Despite an overall expansion in the industry, car audio stores are experiencing financial difficulties, leading some to file for bankruptcy.

According to market research firm Circana, the automotive aftermarket held steady in the first half of 2025, with retail sales showing an increase of approximately 1% in both revenue and demand. However, specialty retailers in this sector continue to confront significant financial challenges.

Warning Signs

In 2025, the automotive parts industry faced significant challenges, leading to the bankruptcy filings of four major companies. Marelli Holdings, a global leader in the sector, filed for bankruptcy in June, reporting $4.9 billion in funded debt.

Prior to Marelli’s filing, Northvolt AB declared bankruptcy in March, followed by Hypertech Inc. in April, and Car Toys in August. These events highlight a concerning trend of distress within the automotive parts market.

Industry History

Car Toys was established in 1987 by Daniel Brettler and has since become a prominent name in the automotive industry. The company specializes in a wide range of services and products, including car audio and video systems, car alarms, remote start installations, car accessories, marine audio, powersports equipment, and window tinting services.

Over the years, Car Toys has achieved significant growth, emerging as the largest independent specialty car audio and mobile electronics retail chain in the nation.

Mounting Pressures

Since 2020, Auto Parts Chain Car Toys has experienced a decline in its car audio business, with annual reductions averaging between 8% and 10%. This segment accounts for approximately 70% of the company’s total sales.

Philip Kaestle, the Chief Restructuring Officer of Sierra Constellation Partners, noted that this continuous downturn has placed significant financial pressure on the company, making it difficult to resolve the issues through conventional cost-cutting strategies.

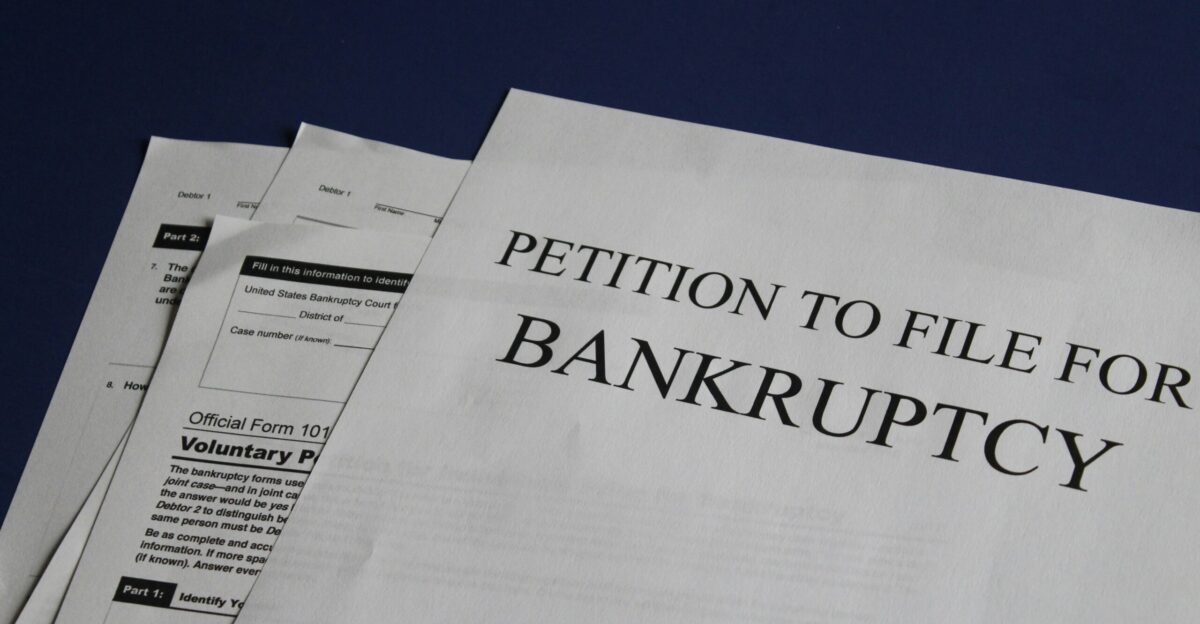

Chapter 11 Bankruptcy Protection

Car Toys has filed for Chapter 11 bankruptcy protection, a legal process that allows companies to reorganize their debts. This filing took place on August 18, 2025, in the U.S. Bankruptcy Court for the Western District of Washington.

According to court documents, the company reported total assets and liabilities in the range of $10 million to $50 million, with approximately $30 million categorized as total liabilities. This move indicates significant financial challenges for the company as it seeks to restructure and stabilize its operations.

