Due to a tightening agricultural economy and a decline in demand for farm equipment, John Deere announced 141 layoffs in Iowa in 2025. The $600 million hit from steel and aluminum tariffs imposed during President Donald Trump’s administration is a significant motivator.

These tariffs led to a decline in equipment sales and a significant increase in production costs. The layoffs, which are dispersed among Waterloo and Ankeny facilities, are a result of both general economic pressures and seasonal production adjustments.

The Historical Background of John Deere’s Employee Layoffs

Since 1837, John Deere has been a major employer in Iowa and the Midwest, and it has a long history as an American manufacturer of agricultural equipment. Nevertheless, the business has been laying off employees on a regular basis; since April 2024, more than 2,200 jobs have been eliminated in Iowa alone.

These decreases are consistent with cyclical shifts in the demand for farm equipment, which have been made worse by agricultural economic downturns, tensions in international trade, and tariff policies implemented since 2018.

The Effect of Tariffs on John Deere’s Profits

In fiscal year 2025, Deere’s production costs increased by almost $600 million as a direct result of tariffs on steel and aluminum inputs. These tariffs have inadvertently increased costs for downstream manufacturers like Deere, despite being part of a larger protectionist trade policy meant to protect American industries.

Although only 25% of Deere’s components are imported and about 75% of its equipment is assembled domestically, the company still has to deal with price increases for steel and aluminum that affect its supply chain.

Demand for Agriculture and Retaliatory Trade Measures

Retaliatory tariffs from trading partners, particularly China, which has imposed tariffs on American soybeans and other crops, increase the costs of the tariffs. Farmers’ ability to purchase new equipment has been directly impacted by the shrinking export markets and decreased farm income.

The demand for Deere’s products has decreased as a result of a more than 50% decline in soybean exports and a sharp decline in crop prices. In addition to having an adverse effect on Deere’s sales, this negative feedback loop puts the financial stability of rural farming communities that depend on equipment purchases at risk.

Economic and Seasonal Factors Affecting Layoffs

According to John Deere, production follows agricultural cycles in response to seasonal demand patterns; however, the current decline in farm profitability has gone beyond typical trends. Due to credit conditions, increased input costs, and economic uncertainty, farmers are delaying the purchase of new equipment and keeping older machinery longer.

These elements, along with tariffs and shrinking export markets, make it impossible to maintain high production levels. As a result, Deere must modify its workforce size to prevent overproduction and inventory glut.

Tariffs vs. Strategy for Domestic Manufacturing

Tariffs meant to safeguard domestic manufacturing actually hurt Deere’s ability by raising input costs, posing a strategic conundrum for the company. The company uses steel and aluminum that are sourced internationally, even though a significant portion of its equipment is assembled domestically.

Even though Deere is committed to improving its U.S. factories with large investment plans, the tariff burden threatens operational efficiency and profit margins, resulting in layoffs. The intricacy of international supply chains and the unforeseen effects of isolationist trade policies on American manufacturing are both highlighted by this paradox.

Impacts of Economic Ripples on Iowa and the Midwest

In Iowa, where Deere is a major employer, the loss of 141 jobs, combined with thousands of regional layoffs, worsens economic hardships. Layoffs in the manufacturing sector hurt local economies by impacting not only employees but also ancillary businesses and government revenue.

These impacts are exacerbated by the strain on the agricultural sector, upsetting the economic ecosystems of the Midwest. However, by modernizing manufacturing and maintaining some future job potential, Deere’s planned $20 billion investment might mitigate some long-term effects.

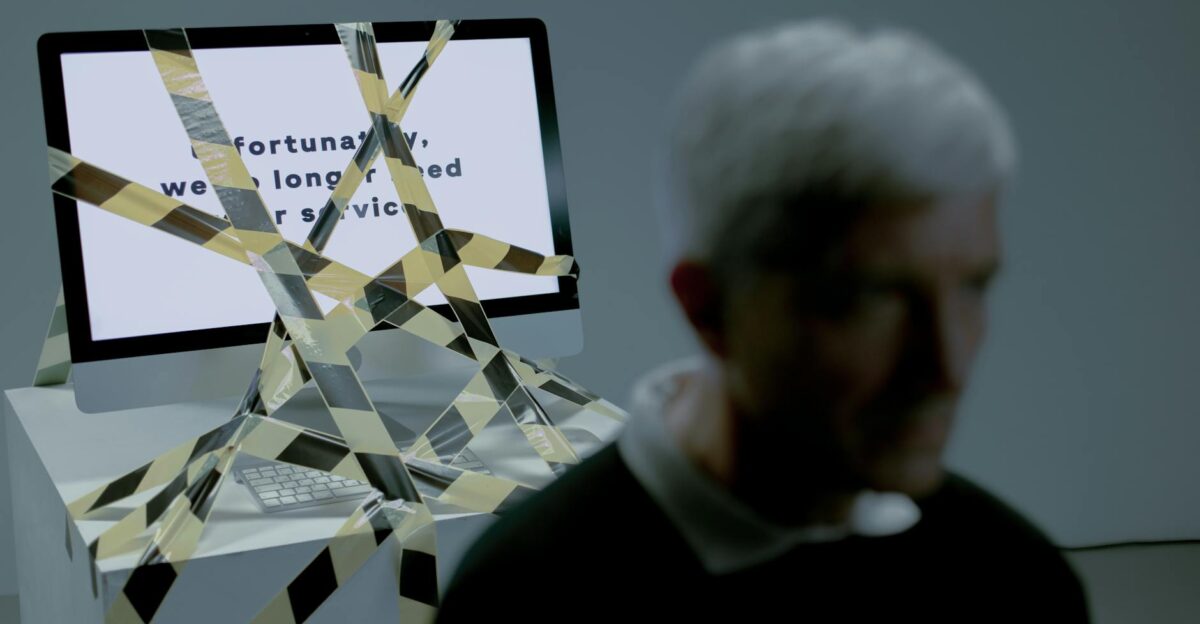

The Effects of Job Cuts on the Mind

For impacted employees and communities, job cuts at a company like John Deere have a substantial psychological impact that affects their sense of economic stability, mental health, and morale. As economic anchors dwindle, communities experience collective stress while workers deal with uncertainty, income loss, and diminished social status.

