First impressions are powerful, especially when it comes to financial stability. People rarely judge wealth by bank statements; they read subtle cues in behavior, language, and habits. Behavioral economist Eldar Shafir notes people “read into your money mindset within seconds, just from the way you act or talk.”

Research published in Psychological Science by Bjornsdottir and Rule in 2020 confirms that these small cues strongly influence how competent and stable someone appears. Even minor, repeated behaviors, like casual remarks about finances, can make others perceive insecurity, regardless of actual net worth. Awareness of these cues is the first step toward projecting confidence.

The Power of Small Habits

“It’s not about what you make, it’s about what you keep, and how you act with it,” according to Suze Orman. Research shows that many high earners unintentionally signal insecurity through daily habits. Decisions about spending, conversations about money, and what is prioritized or neglected influence how others perceive competence.

Subtle signals, gestures, phrasing, or visible clutter shape social judgments of financial stability. Understanding these behaviors allows us to adjust actions to convey control consciously. The following sections explore specific actions undermining the perception of wealth, beginning with spending habits and lifestyle choices

1. Living Beyond Your Means – Keeping Up at a Cost

Trying to match peers’ spending can be dangerous. As one advisor warned, “The moment you feel you need to have what ‘everyone else’ has, you’ve already lost control.” Research shows that friends and colleagues pick up on subtle overspending cues, detecting attempts to maintain appearances, interpreting them as signals of financial strain.

Minor upgrades, from trendy restaurants to the latest gadgets, are noticed, particularly if discussions about money become vague or defensive. Maintaining awareness of choices and limiting unnecessary comparison projects control and stability, even if your lifestyle occasionally includes indulgences.

Social Pressure

Social pressure and FOMO can push spending beyond comfort levels. Dr. Emily Tarry explains, “The desire to appear successful leads more people to debt than any actual emergency.” Platforms like social media amplify this urge, prompting purchases that signal status rather than financial security.

Friends may sense stress or discomfort even without explicit discussion. Learning to decline costly invitations or prioritize needs over appearances signals discipline, confidence, and foresight – traits consistently associated with financial stability.

