Meta’s ambitious metaverse push has drained over $70 billion since late 2020, fueling relentless operating losses in its Reality Labs division.

On January 13, 2026, the company began notifying more than 1,000 employees—roughly 10% of the division’s 15,000-person workforce—of permanent job eliminations.

CTO Andrew Bosworth confirmed the cuts via internal memo, signaling Meta’s dramatic pivot away from virtual reality toward AI wearables and smart glasses development.

VR Empire Crumbles

Reality Labs, Meta’s hub for virtual reality, augmented reality, and metaverse dreams, racks up multibillion-dollar losses yearly.

Since Meta’s 2021 rebrand from Facebook, the division hemorrhaged cash on VR headsets and digital worlds. Q3 2025 alone posted $4.4 billion in operating losses on just $470 million in revenue.

Pressure mounts as smart glasses succeed where VR falters, forcing executives to fundamentally restructure the division’s priorities and workforce.

Metaverse Bet Backfires

Meta rebranded in October 2021 to chase a metaverse future, pouring billions into Reality Labs for immersive VR/AR experiences.

Horizon Worlds and Quest headsets promised revolution but delivered persistent deficits. Cumulative losses since late 2020 now exceed $73 billion, eroding shareholder trust and investor confidence.

Internal leadership shifts accelerated in 2025, signaling Meta’s acknowledgment that the metaverse vision requires a fundamental reset toward emerging AI hardware opportunities.

Losses Escalate Dramatically

Reality Labs posted $4.4 billion in losses in Q3 2025 alone—part of over $70 billion in cumulative losses since late 2020. VR hardware, software, and platforms like Horizon Worlds bleed resources quarterly.

Meta’s 2024 Reality Labs losses totaled $17.73 billion, while 2023 hit $16.12 billion. Employee anxiety spiked as executives debated budget cuts reaching 30%.

The January 2026 restructuring represents management’s attempt to finally achieve “long-term sustainability” in the perpetually unprofitable division.

Over 1,000 Jobs Axed

Meta cut more than 1,000 Reality Labs jobs—roughly 10% of its 15,000-strong workforce—starting January 13, 2026. CTO Andrew Bosworth’s internal memo confirmed the cuts target VR teams, hardware development, and metaverse platforms.

Entire units dissolved as Meta pivoted from metaverse to AI wearables.

The restructuring permanently shuttered three VR game studios: Sanzaru Games, Twisted Pixel, and Armature Studio—ending Meta’s first-party VR game development era and displacing hundreds of game developers.

Studios Shuttered Permanently

Meta permanently shuttered three VR game studios: Sanzaru Games, Twisted Pixel, and Armature Studio. Sanzaru built Moss and Asgard’s Wrath franchises; Twisted Pixel delivered Marvel’s Deadpool VR; Armature ported Resident Evil 4 VR.

These closures eliminated key Meta VR exclusives and first-party content pipelines. Entire teams dissolved overnight, with hundreds of developers and artists flooding LinkedIn with “Open to Work” posts within hours. The personal toll on affected families proved substantial and widespread.

Workers Seek New Paths

Affected employees pivoted rapidly following January 13 notifications. LinkedIn surged with “Open to Work” posts from ex-Reality Labs staff and shuttered studio developers.

Professionals from Sanzaru, Twisted Pixel, and Armature began sharing portfolios and updating resumes online within hours.

Families faced disruption in expensive tech hubs like Austin and Seattle. Career trajectories built around Meta’s metaverse vision suddenly shifted as talent flooded a competitive job market seeking alternative opportunities.

Legacy Studios Lost

Sanzaru Games crafted Moss and Asgard’s Wrath; Twisted Pixel delivered acclaimed VR adventures and Marvel’s Deadpool VR; Armature ported Resident Evil 4 VR, bringing AAA gaming to Meta’s platform.

These studio closures erase key Meta exclusives and eliminate creators of marquee VR titles. The VR ecosystem loses critical momentum as third-party developers watch warily.

A broader content drought looms for Meta Quest users, threatening the platform’s competitive position against PlayStation VR2 and emerging competitors in the VR space.