Store Sales Plan

Car Toys has successfully entered into purchase agreements with five competitors, facilitating the sale of 35 of its 46 retail locations in four states.

This transaction is part of a Section 363 bankruptcy sale, totaling approximately $13.75 million. The company initiated its marketing efforts to find a buyer in March 2025, which was five months prior to its bankruptcy filing.

Buyer Details

Aspen Sound is acquiring two locations in Spokane, Washington, with a total investment of $477,536. Meanwhile, Drive In Sound has plans to purchase one location in Colorado Springs for $533,809.

Sound Distribution aims to expand its footprint by acquiring six locations in Colorado and nine in Washington for a combined total of $1.138 million. Additionally, CTX Operating Company has set its sights on acquiring 12 locations in Texas, with a projected expenditure of $3.951 million.

Revenue Crash

Car Toys has seen its sales drop sharply over the last few years. In 2021, the company made $127 million, but that amount fell to $123 million in 2022, a decline of about 3.3%.

Things worsened in 2023, when sales dropped by another 8.3% to $113 million. According to Kaestle’s report, by July 2025, the company’s sales had decreased by 14% compared to the previous year, showing their struggles worsening.

Creditor Pressure

The company is facing financial difficulties, which have led it to file for bankruptcy. Most of this situation stems from debts owed to some of their largest creditors.

For example, Pembroke Real Estate is owed $4.2 million due to a lawsuit, Kenwood Electronics is owed over $1.27 million, and Alpine Electronics is owed more than $612,000.

Fatal Blow

The situation worsened for Car Toys when its affiliate, Wireless Advocates LLC, lost its exclusive partnership with Costco Wholesale Company, leading to the shutdown of its business in December 2022.

This loss of partnership resulted in the shared management and overhead expenses that had previously been divided between the two affiliates being solely absorbed by Car Toys, thereby increasing its financial strain.

Management Perspective

“In 2021, the company experienced a strong financial year following pent-up demand coming out of the Covid-19 pandemic,” Chief Restructuring Officer Philip Kaestle said in his court declaration.

“However, this success was short-lived,” he added, explaining how the brief recovery couldn’t sustain operations.

Cost-Cutting Efforts

As revenues declined in 2024, Car Toys hired restructuring advisers and laid off 140 employees to reduce costs.

Despite these measures, the company couldn’t reverse the fundamental decline in its core car audio business, which represented the majority of total sales.

Market Position

Car Toys operated as “the nation’s largest independent specialty car audio and mobile electronics retail chain” with 46 locations in four states, according to court papers.

Despite this market-leading position, the company couldn’t overcome industry-wide challenges affecting specialty aftermarket retailers.

Partnership Details

Partners Don Longworth and Raul Shakarov, representing experienced operators who understand the local market, offered to buy five Oregon locations for $1.522 million.

These buyers suggest that while the national chain failed, regional operators believe they can succeed with focused, smaller-scale operations.

Industry Context

Marelli Holdings blamed its $4.9 billion bankruptcy on “the effects of the Covid pandemic and post-pandemic market challenges and headwinds, including supply chain challenges, labor shortages, high costs, inflation, rising prices of raw materials, and declining customer volumes.”

These same pressures affected smaller retailers like Car Toys.

Affiliate Impact

Wireless Advocates is a Chapter 7 bankruptcy liquidation debtor, showing how the affiliate’s failure had lasting consequences for Car Toys.

The dissolved Costco partnership was described as “a fatal blow” that ultimately contributed to both companies’ demise under shared ownership.

Geographic Spread

The 46 Car Toys locations span Washington, Oregon, Colorado, and Texas, with buyers identified for 35 stores across all four states.

This geographic diversification couldn’t protect the company from industry-wide trends affecting car audio specialty retailers nationwide.

Restructuring Process

The Section 363 bankruptcy sale allows Car Toys to sell assets quickly while under court protection, potentially preserving jobs and customer relationships.

This process enables buyers to acquire established locations without assuming the seller’s debts, making the transactions more attractive to regional operators.

Timeline Summary

Car Toys filed for bankruptcy in August 2025, joining Northvolt AB (March), Hypertech Inc. (April), and Marelli Holdings (June) in a wave of auto parts industry failures.

The company had been marketing itself for sale since March, showing management recognized the severity of financial challenges months before filing.

Future Outlook

The bankruptcy of this 38-year-old specialty retailer, founded in 1987, demonstrates how even established market leaders face existential challenges from changing consumer preferences and industry consolidation.

Successful asset sales to regional buyers suggest local operators may succeed where national chains struggle.