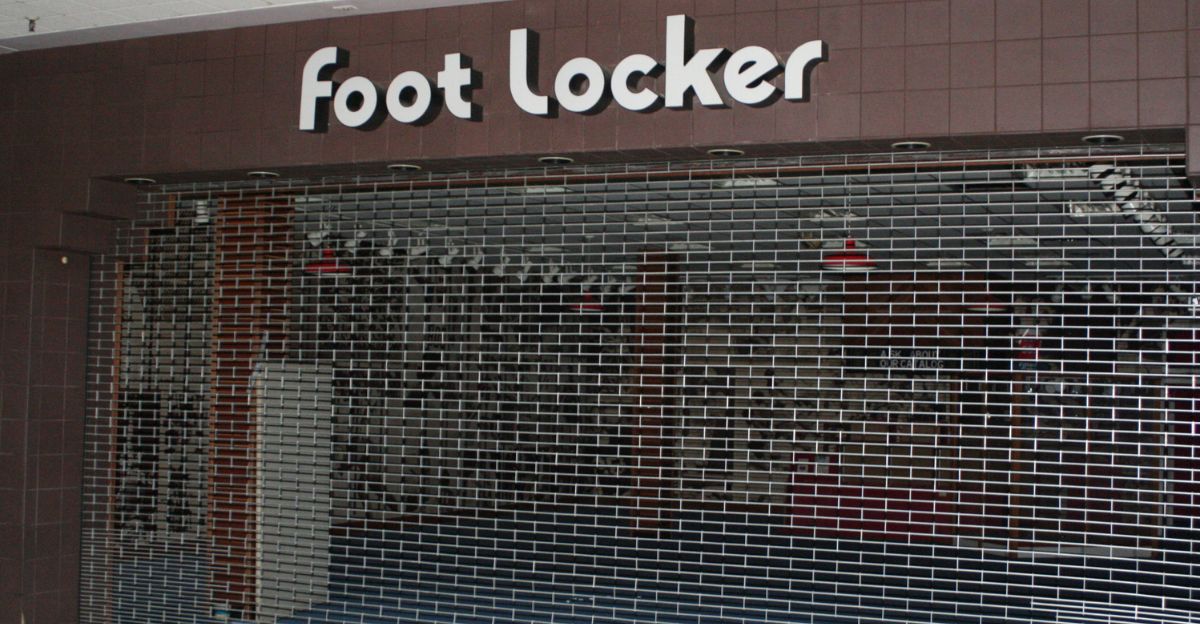

The retail giant Foot Locker, a staple in malls across America, is undergoing a major transformation. The company announced in 2023 that it would close approximately 400 stores by 2026, marking a significant restructuring of its North American operations. This strategic shift was formalized when Dick’s Sporting Goods completed its acquisition of Foot Locker in September 2025 for $2.4 billion.

As stores shutter and employees face potential displacement, the retail landscape is changing faster than anyone could have predicted. What led to this dramatic pivot for a brand once synonymous with sneaker culture? Stay tuned as we explore the forces reshaping the sneaker retail world and the communities that will feel the effects the most.

Why It’s Happening: The Perfect Storm

Foot Locker’s troubles stem from a combination of declining mall foot traffic, the rise of direct sales from brands like Nike, and a shrinking profit margin.

Despite a global presence of about 2,400 stores, the company has been struggling to adapt to changing consumer behavior, leaving it vulnerable in a competitive market.

Direct Consumer Impact: The End of Local Sneaker Access

Millions of sneaker enthusiasts will be impacted by the store closures. Particularly in smaller regional malls, consumers will lose easy access to curated sneaker releases and in-store experiences.

Rural and secondary markets will be hit hardest, with customers having to rely more on e-commerce or travel to distant concept stores.

Corporate Response: Dick’s Repositioning Strategy

Following the acquisition, Dick’s plans to operate Foot Locker as a separate business while finding cost synergies. The company has indicated future pre-tax charges of $500 million to $750 million related to a comprehensive review of Foot Locker’s unproductive assets, including inventory cleanup, underperforming store closures, and right-sizing operations.

Together, the combined entity operates over 3,200 stores across 20 countries, positioning itself as a major sports retail powerhouse with an estimated $21 billion in annual sales.

Retail Substitution: Where Sneaker Buyers Will Go

As Foot Locker shutters stores, online platforms such as StockX and Foot Locker’s own e-commerce site are likely to absorb some of the displaced demand.

Smaller boutiques and brand-owned stores may also capture market share in areas where Foot Locker stores close, shifting the sneaker shopping experience further into the digital realm.

International Trade Effects: Global Footprint Consolidation

Foot Locker’s international operations will also see consolidation. Its presence in Europe, Asia, and Australia represents a significant share of its business, though precise recent figures vary by year.

Dick’s may adjust sourcing strategies, accelerating e-commerce investment in global markets as the physical retail footprint shrinks, potentially impacting supply chains and vendor relationships.

