For decades, drive-thru lanes symbolized American convenience, a quick way to grab a meal without leaving the car. But by 2025, a dramatic shift occurred. Drive-thru orders dropped to 65% of quick-service restaurant sales, down from 83% in 2020.

This 18-point collapse marks the largest change in the QSR industry. The convenience of drive-thru, once king, is now being dethroned by changing consumer preferences.

The Takeout & Delivery Surge

As drive-thru traffic dwindles, takeout and delivery have flourished. In 2025, takeout grew by 15.5%, while delivery increased by 13.5%. Off-premises dining now makes up about 75% of all restaurant traffic.

This is a massive change from pre-pandemic norms, with younger consumers—particularly Gen Z and millennials—embracing the convenience of ordering from home. The pandemic kickstarted this trend, and now it’s become the norm.

A Brief History of Drive-In Dominance

Drive-ins reached their peak in the 1950s as symbols of leisure and mobility. By the 1980s and 90s, the drive-thru model replaced them as the operational backbone of fast food.

Chains like McDonald’s, Wendy’s, and Burger King built empires on drive-thrus. For decades, the model was a foolproof revenue generator. But now, the very foundation of this fast-food empire is under threat.

Pandemic Acceleration & Post-Pandemic Reversal

During COVID-19 lockdowns, drive-thrus became essential. Restaurants innovated with double lanes, AI systems, and better service models.

But as restrictions lifted, indoor dining returned, and consumers discovered its benefits: faster service, greater order accuracy, and a more enjoyable experience. The pandemic exposed a hidden preference—people enjoy eating inside more than they thought.

Hi-Pointe Drive-In Closes One-Third of Locations

Hi-Pointe Drive-In, a beloved St. Louis burger chain, has closed three out of nine locations, cutting its presence by one-third. The closures affect sites in Edwardsville, O’Fallon, and Ballwin, Missouri.

The company attributed the move to a strategy aimed at “strengthening brand quality and consistency.” Despite the closures, they continue to honor gift cards and loyalty points at the six remaining locations.

St. Louis Metro Feels the Ripple

The closures eliminate three of Hi-Pointe’s locations in the St. Louis metro, leaving just six in operation. These closures have cultural and economic impacts, as Hi-Pointe has been a cherished local brand.

The remaining locations in St. Louis, Kirkwood, Cottleville, and Chesterfield will now bear the weight of a more concentrated presence, affecting local jobs and the community fabric.

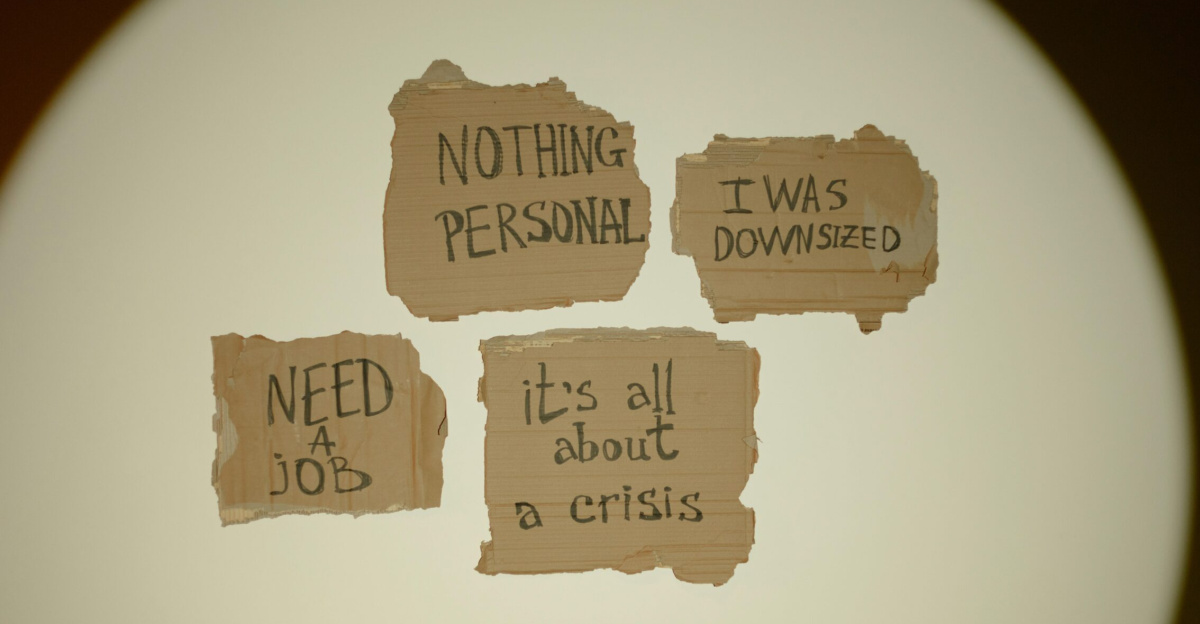

Workers and Communities Bear the Cost

The closure of three Hi-Pointe locations has displaced numerous employees—estimated between 90 and 120 workers based on typical staffing levels at similar-sized locations. However, the company has promised support for affected workers, offering them transfer opportunities at remaining locations.

Hi-Pointe’s President emphasized the difficult nature of the decision, expressing gratitude to the hardworking employees who helped build the brand. For those in Edwardsville, O’Fallon, and Ballwin, the loss is bittersweet.

Sonic, Salad and Go, Hot ‘n Now: A Pattern Emerges

Hi-Pointe is not alone. Sonic Drive-In closed approximately 60 locations in 2024, with more closures continuing into 2025. Similarly, Salad and Go closed 41 locations in Texas and Oklahoma, and Hot ‘n Now collapsed from over 150 locations to just two.

