local and state tax revenues decline immediately from reduced income and sales tax contributions.

Schools dependent on property tax revenue face funding pressures. Small businesses—restaurants, retail, services—lose customer spending power. Property values in manufacturing-dependent communities typically decline as employment uncertainty spreads and out-migration increases.

Multiplier Effects and Indirect Job Losses

Economic multiplier effects typically extend 2-3 times the initial job loss across supplier companies, logistics, and service sectors. Consequently, 1,750 direct layoffs may trigger 3,500-5,250 additional job losses among suppliers, retailers, and service providers dependent on manufacturing payroll spending. Parts suppliers report reduced orders from assembly plant slowdowns.

Transportation companies anticipate lower shipping volumes. Local restaurants and retail establishments brace for declining customer traffic. Community-wide unemployment rises beyond direct auto worker figures, compounding local economic strain and municipal revenue challenges across affected regions.

Supply Chain Ripple Effects

Lower EV and battery production volumes reduce demand from suppliers manufacturing components, materials, and subassemblies. Companies dependent on Ultium Cells orders scale back operations or implement layoffs themselves. International Automotive Components’ closures in Michigan affected additional workers.

Transportation and logistics providers experience reduced shipment volumes. Companies that had hired workers expecting sustained EV production demand now face unexpected capacity underutilization. Supply chain restructuring cascades through regional manufacturing networks, with smaller suppliers facing potential insolvency if they lack financial reserves or alternative customers.

Worker Options and Relocation Challenges

UAW-represented workers have several options: transfers to other GM facilities, retraining programs, or income security provisions under the 2023 contract. However, available transfers often require relocation to different states or regions—costly and disruptive for families with established roots, schools, and community ties.

Retraining programs offer paths to EV production or other manufacturing sectors but require significant time investment and accept no wage guarantees in new roles. Income security provisions provide temporary relief but do not address long-term employment security or career stability for workers expecting manufacturing careers to retirement.

Impact on Public Services and Schools

School districts dependent on property and income tax revenue from manufacturing employment face budget pressures immediately. Reduced enrollment in some communities follows out-migration of displaced workers. Municipal services including police, fire, and infrastructure maintenance become strained as tax bases contract.

Healthcare providers report increased uninsured patients among recently displaced workers. Libraries, parks, and community programs reduce hours or services. Long-term disinvestment in public services creates additional community deterioration beyond direct employment losses, affecting quality of life and economic development prospects for remaining residents.

Housing Market Pressure and Property Values

Communities with large auto manufacturing populations typically experience home value declines following major layoffs. Increased inventory from workers relocating or facing foreclosure suppresses prices. Families remaining in communities face reduced home equity and limited ability to access mortgage refinancing or home equity credit.

Rental markets tighten as property owners adjust expectations downward. Real estate tax assessments ultimately decline, compounding municipal revenue loss. Entire neighborhoods decline as housing maintenance defers and property investment slows. Long-term community stability and generational wealth-building capacity for working families diminishes significantly.

