The Giant Company is closing five automated e-commerce fulfillment centers across Pennsylvania by April 2026, incurring $50 million in non-cash impairment charges.

The closures affect facilities in Philadelphia, Willow Grove, Coopersburg, North Coventry, and Lancaster, with hundreds of workers facing displacement. Parent company Ahold Delhaize USA is simultaneously shuttering a sixth facility in Virginia, marking a dramatic strategic reversal.

From Cutting-Edge to Obsolete in Four Years

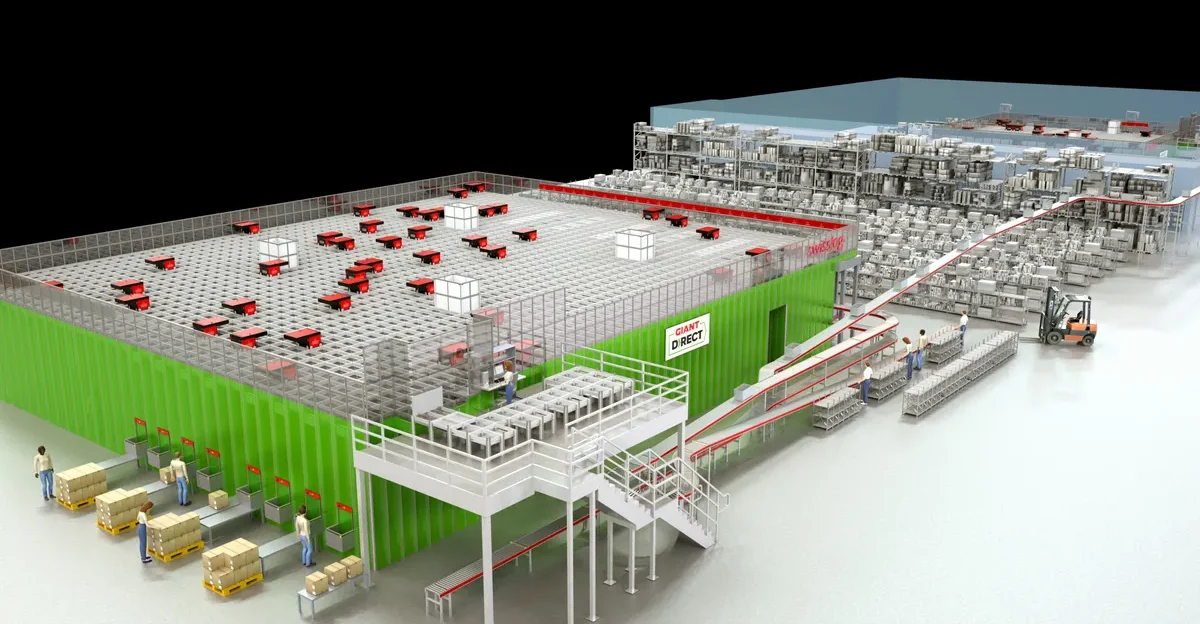

The Philadelphia fulfillment center opened in November 2021 as a state-of-the-art facility featuring advanced robotics from Swisslog and AutoStore. The 124,000-square-foot operation could process 15,000 weekly orders across 22,000 products.

Less than four years later, the facility will permanently close, with 128 employees receiving termination notices effective February 13, 2026. The rapid closure underscores how quickly grocery e-commerce economics have shifted.

Store-Based Fulfillment Replaces Warehouse Model

The Giant Company is pivoting to store-based order fulfillment powered by third-party delivery services Instacart and DoorDash.

The new approach positions inventory closer to customers, enabling delivery in as little as 30 minutes compared to previous longer timeframes. “We’ve learned over the past few years that there isn’t a one-size-fits-all approach to our e-commerce business,” a Giant spokesperson stated.

Faster Delivery, Lower Costs Drive Strategic Shift

Store-based fulfillment offers delivery windows of just one hour versus previous extended timeframes. Customers gain access to full store assortment rather than limited online selections, with in-store pricing instead of online markups.

Orders can be modified two to three hours before delivery rather than four to six hours previously. The model converts fixed infrastructure costs into variable expenses aligned with order volume.

Lancaster and Philadelphia Hit Hardest by Closures

The Lancaster facility closure affects 81 employees, scheduled to shut down by late April 2026. Philadelphia’s 128-worker operation closes February 13, representing the largest single-location job loss.

The Coopersburg facility employs over 100 workers being offered alternative positions within the company. Formal WARN notices had not been filed for all locations as of late December 2025.

Kroger’s $2.6 Billion Loss Validates Trend

The Giant Company’s decision follows Kroger’s November 2025 announcement closing three automated fulfillment centers developed with UK-based Ocado Group.

Kroger is taking $2.6 billion in impairment charges and paying Ocado $350 million to exit agreements for additional facilities. The grocery giant canceled plans for a Charlotte facility and closed operations in Wisconsin, Maryland, and Florida after less than three years.

Ahold Delhaize Achieves E-Commerce Profitability

Parent company Ahold Delhaize USA reached e-commerce profitability on a fully allocated basis during the first half of 2025.

CFO Jolanda Poots-Bijl credited “asset-light fulfillment models like pickup, boosting fulfillment capacity, and automating key operations” for the milestone. Online sales grew 15.4% in Q3 2025 while the company maintained underlying operating margin of 4.6% in U.S. operations.

Online Grocery Sales Hit Record Highs

U.S. online grocery sales reached $12.5 billion in September 2025, a 31% year-over-year increase and new record. Online spending captured nearly 19% of weekly grocery budgets, the highest penetration since early pandemic periods.

Monthly active users reached unprecedented levels, up nearly 13% year-over-year across delivery, pickup, and ship-to-home methods. Despite explosive growth, profitability remains the top challenge for 93% of grocers.

