A leaked audio recording thrust Campbell’s into an unprecedented corporate crisis in November 2025 when alleged remarks by a senior executive about the company’s chicken products triggered regulatory investigations, consumer backlash, and significant financial losses. The incident demonstrates how quickly internal communications can spiral into a multi-front crisis affecting stock prices, regulatory standing, and brand reputation.

The Recording and Its Allegations

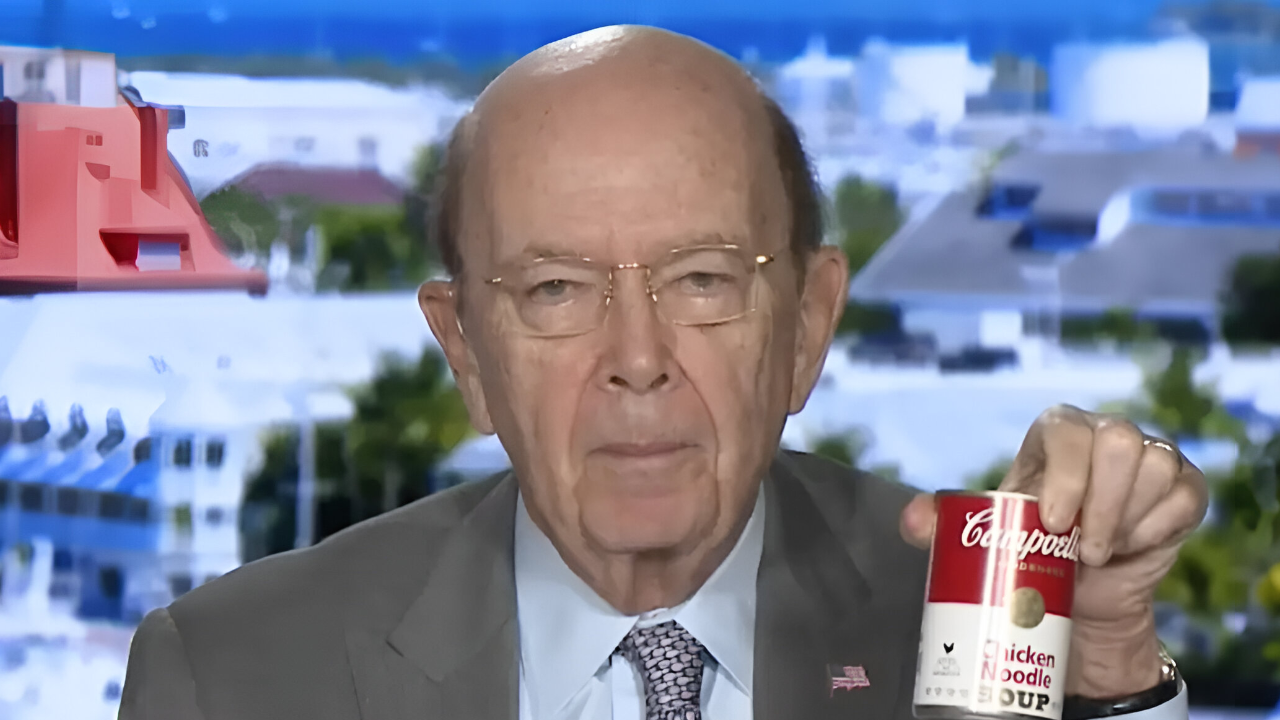

The audio clip, reportedly featuring Martin Bally, the company’s Vice President of Information Security, allegedly contained inflammatory statements about Campbell’s products. According to reports, Bally described the chicken as coming from a 3D printer and used derogatory language to characterize the company’s soups. The recording further allegedly included racist remarks directed at Indian coworkers, escalating public outrage beyond product concerns to workplace culture issues.

The audio emerged through litigation—a wrongful termination lawsuit filed by another former employee that produced the recording as evidence before it leaked publicly. Within hours, the clip spread across digital platforms, with hashtags mocking the “3D chicken” trending as millions encountered the allegations before Campbell’s could mount a coordinated response.

Campbell’s Immediate Response

The company moved swiftly to contain the damage. Campbell’s publicly denied every claim, stating that its products contain no 3D-printed, lab-grown, or bioengineered meat. The company emphasized that its chicken comes from reputable U.S. suppliers and meets all USDA standards. Internally, Campbell’s initially placed Bally on administrative leave while investigating the recording’s authenticity, but the leave proved short-lived. Bally was terminated shortly after, signaling how seriously leadership viewed the reputational threat.

Regulatory Consequences Emerge

The regulatory response arrived faster than anticipated. Florida Attorney General James Uthmeier announced consideration of an investigation into Campbell’s, citing state laws that ban the sale of lab-grown and cultivated meat products. The state’s interest stems directly from Bally’s alleged claims about bioengineered ingredients. Even though Campbell’s denies using such products, the mere allegation triggered scrutiny that could take months to resolve and cost millions in legal fees. If allegations proved true, the company could face operational restrictions in Florida—a significant prospect for a food industry giant.

Financial Impact and Market Reaction

Investors responded decisively. Campbell’s stock had declined significantly over the preceding weeks, with shares falling from around $34 to approximately $30.61 per share by late November. With roughly 300 million shares outstanding, this decline represented approximately $1 billion in lost market value. For shareholders, the extended downturn erased months of gains, pushing shares to levels not seen since the 2008 financial crisis.

The Broader Stakes Ahead

Campbell’s now faces a multi-front battle: reassuring consumers, satisfying regulators, stabilizing stock prices, and addressing workplace culture concerns. The alleged racist remarks ensured this scandal could not be reduced to a food-labeling dispute, with advocacy groups and employees demanding accountability extending beyond a single termination. Industry analysts noted that the incident highlights how vulnerable legacy brands are to viral misinformation, even when claims originate internally. One disgruntled executive’s alleged remarks can ignite a crisis requiring years to fully extinguish. If Florida proceeds with enforcement actions, hundreds of jobs at distribution centers and retail partners could potentially be at risk. As the company navigates regulatory investigations and consumer skepticism, the next quarterly earnings call will be closely watched for signs of lasting damage. For boardrooms everywhere, the Campbell’s crisis offers a stark reminder: in an age of smartphones and social media, no conversation remains truly private, and the cost of careless words can be measured in billions.

Sources:

Business Insider — Original audio leak reporting and executive details

The Verge — Termination confirmation and timeline details

Florida Attorney General (James Uthmeier) — Official investigation announcement and lab-grown meat ban context

NASDAQ/Financial Markets Data — Stock price decline, market capitalization calculations

New York Times — Executive profile and corporate response statements

Axios — Campbell’s official denials and USDA compliance statements