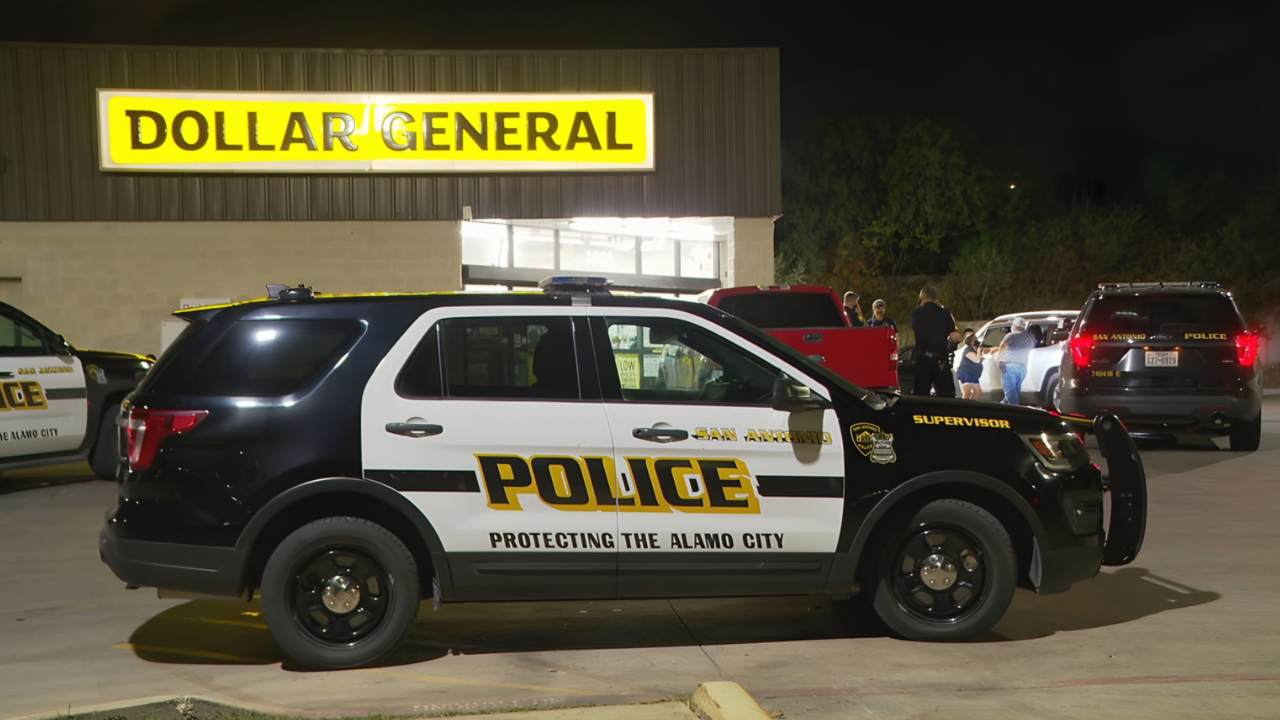

Dollar General finds itself at the center of a significant legal battle in Missouri, following a 2023 state investigation revealing troubling pricing practices.

Out of 147 stores examined, 92 were found to have overcharged customers, with some items marked up as much as $6.50 above their advertised shelf prices.

The findings suggest that nearly two-thirds of the locations involved in the investigation were engaged in deceptive pricing, raising questions about the retailer’s business practices and consumer trust.

Why Dollar General’s Pricing Raised Red Flags

Missouri’s Attorney General launched the 2023 investigation after evidence emerged of widespread overcharging across the state. The probe examined 147 stores and uncovered systematic failures where checkout prices exceeded shelf-advertised prices.

The 62.6% violation rate among inspected locations indicates the problem extends beyond isolated incidents to potential company-wide pricing system failures.

The investigation documented over 5,000 price-checked items, revealing consistent discrepancies between the advertised and charged amounts.

Direct Impact on Missouri Shoppers

Between 460,000 and 920,000 Missouri residents may have been affected annually by Dollar General’s overcharging practices. Shoppers reported paying more at registers than shelf-listed prices, with maximum documented overcharges reaching $6.50 per item.

For budget-conscious families relying on dollar stores for essentials, these pricing errors represent a significant financial burden.

Conservative estimates suggest Dollar General’s overcharging practices may have resulted in approximately $2.3-$6.9 million in annual losses across 92 violating stores, based on documented overcharges and customer transaction volumes. Similar cases in other states have resulted in settlements exceeding $1.8 million combined (Ohio: $1 million, Wisconsin: $ 850,000, Colorado: $ 400,000, Vermont: $1.75 million), suggesting potential exposure.

Dollar General’s Corporate Response

Dollar General has attributed pricing errors to local clerks not updating physical shelf tags and chronic understaffing issues.

The company maintains that updated prices are pushed electronically from its Nashville headquarters; however, individual stores often lag in reflecting these changes on their shelf tags.

The company denies intentionally deceiving customers, characterizing the violations as operational failures rather than deliberate fraud. However, the 62.6% violation rate suggests systemic problems beyond isolated store-level errors.