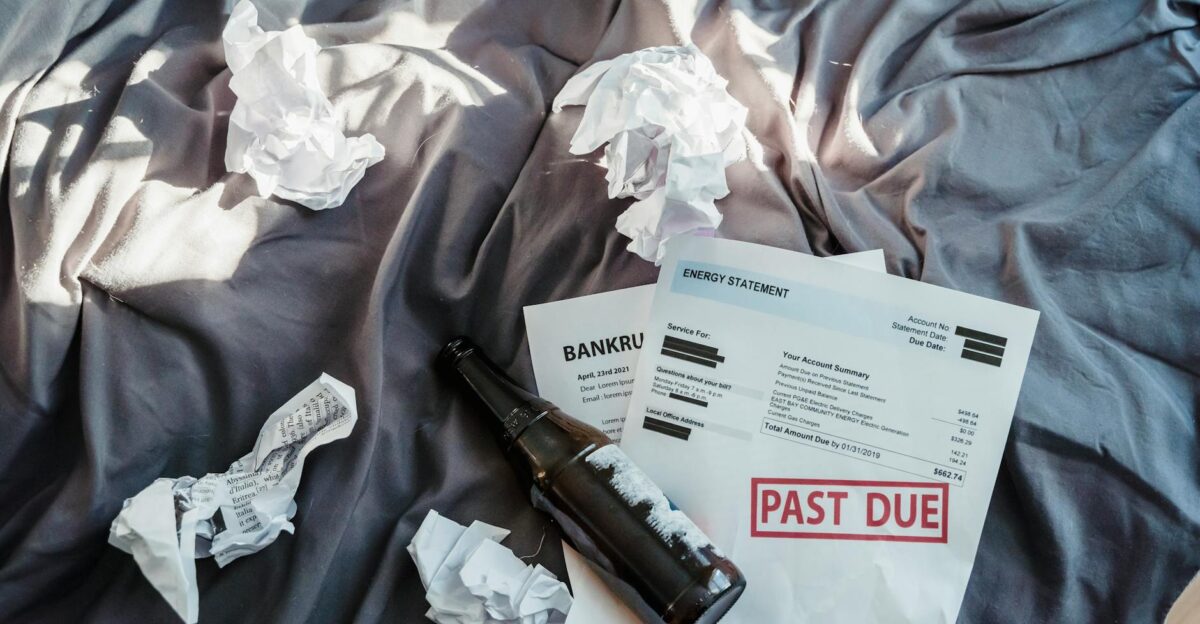

2. Ignoring Financial Details – The Danger of Not Looking

Minor lapses in tracking money become visible fast. Tara Morris warns, “Friends and family notice when you’re unsure about your finances or always caught by surprise at month-end.” Repeatedly missing payments, overdrafts, or forgotten bills signals poor control. Visible financial disorganization strongly influences how competent people appear.

Tracking expenses, setting reminders, and reviewing budgets regularly communicates attention and mastery. Awareness and intentionality in daily money management improve outcomes and project competence, helping you appear as reliable and capable as your actual financial situation warrants.

When Oversight Becomes Obvious

People notice when money management falters. Banking studies show that individuals who fail to track spending often face unexpected cash shortages. Friends and colleagues observe frantic bill shuffling or worried texts.

By reviewing accounts, maintaining clear budgets, and confidently discussing financial routines, you signal preparedness rather than panic. Even small, consistent acts of oversight create the impression of control. Others then perceive you as composed and capable, essential for projecting long-term financial credibility.

3. Reward Spending – “I Deserve It” and How It Shows

“It’s natural to say ‘I deserve this’ after a long week,” explains psychologist Priya Limbu. But habitual self-reward with shopping or luxuries becomes visible. Frequent, emotionally driven purchases signal impulsivity and lower perceived stability. Limbu notes, “People notice a constant stream of little indulgences, especially when paired with complaints about not getting ahead.”

Whether it’s coworkers or friends, observers quickly detect when spending is about comfort rather than celebration. Conscious moderation in rewards communicates discipline, signaling competence and control over finances rather than reactive indulgence.

When Treats Turn Into Trouble

As writer Morgan Housel puts it, “Small luxury treats become a drain when they turn into a habit—your friends notice, even if you pretend it’s just a one-time thing.” Research shows that buying things for short-term comfort, instead of saving for bigger goals, makes people think you’re not great with money.

If buying treats is your main way to feel better, others may assume you don’t have much control. But when you start to treat yourself only for real achievements, not just to cheer up, people see you as more thoughtful and responsible with your money. This small change can really improve how others view your financial know-how.

4. Neglecting Personal Appearance – More Than Looks

Lisa Forbes stresses, “You don’t need designer clothes, but if you show up disheveled, people make fast judgments about your stability.” Research found a strong link between grooming, neatness, and perceived competence and affluence. Sloppiness signals inattentiveness beyond appearance, influencing how colleagues and friends evaluate discipline and reliability.

Basic care like well-fitted clothes, clean shoes and proper posture projects organization and self-respect. Small, consistent attention to appearance signals control over other areas of life, subtly reinforcing the impression of financial competence and stability in social and professional contexts.

What Others Notice

Forbes notes, “Even jokes about skipping showers or showing up worn-out create assumptions.” Minor updates like fresh haircuts, pressed shirts, or tidy shoes instantly improve impressions. When you demonstrate care for appearance, you convey the ability to manage responsibilities, signaling reliability.

Conversely, neglect suggests laxity in other areas, including money management. Maintaining a polished, consistent look communicates self-respect and organization, offering an immediate boost to credibility. The visible cues of grooming become shorthand for overall competence in the eyes of peers and colleagues.

5. Chasing Trends and Status Shopping – Keeping Up With the Latest

Tim Herrera warns, “When you’re always after the latest phone, sneakers, or gadget, people wonder if you’re chasing trends instead of real security.” Serial upgrades signal an external focus on appearances over internal stability. Occasional indulgence is acceptable, but habitual purchases tied to social comparison convey insecurity.

Focusing on value, practicality, or personal priorities signals confidence and control. Observers perceive these habits as hallmarks of maturity, stability, and deliberate decision-making, traits strongly associated with long-term financial competence.

