In early January 2026, Nestlé confirmed that a rare, heat-resistant toxin had entered parts of its infant formula supply, triggering the largest recall in the company’s 160-year history. More than 800 products across over 60 countries were affected, raising urgent questions about food safety, disclosure timing, and global oversight.

While no illnesses had been confirmed, parents were confronted with a chilling reality: boiling water and standard preparation could not neutralize the risk. Austrian authorities described the scale as unprecedented. Here’s what’s happening as this crisis continues to unfold.

A Global Recall That Shattered Confidence

Austrian health authorities labeled the event Nestlé’s largest recall ever, with more than 800 infant formula products withdrawn from over 60 countries and more than 10 factories. The trigger was cereulide contamination, a toxin produced by certain Bacillus cereus strains. While no confirmed illnesses were reported, the danger lay in cereulide’s resilience. Unlike many contaminants, it cannot be destroyed by boiling water or typical formula preparation, leaving parents with few immediate safeguards.

The recall spread rapidly across Europe, Asia-Pacific, and beyond, affecting trusted household brands sold under different names depending on the market. What began as a quality control issue quickly escalated into a global confidence crisis, particularly because infant formula is consumed by the most vulnerable population. As regulators expanded their actions, families were left questioning how something so rare could travel so far undetected.

The Heat-Resistant Toxin Behind the Alarm

Cereulide stands out from most foodborne hazards due to its extreme stability. The UK Food Standards Agency warned on January 7, 2026, that cereulide “is unlikely to be deactivated or destroyed by cooking, using boiling water, or when making the infant milk.” Peer-reviewed research indicates that the toxin can survive temperatures of 121°C for over 2 hours, surpassing the standard industrial sterilization processes.

Symptoms can appear within 5 hours and include vomiting and abdominal distress, making rapid exposure particularly dangerous for infants. Nestlé acknowledged that “the presence of cereulide in oils is very uncommon,” yet its resistance to heat and wide pH tolerance, spanning from 2 to 10, made it uniquely difficult to control once introduced. That scientific reality intensified scrutiny of Nestlé’s preventive systems.

Delays, Silence, And Mounting Anger

Criticism intensified after Austrian authorities alleged Nestlé conducted a “silent recall” during the Christmas holiday period. FoodWatch director Nicole van Gemert said on January 8, 2026, “For infant formula, a ‘silent’ recall is not an appropriate response when there is a potential unacceptable risk.” The lack of public warnings fueled accusations of delayed disclosure and insufficient consumer protection.