Consumer Alternatives and Market Response

The overcharging controversy has prompted affected consumers to seek alternatives, including Walmart, Family Dollar, and local convenience stores.

These competitors may benefit from increased foot traffic as shoppers prioritize pricing reliability and transparency.

The case illustrates how a breach of consumer trust can lead to shifts in shopping patterns, even among budget-conscious customers with limited retail options. Local stores face challenges competing with the chain’s marketing power, despite having pricing accuracy advantages.

Payment Technology and Consumer Vulnerability

Jasper County Sheriff Randee Kaiser warned that modern contactless payment methods, such as Apple Pay, increase the vulnerability to overcharging.

“One of the ways that we are vulnerable is the modern convenience of Apple Pay and other similar devices. It’s easy just to click the payment and then turn around and walk out and not get your receipt, or not even look at your receipt, or really not even look at the amount that you just paid for. That can be kind of dangerous,” Kaiser said.

The convenience of tap-to-pay technology means customers frequently skip receipt verification, making systematic overcharging harder to detect. Traditional cash transactions force price awareness that digital payments obscure.

Store Employees

Dollar General employees cite understaffing and frequent corporate price changes as overwhelming operational challenges. Workers report an inability to maintain current shelf tags due to constant pricing updates from headquarters.

The staffing model requires employees to juggle inventory, customer service, and price maintenance simultaneously.

This creates systematic conditions where checkout overcharges become routine rather than exceptional, victimizing both customers and frontline workers blamed for structural failures.

Legal Status and Timeline

The Missouri lawsuit, filed in September 2023, alleges widespread violations of the Missouri Merchandising Practices Act. A bench trial originally scheduled for October 2025 has been postponed, potentially extending proceedings into 2026.

The delay prolongs uncertainty for consumers awaiting accountability and restitution. No settlement has been reached. The lawsuit seeks injunctions, civil penalties, and restitution for affected Missouri shoppers; however, the exact monetary amounts remain undetermined pending trial.

Nationwide Scope and Scale

Dollar General operates approximately 20,000 stores across the United States. If Missouri’s 62.6% violation rate applies nationally, roughly 12,520 stores could be systematically overcharging customers.

This extrapolation suggests tens of millions of Americans may face similar pricing fraud beyond Missouri’s borders.

The Missouri investigation represents the largest documented state-level pricing fraud case against Dollar General, raising questions about whether other states will launch similar investigations.

Consumer Protection Implications

The case tests state-level consumer protection enforcement against major discount retailers. Missouri’s investigation methodology—examining 147 stores through joint efforts between the Attorney General and Department of Agriculture, Weights and Measures—could serve as a model for other states.

The postponed trial delays the establishment of legal precedents for pricing accuracy requirements. Consumer advocates argue the case demonstrates the need for enhanced regulatory oversight and stricter enforcement mechanisms.

Pricing Transparency and Trust

The Dollar General case highlights broader retail industry challenges in maintaining pricing accuracy across thousands of locations.

The disconnect between electronic pricing systems and physical shelf tags creates systematic opportunities for overcharging.

For discount retailers targeting low-income customers, pricing trust represents a foundational business premise. The 62.6% violation rate suggests that operational convenience has been prioritized over pricing accuracy, undermining the value proposition that defines dollar store retail.

Historical Context and Precedents

Missouri’s lawsuit joins similar consumer protection actions in other states. Ohio reached a $1 million settlement in September 2023, Wisconsin settled for $850,000 in November 2023, and Colorado secured a $400,000 settlement in October 2025.

Vermont obtained a $1.75 million settlement in 2019. These multi-state patterns indicate recurring systemic pricing issues, rather than isolated regional problems, suggesting company-wide operational or policy failures that require comprehensive reforms.

Competitive Market Dynamics

While Dollar General faces legal and reputational challenges, competitors such as Walmart and Family Dollar may gain market share from customers displaced by these challenges.

However, Family Dollar, owned by Dollar Tree, faces similar scrutiny regarding pricing accuracy in some jurisdictions. Small local convenience stores struggle to compete with the marketing budgets of chains, despite having potential advantages in pricing accuracy.

The case may reshape competitive dynamics in discount retail, with pricing transparency becoming a differentiating factor.

Financial and Stock Market Context

Dollar General’s stock experienced volatility in 2024-2025, although linking fluctuations specifically to the Missouri lawsuit remains speculative, given the multiple market factors at play.

The company operates in a challenging retail environment characterized by inflationary pressures, shifting consumer behavior, and heightened regulatory scrutiny.

Analysts monitor ongoing litigation costs, potential settlement exposure, and reputational impacts. The trial postponement extends uncertainty for investors evaluating the company’s risk of non-compliance with consumer protection regulations.

Forward Outlook and Consumer Advice

The postponed trial leaves Missouri consumers in limbo, while the risk of overcharging persists. Consumer advocates recommend checking receipts immediately after purchase, comparing register amounts to shelf prices, and reporting discrepancies to state authorities.

The case underscores that pricing accuracy cannot be assumed even at major retailers. As proceedings potentially extend into 2026, the outcome will establish important precedents for pricing transparency enforcement and consumer protection in discount retail nationwide.