The Backfire Effect

Status symbols can backfire. Research shows that compulsive pursuit of trends signals insecurity more than success. Sarah Duval notes, “People distinguish between buying for the likes and buying out of confidence.” Avoiding flashy, attention-seeking purchases while prioritizing meaningful investment projects shows competence.

The subtle distinction between quiet, confident consumption and conspicuous spending shapes perceptions of wealth and reliability. By signaling restraint, you communicate maturity, discipline, and financial stability, which consistently outweigh the superficial boost from trend-based consumption.

6. Not Planning or Saving for the Future – Flying Blind

Failing to save or plan communicates risk. Jeanette Arriaga notes, “People notice if you’re winging it financially.” Repeatedly expressing surprise at money issues or avoiding retirement discussions signals instability. Lack of preparation affects social trust, your colleagues, friends, and even clients will perceive you as unpredictable.

Taking visible, deliberate steps—budgeting, automated savings, or emergency funds—signals responsibility. Transparency about preparation demonstrates control, reassuring observers that you are organized and financially capable, regardless of your current balance.

It’s Not Just Numbers

Gallup reports that peers notice whether individuals plan ahead or merely scrape by. Integrating savings into daily routines signals organization and trustworthiness. Even small, routine actions—setting aside a few dollars, contributing to retirement, or discussing budgeting—reinforce reliability.

People assign responsibility based on these cues, offering more trust, opportunities, and leadership roles. Planning for the future, then, is not just about wealth, it’s about consistently signaling stability, competence, and credibility to others.

7. Relying on Debt for Daily Expenses – The Warning Signs

Using credit for essentials, paying minimums, shuffling bills, or stressing over balances creates social cues of instability. Research published in Psychological Science by Bjornsdottir and Rule (2020) highlights that these patterns are noticed and interpreted as poor financial control.

Observers connect habitual reliance on debt with vulnerability, regardless of actual income. Transparent, strategic use of credit—paired with repayment plans—projects competence. Others see discipline and self-regulation, signaling stability and responsibility, even when financial pressures exist.

The Perception Trap

A national study found that people observing repeated debt perceive instability rather than resourcefulness. Visible behaviors like turning down invitations, borrowing short-term, or stressing about payments, make ones insecurity obvious.

You shift this narrative by managing debt responsibly, paying on time, and limiting reliance on credit for essentials. Perceived competence rises, and observers equate careful management with broader reliability. Financial behavior is a social signal: consistency in responsible handling enhances reputation as much as income.

8. Fatalism and Negative Money Talk – Words Shape Worlds

Javier Arroyo reminds clients, “If you constantly say ‘I’ll never get ahead,’ people stop expecting you to.” Language profoundly shapes perception. Negative financial talk signals passivity and limits opportunities. Observers infer hopelessness, reducing trust and willingness to collaborate.

Even minor comments can influence how others assess competence and stability. Framing challenges optimistically, discussing progress, and avoiding fatalistic statements communicates agency and resilience. Words become cues as they reflect mindset and indirectly signal financial control.

Taking Back the Narrative

Optimism transforms perception. Behavioral studies show that forward-looking, solution-focused talk attracts support and respect. Even in hardship, expressing plans and intentions conveys stability. Choosing words intentionally projects resilience and inspires confidence in peers.

By reframing struggles as manageable and controllable, you reinforce the perception of capability, signaling that challenges are temporary and manageable rather than defining.

Shifting Habits, Shifting Perceptions

Sandra Tsing Loh observes, “Behaviors shape stories, both the ones you tell yourself, and the ones others believe.” Every choice—from spending to self-talk—sends social signals. Awareness and deliberate adjustment of behaviors can shift how others view you, improving credibility and social capital.

Tara Morris emphasizes, “Everyday habits are visible; they’re how the world sizes up your stability.” Small, consistent changes offer tangible benefits, aligning others’ perceptions with your financial capability.

Next Steps for Confidence and Stability

Suze Orman reminds us, “Wealth isn’t just what you have, but how you show up.” Tracking expenses, planning, maintaining appearance, and correcting negative language are visible signals of control. Projecting confidence starts with action, not statements.

By intentionally cultivating these habits, you improve financial outcomes and influence perception. Visible discipline and foresight signal reliability, security, and maturity, aligning your image with the control and stability you already possess.