The email lands without warning—“Important changes to your Medicare Advantage plan”—and somewhere in America, a 78‑year‑old widower clicks it open to discover he has been effectively fired as a customer by the nation’s largest health insurer.

UnitedHealth Group is cutting 1 million Medicare Advantage members loose in a single strategic move, the biggest pullback by a major player in the program’s modern history.

America’s Largest Insurer Quietly Fires 1 Million Customers

UnitedHealth, which dominates the Medicare Advantage market, told investors last month it plans to shrink its enrollment by about 1 million people in 2026, reversing years of relentless growth.

The reduction equals roughly 12 percent of its Medicare Advantage membership, a contraction that analysts say is unprecedented for a company of this size in the program’s two‑decade expansion era.

Inside the UBS Room Where “Swagger” Became a Strategy

Two weeks after the announcement, UnitedHealth’s new chief financial officer, Wayne DeVeydt, stepped onto a stage at a UBS healthcare conference and tried to reassure Wall Street that the pain would be worth it.

DeVeydt told the audience that many of the changes the company is making would allow UnitedHealth to “get back to the swagger the company once had,” language that stunned patient advocates given the scale of the cuts.

How a 600,000 Cut Turned Into 1 Million Vanishing Seniors

Back in July, UnitedHealth had warned that it expected Medicare Advantage enrollment to decline by approximately 600,000 members, primarily due to targeted plan exits and network reductions.

By the October 28 earnings call, that projection had ballooned to 1 million, as executives doubled down on a “margin over membership” play and acknowledged they had sharply adjusted benefits for 2026.

Which Plans Are Disappearing

UnitedHealth is shutting down more than 100 Medicare Advantage plans across 109 U.S. counties, a move that will directly affect approximately 600,000 members, according to a filing reported by Reuters.

Many of the discontinued products are preferred provider organization (PPO) plans that allow seniors to go out of network, which executives have flagged as especially costly during a period of rising medical costs and lower government payments.

The Profit Math Behind the Cuts

On the October earnings call, UnitedHealthcare CEO Tim Noel said the company’s 2026 strategy “reflects a conservative path focused on margin growth,” noting that benefits had been “significantly” tightened and some plans exited to offset higher medical costs and funding cuts.

Analysts at TD Cowen and others have said insurers across Medicare Advantage are now “pricing for margin expansion” instead of chasing enrollment volumes, after several years of unexpectedly high care use.

Medicare Advantage Enrollment Set to Fall

For the first time in nearly 20 years, Medicare Advantage enrollment overall is projected to decline instead of grow, according to the Centers for Medicare and Medicaid Services.

Plans expect enrollment to fall from about 34.9 million beneficiaries this year to roughly 34 million in 2026, pulling Medicare Advantage’s share of the Medicare population down from 50 percent to about 48 percent.

Why Insurers Say the Old Model No Longer Works

Health insurers argue that the economics of Medicare Advantage have shifted rapidly, citing higher post-pandemic utilization, rising hospital and drug costs, and changes in government risk-adjustment payments.

A Healthcare Dive analysis noted that plans are blaming a combination of elevated medical trends and tighter federal benchmarks for forcing them to cut benefits, raise premiums, or even exit markets entirely.

A Billion‑Dollar Cyberattack

UnitedHealth is also still digesting the fallout from the 2024 ransomware attack on its Change Healthcare unit, which IBM estimated would cost more than $1 billion and disrupt vast swaths of the U.S. claims system.

Cybersecurity Dive later reported that the company said data from roughly 190 million people may have been exposed, underscoring the scale of the crisis that damaged relationships with providers and payers.

How a MarketWatch Column Turned “Swagger” Into a Flashpoint

In a widely discussed MarketWatch opinion column, financial journalist Neal Shah highlighted DeVeydt’s “swagger” remark as emblematic of a system where financial confidence is celebrated even as 1 million elderly customers are being shed.

Shah wrote that UnitedHealth was exiting unprofitable Medicare Advantage products and sharply raising some Affordable Care Act premiums, describing it as a “purge” of patients who made the business model look broken.