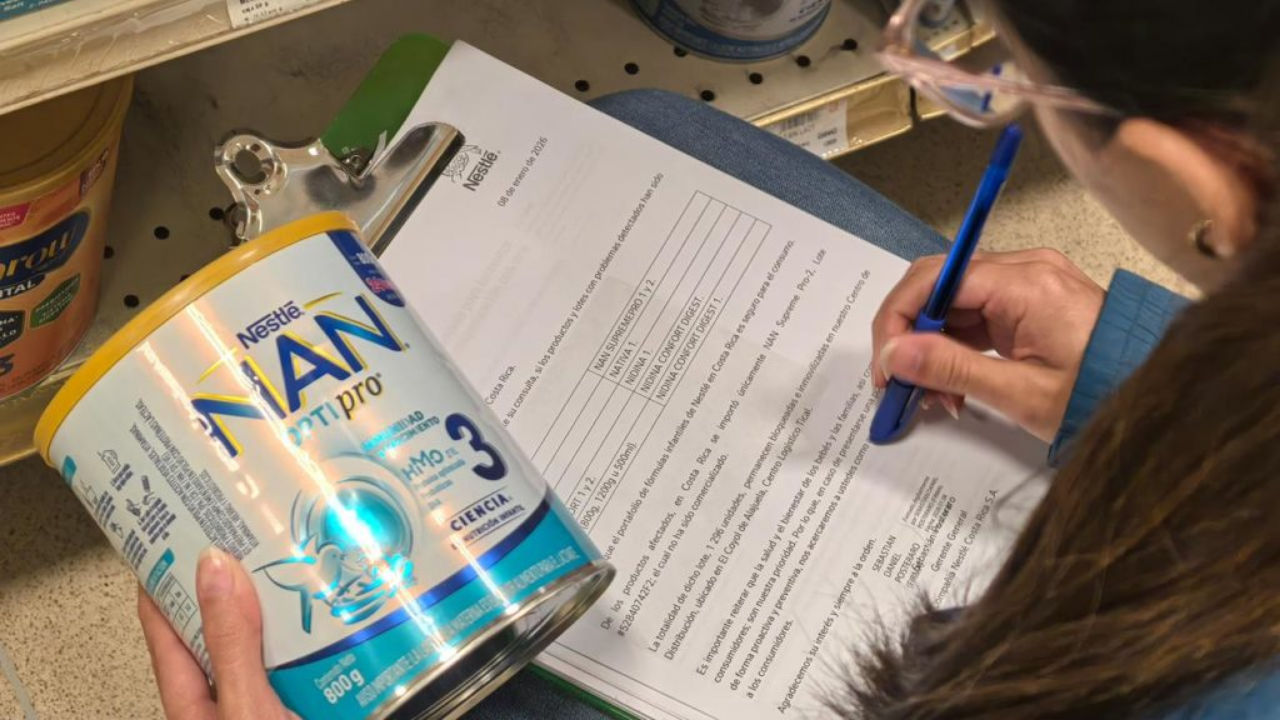

Timeline details deepened the controversy. Nestlé detected Bacillus cereus during routine self-monitoring at its Nunspeet facility in early December 2025 and notified Dutch authorities on December 9. However, a public global recall was not announced until January 5, 2026. While some countries acted in mid-December, the full scope only became clear weeks later, leaving consumers unknowingly exposed.

Supply Chains, Contradictions, And Global Reach

FoodWatch highlighted inconsistencies in Nestlé’s communication about distribution. On December 15, Dutch authorities reportedly said Nestlé confirmed no shipments to the Netherlands or Belgium. Weeks later, both countries issued recalls. FoodWatch stated on January 8, 2026, “So either distribution did occur, or the risk assessment and scope changed, or traceability and communication failed.”

The contamination was first identified at Nestlé’s Nunspeet plant, which exports infant nutrition products to about 140 markets. The Dutch food safety authority, NVWA, confirmed on January 8, 2026, that contaminated raw material had been used at multiple production sites, including those outside the Netherlands. With such global reach, even a localized failure quickly became an international problem.

The Ingredient, The Supplier, And The Cost Debate

Nestlé traced the issue to arachidonic acid oil supplied by an unnamed third party. Yicai Global reported that Cabio Biotech, a Wuhan-based supplier, was likely involved, as its ARA revenue rose 29% to CNY 390 million ($55.9 million) in 2024. Following the recall announcement, Cabio shares fell 11.9% to CNY 21.15 ($3.03) on January 8, 2026, as the company stated that testing was underway.

Nestlé maintained that affected batches represented “significantly less than 0.5%” of annual group sales. Analysts disagreed. Jefferies estimated exposure at about 1.3% of group sales, or CHF 1.2 billion ($1.5 billion), while Barclays placed it between 0.8% and 1.5%. The gap highlighted uncertainty around recall costs and long-term brand damage.

Vulnerable Infants And Uneven Guidance

The recall’s human impact was most acute among medically fragile infants. In New Zealand, Alfamino specialist formula is primarily distributed through hospitals and by prescription, rather than in supermarkets. New Zealand Food Safety deputy director Vincent Arbuckle warned on January 8, 2026, “Infants are vulnerable to dehydration and parents should have a low threshold for contacting a GP or emergency room if the child experiences vomiting, abdominal pain or diarrhoea within the first 24 hours after ingestion.”

Guidance to parents also conflicted. Nestlé advised destroying recalled products, while FoodWatch urged families to keep packaging as evidence for potential legal action. The disagreement added confusion at a time when parents were focused on immediate safety. Combined with past recalls involving Cronobacter spp., ochratoxin A, and mineral oil residues, trust eroded further.

A Defining Test For Trust And Reform

Nestlé controls about 25% of the $92.2 billion global infant nutrition market, which accounted for 16.6% of its CHF 91.4 billion ($102.4 billion) sales in 2024. That scale magnifies both risk and responsibility. Past crises show recovery is possible but slow, as seen with Danone’s Dumex division in 2013 and Abbott’s Similac recalls in 2010 and 2022.

As investigations continue into mid-January 2026, regulators worldwide are reassessing whether existing safeguards are sufficient. Investors await clearer answers when CEO Philipp Navratil presents results on February 19, 2026. For parents and policymakers alike, the central question remains whether this crisis leads to lasting reform or fades into another episode of damage control.

Sources:

Nestlé recalls several SMA Infant Formula and Follow-On Formula products. UK Food Standards Agency, January 5-8, 2026

Recall of specialist infant formula due to potential toxin. New Zealand Food Safety, January 8, 2026

Global recall of Nestlé baby food: foodwatch criticizes lack of transparency. FoodWatch International, January 8, 2026

Heat resistance of Bacillus cereus emetic toxin, cereulide. PubMed/National Institutes of Health, May 2008

Nestlé’s Chinese ARA Supplier Plunges After Swiss Firm Issues Global Recall of Baby Formula. Yicai Global, January 8, 2026

Nestlé launches biggest product recall in its history amid baby formula toxin fears. Brussels Times, January 8, 2026