On December 29, 2025, United Site Services filed for Chapter 11 bankruptcy protection with lender support, as creditors agreed to take over America’s largest portable sanitation provider, burdened by $2.4 billion in debt, a fleet of 350,000 units, and over 3,000 employees facing an uncertain future. This quiet giant, serving construction sites, festivals, disasters, and events like the Super Bowl, teetered amid rising costs and fading demand, exposing vulnerabilities in a once-reliable industry.

Jobs on Knife-Edge

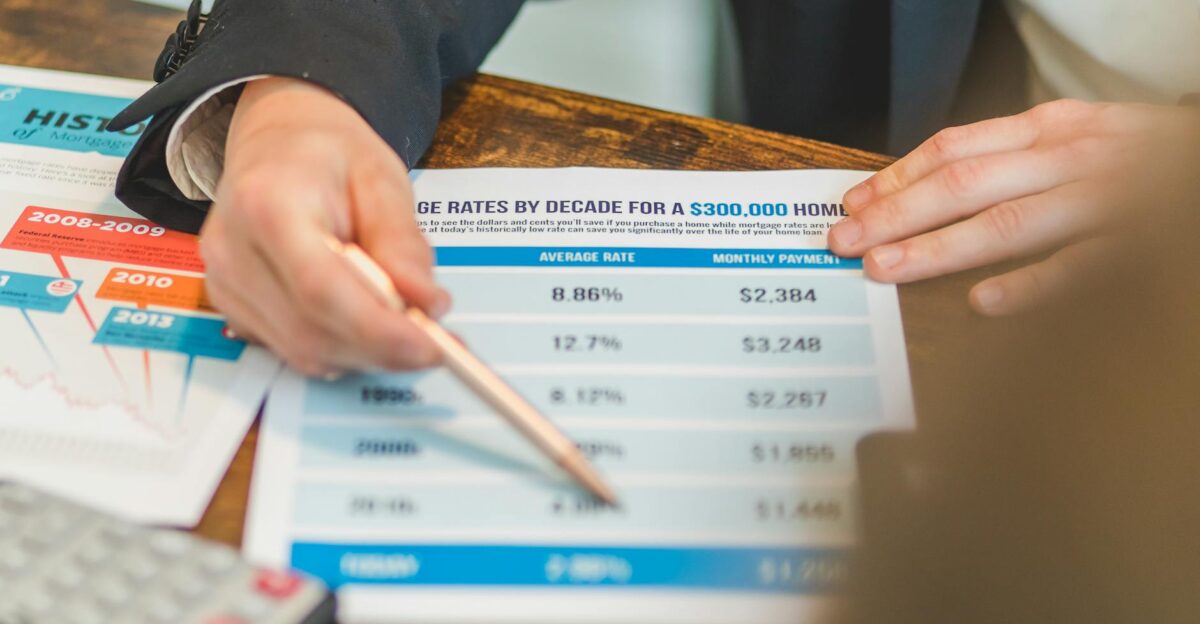

More than 3,000 workers now confront job insecurity as inflation spiked fuel, labor, and maintenance expenses while residential housing starts dropped to 2.5-year lows. Higher interest rates, with Federal Reserve benchmarks exceeding 4 percent, turned debt servicing into an overwhelming burden. What had been viewed as a recession-proof operation buckled under simultaneous demand collapse and financial strain.

Over 25 years, United Site Services consolidated the portable sanitation sector through about 45 acquisitions, establishing nationwide dominance. Platinum Equity acquired it in August 2017 and pursued aggressive expansion. Services spanned construction, music festivals, FEMA responses, and major events, with growth propelled by scale until the underpinning debt overwhelmed cash flows.

Pressure Built Relentlessly

Post-pandemic recovery soured as interest costs soared and high mortgage rates stalled housing projects, eroding core demand. Integrating acquisitions drained liquidity, pushing leverage to roughly 18 times earnings by mid-2025. Cash burn intensified, transforming a viable business into one on the verge of collapse.

The company entered Chapter 11 in New Jersey’s U.S. Bankruptcy Court (case No. 25-23630), pursuing a creditor-backed restructuring to shed $2.4 billion in debt. Over 75 percent of creditors support the pre-packaged plan, under which lenders will assume full control, erasing Platinum Equity’s eight-year ownership. A $480 million equity rights offering anchors the shift to creditor governance.

Restructuring Blueprint and Path Ahead

Headquartered in Westborough, Massachusetts, the firm will maintain operations nationwide via up to $120 million in debtor-in-possession financing. Post-restructuring, it plans $1.1 billion in new capital: a $300 million term loan, $195 million asset-based loan, and $100 million revolver. Vendors face full payment, with first-day motions ensuring continuity for its vast fleet supporting fencing, hand-washing stations, and logistics.

All employees stay on payroll with wages and benefits intact for now, though security depends on a smooth process. CEO Bobby Creason described the move as fortifying the foundation for the workforce. Operations target a February 2026 exit, hinging on resolved legal hurdles.

Broader Pressures

One creditor holdout eyes “delay and litigation,” risking timeline slips, while backers like Clearlake Capital and Searchlight Capital Partners push the plan. Advisors PJT Partners and Alvarez & Marsal handle claims between $1 billion and $10 billion in assets and liabilities.

The 2021 continuation fund valued the company at $4 billion, letting Platinum Equity extract $2.6 billion as Fortress, Ares, and Blackstone invested—now facing $1.4 billion in losses. This saga reflects broader pressures: U.S. bankruptcies nearing 15-year highs, $1 trillion in private equity holdovers, and scrutiny of debt in cyclical, essential services.

A Marker For Leveraged Plays

Rivals eye opportunities in construction, events, and disasters if disruptions arise. Moody’s had warned of unsustainable leverage. Long-term success rests on housing recovery and rate cuts; without them, a lighter balance sheet may not suffice amid economic cycles.

The case spotlights risks in private equity’s leverage for infrastructure-like businesses, fueling policy debates on continuation funds and resilience. Confined to U.S. operations, its ripples hit global investors like Ares and Blackstone, serving as a marker for leveraged plays in volatile sectors. As creditors steer the reset, housing trends and Fed policy will gauge if this stabilizes the firm or signals wider strain in dependable industries.

Sources:

“United Site Services Reaches Agreement with Key Financial Stakeholders to Position Company for Long-term Growth.” PRNewswire, 29 December 2025.

“Porta-Potty Company Sinks Into Bankruptcy to Slash Debt.” Bloomberg, 29 December 2025.

“Fortress, Ares Face Total Loss on Platinum Equity Toilet Deal.” Bloomberg, 25 November 2025.

“Billions Down The Toilet As Private Equity Firms Take Bath On Portable Sanitation Play.” Yahoo Finance, 27 November 2025.