One thousand Citigroup workers received termination notices this week in a sequence of events that captures Wall Street’s stark contradictions. The layoffs came just hours before the bank’s fourth-quarter earnings announcement on Wednesday, January 14, 2026, during the week when annual bonuses traditionally arrive—the financial industry’s most lucrative period. As executives prepared to celebrate a 66% stock surge and record-breaking results, affected employees cleared their desks, embodying the jarring disconnect between corporate success and individual sacrifice.

The New York-based banking giant’s latest workforce reduction represents another phase in CEO Jane Fraser’s sweeping plan to eliminate 20,000 positions by the end of 2026. Citigroup employed approximately 227,000 full-time staff as of September 2025, down from 229,000 at the close of 2024. To reach its target workforce of roughly 180,000 employees, the institution must cut several thousand additional roles throughout the year.

Fraser’s Transformation Vision

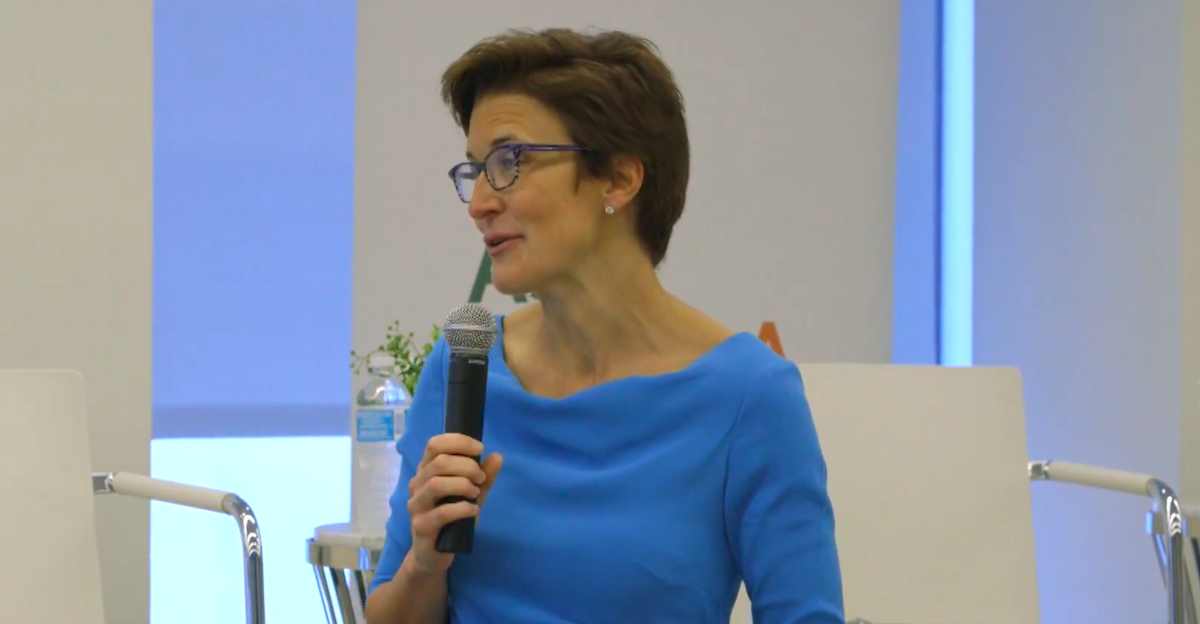

Jane Fraser made history in March 2021 as the first woman to lead a major U.S. bank, and she has staked her legacy on this ambitious restructuring. Announced in September 2023, the transformation seeks to simplify Citigroup’s notoriously complex organizational structure, exit underperforming international markets, and generate approximately $2.5 billion in annual savings while closing a persistent performance gap with competitors.

The mathematics behind the workforce reduction reveal its true scale. The 180,000 employee target includes approximately 40,000 positions expected to depart when Citigroup completes the initial public offering of Banamex, its Mexican retail banking subsidiary. That means roughly 20,000 actual job eliminations beyond the Banamex divestiture—a staggering reduction reshaping one of America’s largest financial institutions.

Fraser fundamentally dismantled Citigroup’s organizational hierarchy, reducing management layers from 23 to 13, eliminating approximately 60 internal committees that slowed decision-making, and collapsing dual reporting lines. Approximately 50,000 staff now report to different managers. The first major wave in November 2023 targeted senior management specifically, affecting roughly 10% of these roles or around 300 managers. In October 2025, Fraser became the first Citigroup CEO since 2007 to simultaneously serve as board chair, consolidating her authority as the transformation enters its final critical phase.

Technology Driving Workforce Reduction

Citigroup justified the cuts by citing efficiencies gained through technology and transformation work nearing the bank’s target state. The institution deployed artificial intelligence tools to 140,000 employees across eight countries during 2025, representing one of banking’s largest enterprise AI rollouts. Employees entered more than 6.5 million prompts into AI systems last year, demonstrating how automation now handles tasks previously requiring human judgment.