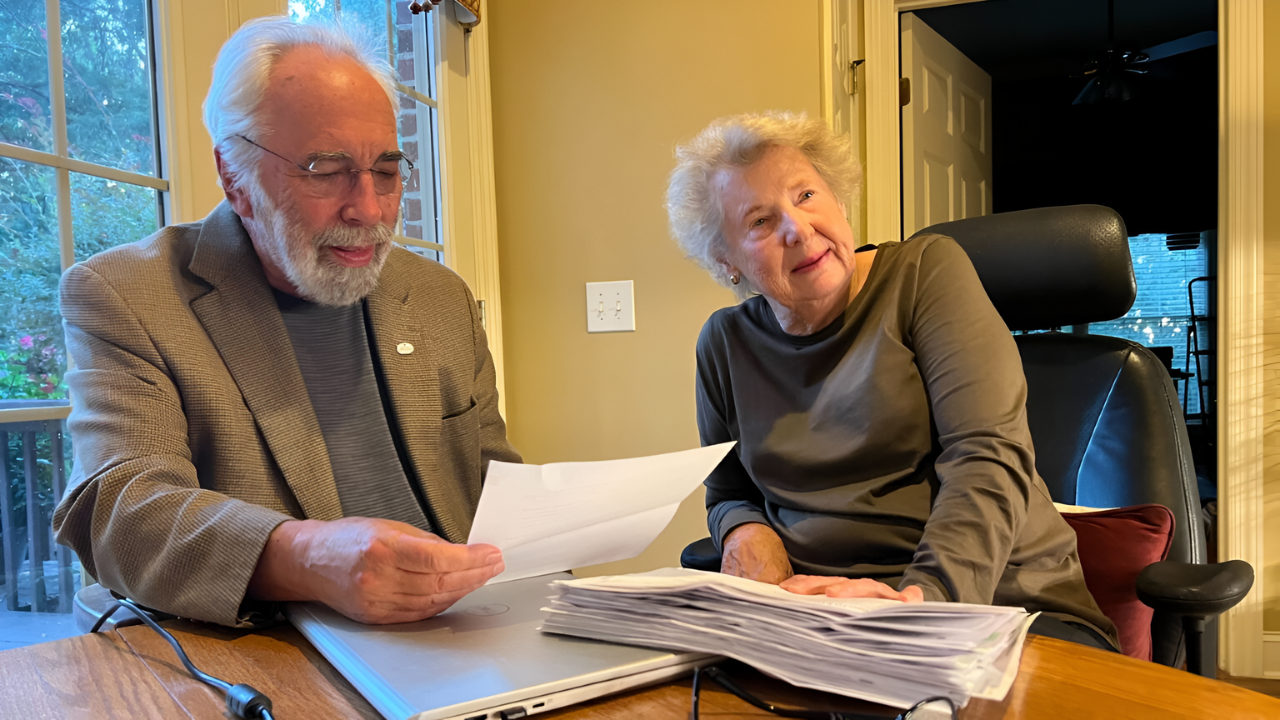

Seniors Learn Their Plan Is Ending

For members, the shift begins with a plain‑language notice: their Medicare Advantage plan will not be offered next year, a scenario federal rules treat as a qualifying event to pick new coverage.

Consumer guides explain that when a Medicare Advantage contract is terminated, enrollees typically receive a Special Enrollment Period to select another plan or return to Original Medicare; however, missing deadlines can result in temporary coverage gaps.

Open Enrollment as a Race Against Time

The mass disenrollment collides directly with the Medicare Annual Enrollment Period, which runs from October 15 through December 7 for 2026 coverage.

Seniors whose plans are ending must make new choices by year’s end if they want uninterrupted coverage starting January 1, turning what is usually a confusing season into a high‑stakes scramble for 1 million people.

What Happens If Seniors Do Nothing

Suppose a Medicare Advantage plan terminates and a beneficiary fails to actively choose another Medicare Advantage option or a stand‑alone Part D plan. In that case, they are generally moved back to Original Medicare by default.

Advocates warn that this can leave people without prescription drug coverage or supplemental “Medigap” protection, exposing them to higher out‑of‑pocket costs until they manage to enroll in new products.

Switching Back to Original Medicare Is Harder Than It Sounds

Consumer resources note that while seniors can move from Medicare Advantage to Original Medicare during specific windows, buying a Medigap policy later in life often requires medical underwriting in most states.

Morningstar and MarketWatch reporting have highlighted that insurers can charge higher premiums or deny coverage based on health status, making it costly or impossible for some long-time Medicare Advantage members to secure robust supplemental coverage when they attempt to switch back.

UnitedHealth Is Not Alone in Cutting Back

UnitedHealth’s retreat is part of a broader contraction that includes other major players, such as CVS Health’s Aetna and Humana, trimming their Medicare Advantage offerings for 2025 and 2026.

Healthcare Dive reported that some insurers are explicitly prioritizing margin resilience over membership, with product exits and benefit reductions now common across the market.

A System Built on Choice, Now Offering Less of It

Research from KFF shows that in many counties, just one or two insurers dominate the Medicare Advantage market, with UnitedHealth often holding the largest share.

When a dominant carrier pulls plans or tightens networks, seniors in those regions can suddenly find themselves with far fewer local options than the national averages might suggest.

Why Advocates Say Seniors Are the Shock Absorbers

The Center for Medicare Advocacy has argued that enrollees are effectively serving as shock absorbers for policy and pricing shifts, facing benefit cuts, prior‑authorization hurdles, and now plan exits as insurers respond to pressure.

Its reports have criticized what it calls “overpayments” and gaming in Medicare Advantage, even as companies narrow networks or reduce extra benefits like vision, dental, and transportation.

Experts Warn the Turmoil Is Far From Over

In an October essay, physician-executive Sachin Jain outlined five drivers of Medicare Advantage turmoil, including aggressive past growth, regulatory crackdowns on coding practices, and higher-than-expected care utilization.

Jain argued that plans are now “re‑rating” the business and that members should expect more volatility in benefits, premiums, and plan availability over the next several years as insurers recalibrate.

How 1 Million Seniors May Remember This Moment

For UnitedHealth, success will be measured in restored margins, a steadier stock price, and, in DeVeydt’s words, a renewed sense of corporate swagger in the eyes of investors.

For the roughly 1 million seniors pushed to find new coverage, the memories may be of long call‑center waits, bewildering plan comparisons, and the realization that the “Advantage” plan they trusted could disappear with a single corporate decision.