Human Impact: Employees Face Uncertainty

Store associates, managers, and distribution employees face potential job losses or relocation as a result of the closure plan.

Dick’s has indicated significant restructuring costs but has not disclosed specific employment figures or details on severance packages and retraining programs, leaving employees in a difficult position without clear pathways forward.

Political & Policy Response: Labor Scrutiny

Senator Elizabeth Warren has raised concerns about the Dick’s-Foot Locker merger, citing potential job losses and antitrust issues.

State labor departments may be required to address job displacement through WARN Act notifications if applicable, pressuring policymakers to act in affected regions.

Economic Ripple: Inventory Adjustments and Pricing Power

Dick’s acquisition strengthens its bargaining power with major vendors like Nike and Adidas, which could lower wholesale prices.

However, the immediate focus is on inventory clearance—Dick’s expects Foot Locker’s fourth-quarter gross margin to decline by 1,000 to 1,500 basis points as it clears excess merchandise. This clearance activity may temporarily affect pricing dynamics in the market.

Retailer Adaptation: The Concept Store Pivot

Foot Locker plans to open smaller, curated concept stores to target specific demographics and shopping experiences.

These stores are intended to replace larger mall anchors, offering an experiential shopping environment that contrasts with the sprawling mall layouts that once defined the brand.

Hospitality & Adjacent Retail Shifts

As Foot Locker closes its anchor stores, neighboring retailers such as mall food courts will also feel the impact.

Malls reliant on Foot Locker for foot traffic may face accelerated decline or need to pivot to new retail concepts, such as entertainment or dining, to maintain relevance.

Knock-On Industries: Logistics, Real Estate, and Fixtures

Foot Locker’s closures will ripple through various industries, including logistics, real estate, and display fixtures.

Distribution volumes will decrease for warehouse providers, commercial real estate in secondary malls will see declines, and fixture manufacturers will face reduced orders as mall-based stores close across the country.

Global Consumer Impact: Emerging Market Access

Foot Locker’s retreat from global markets may reduce sneaker availability in regions such as Europe, Asia, and Australia.

Consumers in these areas may increasingly need to rely on e-commerce or brand-specific stores, with Dick’s seeking to maintain its global reach through its digital strategy.

Health & Lifestyle Shifts: The Sneaker Culture Evolution

The decline of Foot Locker signals a major shift for mall-based sneaker culture.

Younger consumers are turning to social media and direct brand channels to discover new releases, shifting the role of physical retail from destination shopping to experiential events and pop-up releases.

Cultural & Environmental Debate: Sustainability Questions

While fewer physical stores could lower carbon footprints, the shift to online shopping increases shipping emissions and packaging waste.

Environmental advocates are questioning whether the move to e-commerce will truly benefit sustainability or simply shift the burden to other parts of the retail ecosystem.

Unexpected Winners: E-Commerce Platforms and Boutiques

E-commerce platforms like StockX and SNKRS—as well as regional sneaker boutiques—may benefit from Foot Locker’s decline, as could specialty retailers in underserved markets.

This shift is likely to move more sneaker sales to new channels, though precise impacts remain to be seen.

Financial Markets: Investor Speculation and Integration Bets

Dick’s stock performance will largely depend on its ability to integrate Foot Locker successfully and realize the projected cost synergies while managing the $500-750 million in restructuring charges.

Investors are expected to closely watch the company’s performance throughout 2026 for signs of successful integration and profitability improvement at Foot Locker.

Consumer Advice: How to Navigate the Transition

Sneaker enthusiasts may want to consider stocking up on their preferred styles before closures ramp up. Dick’s omnichannel offerings and the integration of Foot Locker inventory may provide opportunities for continued access to sneakers.

Concept stores and e-commerce alternatives will play a larger role going forward.

Looking Ahead: The Future of Retail and Sneaker Culture

Foot Locker’s restructuring is part of a broader trend of retail consolidation, with physical stores shifting to experience-driven and digitally integrated formats.

Success in the coming years will depend on Dick’s execution of its new strategy and how well consumers adapt to these changes in the retail landscape.

Final Synthesis: Ripples Across Industries and Culture

The closure of 400 North American stores by 2026 marks a profound shift in retail, affecting employment, real estate, and consumer culture.

The acquisition by Dick’s Sporting Goods has formalized the company’s post-restructuring strategy, with winners emerging in e-commerce and boutiques. The mall-based sneaker retail era is giving way to new formats focused on digital-first and curated shopping experiences.

Sources:

Foot Locker, Inc. Investor Day Presentation and Fourth Quarter 2022 Earnings Results; March 20, 2023

Dick’s Sporting Goods Q3 2025 Earnings Call Transcript and Investor Presentation; November 25, 2025

Reuters/Dick’s Sporting Goods official announcement of Foot Locker acquisition completion; September 8, 2025

Senator Elizabeth Warren letter to FTC and Department of Justice regarding Dick’s-Foot Locker merger antitrust concerns; August 6, 2025