The bank committed $14.7 billion to technology transformation, including $11.8 billion in core technology budgets and $2.9 billion specifically for transformation initiatives. Citigroup retired or replaced 130 applications in the first quarter of 2025 alone, adding to 2,000 legacy systems decommissioned previously. In October 2025, the institution mandated AI training for 175,000 employees across 80 locations, essentially teaching workers to use tools that may eventually replace them.

The human toll carries a steep financial price. Citigroup allocated approximately $600 million for severance payments in 2025, down from $700 million in 2024 when the bank laid off more than 10,000 employees. Chief Financial Officer Mark Mason noted that typical annual severance costs hover around $300 million, meaning the bank is spending double its normal amount to restructure its workforce. Severance packages offer two weeks of base pay for each full year of service, capped at 52 weeks maximum, along with temporary healthcare coverage extensions and outplacement services with up to six months of career coaching.

Financial Performance Validates Strategy

Investor reaction has been overwhelmingly positive despite—or perhaps because of—the job cuts. Citigroup’s stock surged 66% in 2025, delivering the best performance among major U.S. banks and nearly doubling competitors’ gains. JPMorgan Chase rose 35%, while Bank of America and Wells Fargo each gained approximately 25%. Shares reached a 52-week high near $124, dramatically narrowing the notorious discount that plagued the stock for years.

Third-quarter 2025 performance demonstrated Fraser’s strategy is working financially. Net income reached $3.8 billion, up from $3.2 billion year-over-year. Adjusted earnings per share of $2.24 exceeded analyst estimates of $1.93 by 17.1%. Revenue grew 9% to $22.1 billion, driven by strength across all five business divisions, proving cost cuts haven’t compromised revenue generation.

The bank’s return on tangible common equity reached 9.7% by late 2025, approaching management’s 10% to 11% target range for 2026. Bank of America analyst Ebrahim Poonawala noted the turnaround is among the most complex in the corporate world but acknowledged Fraser’s actions give Citigroup a fighting chance of becoming competitive with rivals.

Significant regulatory relief in December 2025 removed a persistent obstacle. The Office of the Comptroller of the Currency withdrew a July 2024 amendment to a 2020 consent order that had required enhanced data governance and risk management reporting, acknowledging Citigroup’s progress in targeted areas.

Industry-Wide Disruption Ahead

Citigroup’s workforce reductions reflect a broader transformation sweeping global finance. Morgan Stanley projects European banks alone could eliminate approximately 200,000 jobs—roughly 10% of their workforce at 35 major institutions—by 2030 as artificial intelligence automates routine compliance, risk management, and back-office tasks, with efficiency gains of up to 30%.

Multiple financial institutions announced significant workforce adjustments in early 2026. Goldman Sachs implemented hiring freezes through late 2025 as part of its AI restructuring initiative. JPMorgan Chase CFO Jeremy Barnum indicated the bank is halting new hires as it rolls out AI across the business. BlackRock eliminated about 250 positions, representing roughly 1% of its global workforce.

A Goldman Sachs analysis reveals changing market dynamics around workforce reductions. Companies announcing layoffs now see share prices fall an average of 2% following such announcements, reversing a long-standing pattern where investors welcomed job cuts as evidence of cost discipline. This sentiment shift creates pressure on banks to demonstrate automation delivers sustainable growth beyond merely cutting expenses.

Today’s fourth-quarter earnings report will reveal whether 2026 marks the transformation’s shift from painful cost reduction to sustainable growth. Analysts project earnings per share of $1.65 to $1.77 on revenue of approximately $20.55 billion to $21.18 billion, representing year-over-year growth of 23% to 32%. As Fraser’s restructuring enters its final year, the stakes extend beyond Citigroup—the outcome will signal whether aggressive AI-driven workforce reductions can deliver the sustainable competitive advantage that Wall Street demands, or whether the human cost proves too steep for long-term success.

Sources:

“Citi to Cut About 1,000 Jobs This Week as Fraser Trims Costs.” Bloomberg News, January 12, 2026.

“Citigroup set to cut about 1,000 jobs this week, source says.” Reuters, January 13, 2026.

“Citigroup to lay off 1,000 employees as part of restructuring.” Yahoo Finance, January 13, 2026.

“Citigroup Third Quarter 2025 Results and Key Metrics.” Citigroup Inc., October 2025.

“Citi Statement on OCC Removal of Amendment to Consent Order.” Citigroup Inc., December 17, 2025.

“Morgan Stanley Says Banks To Cut 200,000 Jobs in 2026 As AI Ready To Take Over.” Good Returns, January 5, 2026.