AI Pivot Accelerates

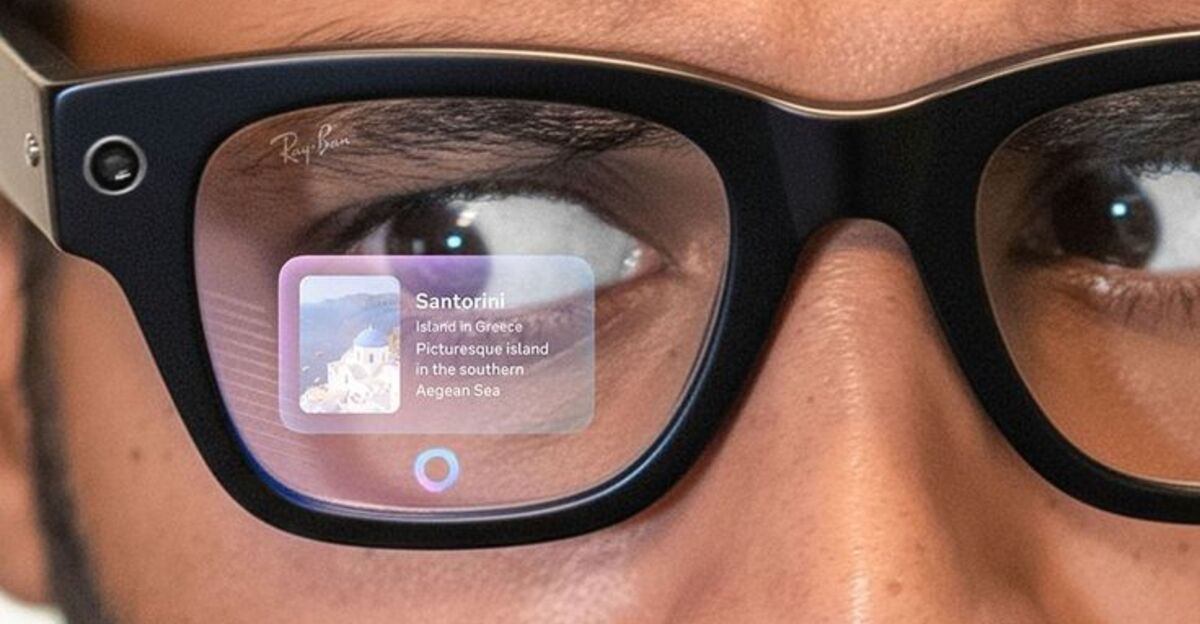

Meta reallocates layoff savings to AI-powered wearables like Ray-Ban smart glasses, which outsell VR headsets significantly. Ray-Ban Meta glasses have sold 2 million units since the October 2023 launch, with production capacity ramping to 10 million units annually by the end of 2026.

Competitors like Apple Vision Pro advance slowly. VR funding dries up after Ready at Dawn (closed August 2024) and Downpour Interactive (closed June 2025).

Supply chains fundamentally shift from headsets toward AI-enabled glasses and wearable-first development strategies.

Game Dev Consolidation

Meta shuttered three studios but retained Beat Games (Beat Saber), BigBox VR, and Camouflaj (Batman: Arkham Shadow)—revealing selective survival favoring revenue-generating titles with proven monetization.

Pattern emerges: Meta trims pure gaming studios with unproven revenue while keeping properties with demonstrable player bases. Oculus Studios Central Technology dissolved.

The VR exclusives era ended abruptly, shifting focus toward mobile Horizon experiences and wearable-first development aligned with Ray-Ban’s hardware rollout strategy.

Staff Frustration Boils

Laid-off developers vented online, echoing Mashable reporter Alex Perry: “The end result is that more than 1,000 people have to figure out what’s next, while the executives who made the decision to chase the metaverse in the first place will remain at their posts.”

Internal memos sparked backlash over targeting creators while leadership remained intact. Morale plummeted ahead of Bosworth’s January 14 all-hands meeting. Stakeholder trust eroded amid repeated cuts in January, April, and October 2025.

Leadership Steers Shift

CTO Andrew Bosworth, Reality Labs veteran, authored the January 13 restructuring memo and called an urgent January 14 in-person all-hands meeting—described as the “most important” of the year.

Meta spokesperson Tracy Clayton confirmed: “We were shifting some of our investment from metaverse toward wearables.”

Internal memos revealed Bosworth’s November 2024 assessment that 2025 would determine “whether this entire effort goes down as the work of visionaries or a legendary misadventure.”

Wearables Surge Ahead

Meta reinvests in Ray-Ban Meta glasses, ramping production to 10 million units annually by year-end 2026, potentially reaching 20 million. Two million units sold since the October 2023 launch represent substantial commercial validation.

Year-over-year sales growth exceeded 300% in H1 2025. First-party AI features delivered real commercial success, unlike VR.

Quest headset sales lagged despite the holiday season. Project Phoenix, a lightweight AR-VR hybrid device, is targeting an early 2027 release and could revolutionize mixed reality hardware strategy.

Skeptics Question Pivot

Industry experts debate complete VR abandonment. Road to VR analysts noted: “Meta isn’t really abandoning VR, just making it more efficient.” Yet cumulative $73 billion losses fuel investor skepticism about overall strategy credibility.

Beat Saber studio survival hints gaming niche persists. Some analysts question whether Project Phoenix can capture the elusive demand for Quest.

Market volatility tests metaverse remnants amid AI hype. Broader questions linger about whether the metaverse remains viable long-term under any financial structure or market condition.

Future Worlds Uncertain?

Will Meta’s VR graveyard bury innovation, or spark leaner AR dominance? With $73 billion in losses and lessons learned, does AI eclipse immersive dreams?

January 2026 layoffs signal endgame—but Project Phoenix looms as potential comeback vehicle. Industry observers debate whether Ray-Ban’s success proves AI wearables viable or merely delays VR retreat.

Strategic uncertainty remains: Can Zuckerberg’s hardware vision pivot successfully toward smart glasses, or will Reality Labs’ losses define the era as “legendary misadventure”?

Sources:

Android Central, 2026-01-13 and 2026-01-14

Bloomberg News, 2026-01-13

Business Insider, 2025-12 and 2026-01

CNBC, 2025-10-29

Economic Times, 2026-01-13

India Today, 2026-01-13