Fixed Costs Make Centralized Hubs Unprofitable

Centralized fulfillment centers require massive upfront capital investment and carry high fixed operating costs regardless of order volume. Longer delivery distances increase last-mile transportation expenses, while inflexible capacity struggles with fluctuating demand patterns.

Grocery orders present particular challenges with varying basket sizes, temperature requirements for fresh and frozen items, and unpredictable demand across diverse product categories.

Walmart’s Success Validates Store-Based Approach

Walmart achieved e-commerce profitability in early 2025, leveraging massive scale and store-based fulfillment infrastructure. The retail giant netted an estimated $71.3 billion in online grocery sales in 2025, representing 31.6% of U.S. market share with 21% projected annual growth.

Amazon relies on Whole Foods stores for grocery fulfillment, while Target has operated a store-first model for years.

Third-Party Platforms Enable Variable Cost Structure

Partnerships with Instacart and DoorDash convert fixed fulfillment costs into variable expenses aligned with order volume. These platforms provide dense logistics networks and sophisticated routing algorithms enabling rapid delivery at scale.

Network effects improve economics as more retailers generate more orders, enabling better route optimization and improved driver utilization. The trade-off involves marketplace fees but proves more favorable than dedicated infrastructure.

Giant Dominates Pennsylvania Grocery Market

The Giant Company operates 174 stores across Pennsylvania, making it the state’s largest grocery chain by location count. The company holds approximately 15.94% market share in the Philadelphia market. Its 193 total stores span Pennsylvania, Maryland, Virginia, and West Virginia, with 133 pharmacies and 107 fuel stations.

The fulfillment strategy proves crucial for defending market share against larger national competitors.

Walmart Cross-Shopping Threatens Regional Grocers

One in four households ordering online from supermarkets also ordered from Walmart during June 2025, up 400 basis points year-over-year.

This cross-shopping metric has risen every June since 2020, indicating systematic share erosion. “If you’re a regional grocer, these results should be a wake-up call,” warned Brick Meets Click analyst Mark Fairhurst regarding competitive threats from mass retailers.

Technology Platform Supports Omnichannel Strategy

Ahold Delhaize USA completed rollout of its proprietary omnichannel platform across all five U.S. brands in November 2025. The cloud-based platform supports more than 26 million weekly customers and powers thousands of daily online orders.

The technology enables faster site performance, personalized promotions, and integrated ordering experiences. Real-time inventory visibility reduces out-of-stock frustrations and enables more accurate order fulfillment.

Workers Offered Alternative Positions

Ahold Delhaize USA committed to offering displaced workers comparable positions within their respective banners or opportunities across the organization. A 2024 transition at The Giant Company’s Camp Hill facility saw more than 80% of staff accept alternative positions.

However, geographic and scheduling constraints mean not all employees find offered options suitable. The transition alters work from specialized warehouse roles to retail-environment store picking.

Quick Commerce Demands 30-Minute Delivery

The ability to deliver in 30 minutes positions The Giant Company to compete with emerging ultra-fast delivery services. Consumer expectations shaped by Amazon Prime and restaurant delivery apps drive demand for rapid fulfillment.

Quick-commerce represents a key trend for sustaining growth and improving profitability alongside retail media and optimized fulfillment. Store-based models uniquely enable participation in ultra-fast delivery without dedicated dark stores.

Stores Provide Operational Flexibility

Store-based fulfillment allows dynamic labor allocation between online fulfillment and traditional retail based on demand patterns. This adaptability proves impossible with dedicated fulfillment centers carrying fixed labor costs regardless of order volume.

The flexibility proves especially valuable during peak periods like holidays when centralized facilities face capacity constraints while stores tap broader workforce resources.

Industry Pivots to Micro-Fulfillment Technology

Automation is shifting from standalone fulfillment centers to store-level micro-fulfillment and pick-assist technologies. Amazon is piloting micro-fulfillment technology in a Pennsylvania Whole Foods store. Kroger plans to “pilot capital-light, store-based automation in high-volume markets.”

These systems combine robotics for high-volume products with manual picking for slower movers, optimizing efficiency without massive centralized infrastructure.

Capital Redeployed to Core Operations

Ahold Delhaize USA is investing $860 million in a new distribution center in Burlington, North Carolina, for physical store replenishment. Redeploying capital from loss-generating e-commerce infrastructure to profitable core supply chain operations reflects disciplined allocation focused on return on invested capital improvement.

Kroger interim CEO Ron Sargent acknowledged: “One of our biggest challenges over the last few years is we haven’t allocated enough capital to growing stores”.

Future Growth Demands Sustainable Models

Online grocery sales for all items are expected to reach $388 billion or nearly 25% market penetration by 2027. “Store-first and hybrid fulfillment models are set to win because they assume volatility,” industry analysts concluded.

The convergence toward store-based fulfillment augmented by third-party delivery partnerships suggests the industry has found an operationally sustainable, strategically coherent omnichannel model for profitable long-term growth.

Sources:

“Giant Food and The Giant Company to shutter centralized e-commerce fulfillment centers.” Grocery Dive, December 2025.

“Ahold Delhaize reports strong Q3 performance; 2025 outlook reconfirmed.” Ahold Delhaize Corporate Newsroom, November 2025.

“Kroger cancels plans for additional automated fulfillment center, closing spoke facility.” Supply Chain Dive, December 2025.

“September 2025 eGrocery Sales Jump 31% Versus Year Ago to $12.5 Billion.” Brick Meets Click, October 2025.

“Giant Food and The Giant Company to shutter centralized e-commerce fulfillment centers.” Yahoo Finance/Reuters, December 2025.