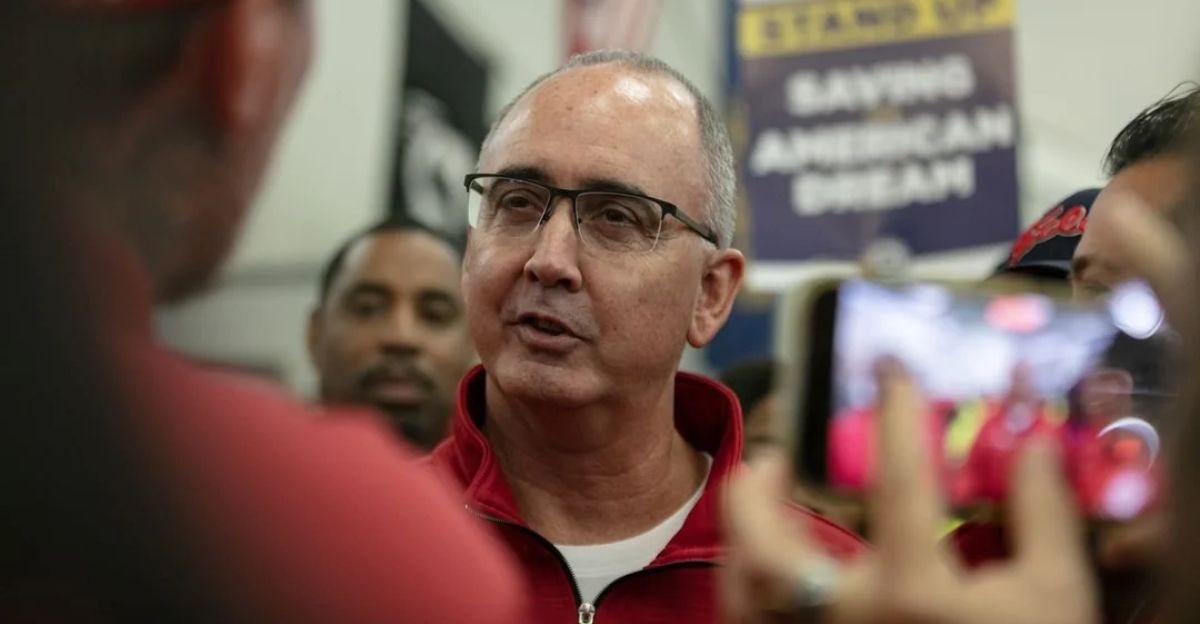

Political and Union Response

The UAW acknowledges worker protection limitations in the contract despite negotiated language. Union leadership emphasizes retraining opportunities and transfer rights while preparing grievance procedures. Federal and state officials debate responsibility allocation between corporate restructuring, federal policy (EV incentive expiration), and market forces.

Some politicians propose infrastructure investment or additional subsidies to offset job losses. The UAW faces internal pressure balancing contract achievements against member layoff realities. Political narratives dispute whether EV transition costs are acceptable prices for environmental benefits or unjust sacrifices by Midwest manufacturing communities.

Broader Industry Restructuring Context

GM’s layoffs are part of wider automotive industry restructuring. Rivian announced 600 layoffs; Volkswagen temporarily suspended ID.4 EV production in Tennessee; Ford and Stellantis face similar pressures. Global automakers are reassessing EV investment timelines amid slower adoption and regulatory uncertainty.

Chinese competitors including BYD are rapidly gaining EV market share. The Midwest’s traditional auto manufacturing advantage erodes as production shifts to newer facilities in other regions or countries with lower labor costs. This broader industry restructuring threatens long-term auto manufacturing viability across Ohio, Michigan, and surrounding states.

EV Investment Paradox—Billions Spent, Jobs Lost

GM invested billions in EV capacity, Ultium battery joint ventures, and Factory Zero expecting sustained demand growth. Federal and state incentives encouraged massive private capital deployment into EV manufacturing infrastructure. Yet anticipated job growth failed to materialize as consumer adoption disappointed and federal incentives evaporated. Workers promised employment security through EV transition investments now face indefinite layoffs.

This paradox undermines confidence in EV-transition-based economic development strategies. Communities question whether future manufacturing investments can deliver promised employment stability, raising broader skepticism about transition-economy planning and public-private sector coordination.

Long-Term Regional Competitiveness

Midwest auto manufacturing’s competitive position weakens amid repeated restructuring cycles. Capital investment uncertainty discourages new facility development or expansion in Ohio and Michigan. Younger workers increasingly pursue careers outside manufacturing, fearing job instability. Educational institutions reduce automotive-focused programming as demand uncertainties grow. Regional brand identity tied to auto manufacturing erodes gradually.

International investment shifts toward regions perceived as more stable for manufacturing employment. Over decades, these cumulative effects reduce the Midwest’s share of global auto production and investment, accelerating the region’s post-industrial transition and economic restructuring challenges.

Affected Worker Demographics and Vulnerable Populations

UAW seniority systems mean less-senior workers face higher layoff risks, disproportionately affecting younger workers and those with shorter tenures. Temporary transfer eligibility favors senior employees with relocation willingness. Minority workers, women, and workers with disabilities may face additional barriers to transfer or retraining opportunities.

Older workers approaching retirement confront forced transitions disrupting retirement plans and health insurance continuity. Families with multiple auto workers face compound income loss and economic disruption. These demographic variations mean Midwest communities experience unequal layoff impacts, with vulnerable populations bearing disproportionate economic and social burdens from restructuring.

Federal and State Policy Crosscurrents

The EV tax credit expiration reflects Congress and Trump administration priorities prioritizing fiscal restraint over EV market development. Simultaneously, federal and state emissions regulations encourage EV transition. This policy contradiction creates uncertainty for manufacturers planning production strategies.

Some states consider new EV incentive programs; others resist perceived federal environmental overreach. International trade policy including potential auto tariffs adds complexity. Worker retraining programs funded through federal workforce development mechanisms become critical safety nets. Policy uncertainty undermines long-term manufacturing planning, as companies cannot reliably forecast regulatory and incentive environments beyond short-term horizons.

Reflection—What’s Next for Midwest Manufacturing?

GM’s restructuring signals deeper challenges facing Midwest auto manufacturing. Evolving technology, global competition, regulatory uncertainty, and changing consumer preferences converge to reshape regional economic foundations. Communities must confront long-term economic transitions requiring workforce retraining, business diversification, and regional economic development strategies beyond manufacturing.

Success requires coordination among workers, companies, educational institutions, and government at multiple levels. The Midwest’s future competitiveness depends on managing this transition thoughtfully, supporting affected workers generously, and investing in diverse economic development—not solely defending legacy manufacturing. This moment demands honest reckoning with structural economic change and strategic regional planning.