These closures reflect a larger trend affecting the drive-thru model. Even major names in the industry are being squeezed by declining consumer demand for drive-thru.

The Macro Trend: Off-Premises Dominance

In 2024, off-premises traffic, including takeout, delivery, and drive-thru, accounted for 83% of limited-service restaurant traffic. But within this category, drive-thru’s share has sharply declined.

Consumers are now opting for delivery and takeout as their preferred modes of dining. The growth of off-premises dining is undeniable, but the reign of the drive-thru is over.

Consumer Intent to Abandon Drive-Thru

One in three consumers plan to cut back on their drive-thru visits. Speed remains a top priority for drive-thru customers, but long wait times have created frustration.

Consumers are now turning to takeout apps and delivery services that offer similar speed without the hassle of waiting in line. This shift represents a significant turning point in consumer dining behavior.

The Operator’s Dilemma: High Costs, Declining Returns

![KFC Drive thru [sic]/Gyrru trwodd <span class="mw-valign-text-top" typeof="mw:File/Frameless"><a href="//commons.wikimedia.org/wiki/File:KFC_Drive_thru_(sic)-Gyrru_trwodd_-_geograph.org.uk_-_4227550.jpg#ooui-php-4" title="Edit this at Structured Data on Commons"><img decoding=](https://aws-wordpress-images.s3.amazonaws.com/ruckus/wp-content/uploads/2026/01/kfc-drive-thru-sic-gyrru-trwodd-geograph-org-uk-4227550-cropped-1769066072.jpg)

Drive-thru real estate has become more expensive, yet traffic continues to decline. Operators are stuck with high costs for drive-thru lanes while struggling with falling customer numbers.

Many chains that relied heavily on drive-thru now find themselves in a tough spot, with weakened overall traffic. The investments made during the pandemic to optimize drive-thru lanes have not paid off as expected.

The Service Gap: Where Chains Stumbled

Chains that focused on drive-thru optimization have often neglected the in-store experience. Kiosks have replaced human service, but for many customers—especially older ones—human interaction is critical.

As chains became more automated, they lost touch with the personal service that made the experience memorable. Hi-Pointe’s shift towards “quality and consistency” signals a recognition of this oversight.

Starbucks’ Labor-First Pivot: A Counterexample

Starbucks has taken a different approach. After evaluating the impact of labor on service speed, Starbucks expanded a staffing pilot, proving that human service can outperform automation.

By focusing on staffing, they were able to reduce wait times and improve service quality. The lesson? Investing in human capital may be more effective than relying on technology.

The Outlook: Survival Requires Reinvention

The fate of drive-thru-dependent chains rests on their ability to reinvent themselves. For Hi-Pointe, closing underperforming locations and consolidating resources was a strategic move to focus on quality over quantity.

However, whether this new direction will prove successful remains to be seen. It’s clear that relying solely on drive-thru is no longer viable.

The Broader Question: What Comes Next?

As drive-thru traffic continues to decline, chains will need to reconsider their real estate investments. Drive-thru lanes were once prime real estate, but with fewer consumers using them, operators are faced with tough decisions.

Will they shift to hybrid models, renegotiate leases, or move away from drive-thru entirely? The next few years will be critical in determining the future of this model.

Policy Implications: Labor and Wage Pressure

As chains consolidate and close locations, labor markets will feel the impact. Hi-Pointe’s closures are a reflection of broader industry trends that threaten jobs in the fast-food sector.

However, chains like Starbucks show that investing in labor can lead to improved service. Policymakers may need to step in to support workers through retraining programs or wage supports as the industry adjusts.

Real Estate Implications: Stranded Assets

Drive-thru real estate, once a premium asset class, risks becoming stranded. If drive-thru traffic continues to decline, operators and landlords with long-term leases face substantial losses.

The conversion of drive-thru properties into delivery-only kitchens or other retail uses is a potential solution, but this shift represents a significant financial challenge for real estate investors.

Environmental and Urban Planning Angles

The decline of the drive-thru could have positive environmental implications. With fewer consumers relying on cars, there may be a decrease in emissions and traffic congestion.

However, the growth of delivery services may increase vehicle traffic, especially from delivery vans and bikes. Urban planners may view this shift as an opportunity to reclaim space for pedestrian-friendly development.

Generational Shift: What Younger Consumers Want

Younger consumers, particularly Gen Z and millennials, are reshaping the restaurant industry. For them, takeout and delivery are essential parts of their lifestyle.

Drive-thru, once seen as a novelty, is now just another option among many—and often an inferior one. As older generations age out of the market, the cultural relevance of the drive-thru continues to wane.

The Bigger Picture: Structural Transformation, Not Cyclical Downturn

Hi-Pointe’s decision to close a third of its locations is not a one-off event but part of a larger shift in American dining. The once-dominant drive-thru model is being replaced by takeout, delivery, and reimagined dining experiences.

This change reflects deeper cultural shifts and consumer preferences. The question is no longer whether the drive-thru survives—it’s whether it remains central to the business model.

Sources:

“QSR Drive-Thru Trends: Why Traffic Is Falling & How Restaurants Can Win It Back.” Revenue Management Solutions, 20 Aug 2025.

“Hi-Pointe Drive-In announces closure of 3 locations in St. Louis area.” Sauce Magazine, 5 Jan 2026.

“Off-Premises Restaurant Trends 2025.” National Restaurant Association, Apr 2025.

“Drive-in burger chain closes one-third of restaurants in 2026.” TheStreet, 11 Jan 2026.