In areas reliant on manufacturing and agriculture, these psychological effects reinforce economic downturn cycles by influencing consumer confidence and spending.

Trends in the Industry and Upcoming Difficulties

The need for agricultural equipment is changing globally as a result of increased mechanization, but it is also temporarily disrupted by fluctuating crop prices, unpredictability in the climate, and changes in international trade.

Farmers’ cautious capital expenditures, possible automation and precision agriculture shifts, and manufacturers’ need to adjust to shifting geopolitical environments are some of the larger industry trends that are reflected in Deere’s current difficulties. Deere has to manage cost pressures and preserve the resilience of American manufacturing while navigating these trends.

Tariffs as an Innovation Catalyst

Tariffs put a strain on Deere’s finances, but ironically, they may spur manufacturing innovation. Deere may increase its investments in automation, efficiency, and alternative materials for equipment construction in response to rising input costs.

Deere may gain an advantage in a cutthroat international market if the $20 billion modernization plan uses tariffs as a catalyst to streamline production, lessen dependency on pricey steel, and introduce more affordable, environmentally friendly technologies.

The Model of the “Tariff Feedback Loop”

One way to describe the situation is as a “Tariff Feedback Loop,” in which tariffs increase the cost of inputs, lower manufacturer profits, cause layoffs and production cuts, lower farmer incomes as a result of lost sales, dwindling demand, and encouraging more delays in equipment purchases, all of which feed back into declines in manufacturer orders.

This model emphasizes the need for nuanced policymaking by highlighting the connections between regional economies, manufacturing, trade policy, and agriculture.

Strategic Inventory Management at Deere

The CEO of Deere points out that by coordinating production with retail demand to prevent surplus, proactive inventory management has helped to lessen economic shocks.

This strategic flexibility might act as a model for other manufacturers dealing with unstable markets. Deere minimizes waste and maximizes workforce utilization by closely aligning supply with demand trends, preserving flexibility in the face of uncertainty and layoff pressures.

Divergent Opinions on the Protective Effectiveness of Tariffs

Tariffs, according to their supporters, safeguard American steel and aluminum jobs, thereby indirectly bolstering Deere’s domestic supply chain.

Tariffs hurt businesses like Deere and their clients by increasing costs for downstream users and exposing them to retaliatory actions, according to critics. A balanced viewpoint must take into account how to safeguard upstream industries without impairing the farming and manufacturing sectors downstream.

Economic Predictions and Deere’s Course for Adaptation

Due to the slow recovery of farm income and the ongoing uncertainty surrounding tariffs, analysts predict that the demand for agricultural equipment will remain soft through 2025–2026.

In order to thrive in a globalized market with growing protectionist risks, Deere is investing in modernizing its factories with the long-term goal of reducing production costs and increasing competitiveness. There is a trade-off between preserving the manufacturing base for the future and reducing the workforce in the short term.

Unexpected Data: Market Share Dynamics and Tariffs

With a 70% market share in tractors, Deere continues to be a leading supplier of agricultural equipment in the United States despite high production costs.

Tariff-driven price increases, however, run the risk of losing market share to overseas rivals in non-tariff markets, particularly those with lower production costs. Deere is under pressure from this dynamic to balance cost increases and innovate without losing market share.

Transition to Additive Manufacturing in the Long Run

In order to produce complex parts more cheaply and with less reliance on raw steel, Deere may investigate additive manufacturing (3D printing) in the face of steel tariffs and supply disruptions.

By decentralizing supply chains and reducing reliance on bulk materials, this forward-thinking change could lessen the impact of tariffs and establish a robust manufacturing paradigm.

Effect on the Infrastructure of Rural Communities

Workers are not the only ones affected by the layoffs; local services like schools, hospitals, and transportation are weakened by lower income tax revenue.

Because John Deere is a vital component of the community, its layoffs fuel a vicious cycle of rural depopulation and economic decline that might continue in the absence of calculated interventions.

Climate-smart farming and agricultural equipment

Trends toward climate-smart farming technologies may align with Deere’s investment in modernizing manufacturing.

Even though tariffs reduce present profitability, new product lines centered on environmentally friendly farming equipment may open up new markets in the future, connecting emerging environmental innovation strategies with trade policy challenges.

Conclusion

A complex combination of declining agricultural demand, tariff-driven cost increases, and shifting international trade tensions led to John Deere’s decision to eliminate 141 jobs in Iowa.

These layoffs, though justified as a business necessity, highlight the unforeseen consequences of protectionist policies that, although intended to safeguard manufacturing, run the risk of weakening it and the agricultural economy it supports. The company’s pledge to make significant investments in American modernization provides a positive trajectory, but it necessitates striking a balance between immediate suffering and long-term resiliency.