A sudden plant closure in Auburn Hills, Michigan has sent ripples through the state’s storied auto industry, exposing the vulnerabilities of a sector in transition. The shutdown of Dana Thermal Products, a major supplier for electric vehicle (EV) components, comes as federal tax credits for EVs expired and consumer demand faltered, leaving hundreds of workers and local businesses facing an uncertain future.

Layoffs and Local Impact

Dana Thermal Products announced the permanent closure of its Auburn Hills facility, with approximately 200 employees set to lose their jobs between October 2025 and January 2026. The company cited “an unexpected and immediate reduction in customer orders driven by lower demand for electric vehicles,” making continued operations unviable. For many families, the news arrived with little warning, upending household budgets and straining the local economy.

Auburn Hills, long a hub for automotive manufacturing, now faces a wave of layoffs that extends beyond the plant gates. Local businesses are bracing for reduced spending, and community organizations report increased requests for food assistance and unemployment support, highlighting the broad reach of the closure’s fallout.

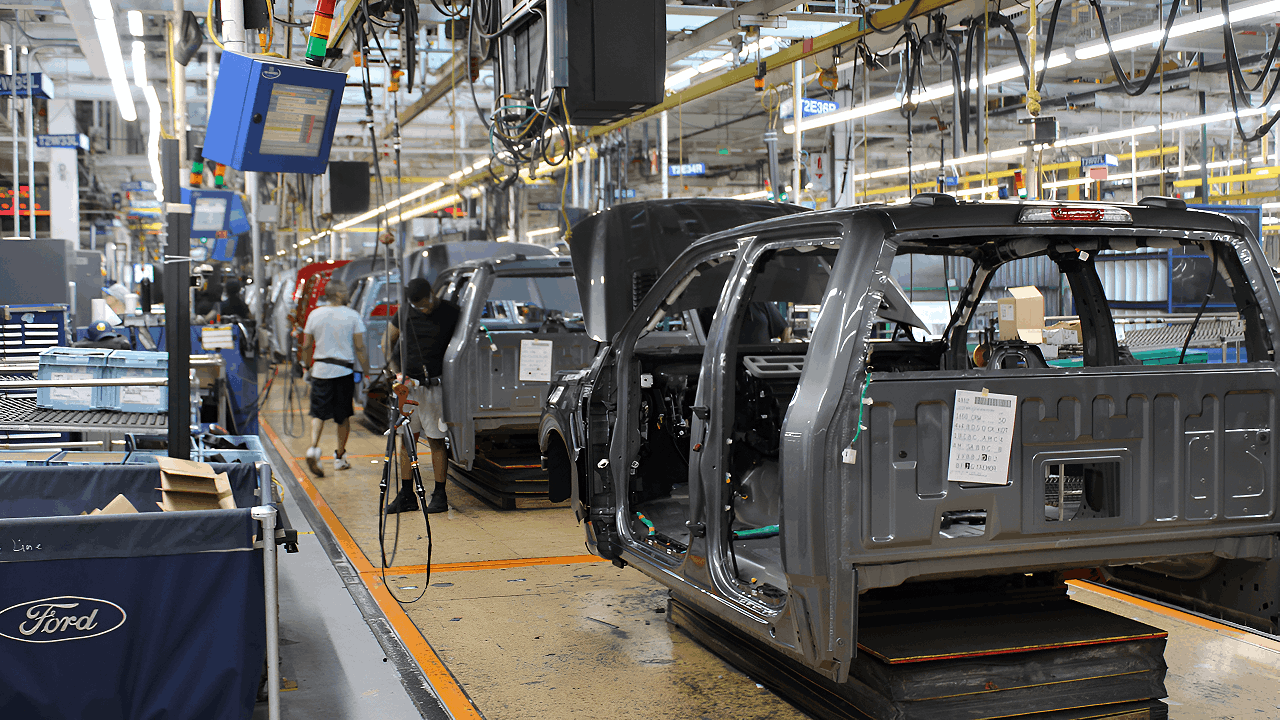

Michigan’s Auto Heritage Under Pressure

Michigan’s identity is deeply tied to the auto industry, with generations of workers building careers in manufacturing. Auburn Hills has played a pivotal role in supplying parts to major automakers, and Dana Thermal Products was seen as a key player in the state’s push toward EV innovation. The facility, which opened in 2022 to produce battery cooling plates, was launched with optimism about the future of electric vehicles.

That optimism has faded as market conditions shifted. The expiration of federal EV tax credits on September 30, 2025 triggered a sharp decline in consumer demand, catching suppliers off guard. “We expected steady growth, but the market changed overnight,” said Chris Dodge, plant manager at Dana Thermal Products, in a notice to the Michigan Department of Labor and Economic Opportunity.

Industry Chain Reaction

Dana’s closure is part of a broader contraction in Michigan’s auto supply chain. Other suppliers have reported reduced orders and production slowdowns, while automakers like General Motors posted significant losses attributed to the same policy shift. GM reported a $1.6 billion quarterly charge—$1.2 billion related to capacity adjustments and $400 million from supplier contract cancellations—underscoring the scale of the challenge facing the industry.

U.S. electric vehicle sales reached a record 438,500 units in the third quarter of 2025, but have since declined following the sudden end of federal incentives. The policy shift has forced companies to reconsider investments and staffing levels, with Michigan’s supply chain particularly exposed to rapid changes in both technology and regulation.

Global Comparison and Ownership Shifts

Michigan’s experience mirrors challenges seen in other auto manufacturing regions worldwide. In Germany, for example, suppliers have also faced layoffs and closures as EV incentives fluctuate and consumer adoption slows. The global EV market remains volatile, with policy decisions playing a critical role in shaping demand and investment.

Dana Incorporated, the parent company of Dana Thermal Products, is undergoing its own transformation. In June 2025, Allison Transmission announced a $2.7 billion deal to acquire Dana’s Off-Highway business, signaling a strategic shift away from traditional vehicle components. The sale, expected to close in late 2025, could reshape Dana’s priorities as it navigates the EV downturn.

Community Response and Calls for Action

The abrupt closure has sparked frustration among local leaders, who argue that policymakers failed to anticipate the consequences of ending EV incentives. Community advocates are urging state and federal leaders to act quickly to prevent further closures and support affected workers.

Local officials warn that the ripple effects could last for months, affecting everything from retail sales to housing stability. The layoffs have exposed the region’s dependence on automotive manufacturing and raised questions about long-term resilience.

Looking Ahead: Adapting to New Realities

Despite the setbacks, some suppliers are exploring ways to adapt, investing in hybrid and alternative powertrain technologies to capture new market segments. Others are lobbying for renewed government incentives to revive EV demand. The path to recovery remains uncertain, but industry leaders insist that innovation and coordinated policy will be key to future growth.

As Michigan’s auto sector faces an inflection point, the fate of hundreds of workers and the broader community hangs in the balance. The region’s ability to reinvent itself in response to technological and policy shifts will determine whether it can remain a leader in automotive manufacturing—or risk falling behind in a rapidly changing global market.