Renee Nicole Good never wanted to become the pivot point of a corporate crisis. A mother of three from Minneapolis, she was fatally shot by ICE agent Jonathan Ross on January 7. Five days later, billionaire Bill Ackman donated $10,000 to Ross’s legal defense GoFundMe.

Within hours, social media erupted with calls for a boycott targeting Chipotle. The company moved quickly to distance itself from Ackman through public statements, revealing acute brand panic—not about money it had, but reputation it couldn’t control.

Why A Woman’s Death Shattered A Billionaire’s Image

Good’s death fractured America along a familiar fault line. The Trump administration called it self-defense during lawful enforcement. Minnesota officials disputed that framing. Ackman, attempting nuance, wrote that Good “likely did not intend to kill the officer” but her “split-second actions led to her death.”

His measured words collapsed under the weight of one choice: he backed the cop, not the family.

“Innocent Until Proven Guilty”

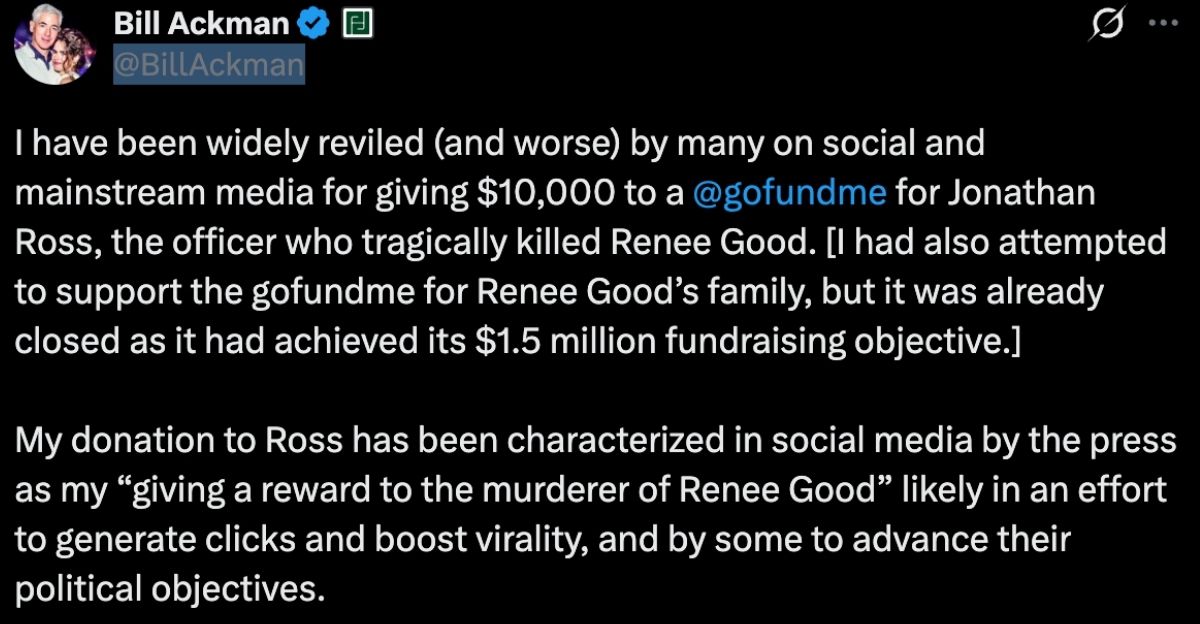

On X, Ackman invoked a legal principle: innocence until proven guilty. He noted federal authorities were investigating. He said he’d also support Good’s family GoFundMe, which had already raised $1.5 million before pausing new donations. None of it mattered.

Supporting both sides isn’t neutrality in a shooting death—it’s a choice, and millions saw it as siding with the shooter.

The Man Who Once Owned Chipotle’s Soul

In September 2016, Ackman purchased a 9.9% stake in Chipotle for approximately $1 billion. He wasn’t a passive investor. Pershing Square Capital Management transformed the chain’s strategy, guiding its recovery from food safety crises and operational failures.

For a decade, Ackman was Chipotle’s architect. Then, starting around 2015, he gradually reduced his position. By late 2025, he had significantly diminished his stake, according to portfolio disclosures.

Selling Your Stakes In The Social Media Age

Chipotle executives faced a cruel reality: they couldn’t rebut a story that was technically irrelevant but emotionally true. Ackman had shaped the company’s identity, then stepped back during their darkest moment. His retreat should have meant freedom from his choices. Instead, his $10,000 donation turned him into a ghost shareholder—a phantom owner of Chipotle’s reputation.

The company responded with public statements distancing itself, removing affiliation, denying connection, and closing the door.

Why Chipotle Couldn’t Stay Silent

Social media had turned speed into currency. A delayed response would have entrenched the false narrative that Ackman controlled Chipotle and that the company tacitly endorsed his donation. With 3,500 U.S. locations and over 120,000 employees depending on brand trust, Chipotle’s leadership understood the stakes.

A single day of ambiguity could trigger cascading effects across platforms, activist networks, and consumer bases.

The Activist Who Created His Own Liability

Ackman built his wealth by identifying and fixing broken companies. He saw value where others saw decline. But his January 2026 decision revealed the limits of activist capital. A billionaire can buy influence and engineer transformation, but he cannot control the moment his personal politics collide with tragedy.

His decade inside Chipotle’s operations, his strategic decisions, his public role as the company’s architect—all became collateral damage.

12,000 Restaurants Now In Play

What terrified corporate strategists wasn’t Chipotle’s immediate exposure. It was a contagion risk. Ackman still controls 27.3 million shares of Restaurant Brands International—8.5% of the holding company that owns Burger King, Tim Hortons, Popeyes, and Firehouse Subs.

That represents approximately 12,000 U.S. locations vulnerable to boycott pressure. The Chipotle backlash served as a tutorial for activists: leverage the investor, not just the brand.

The First Fast-Food Boycott Tied To ICE

Activists had pressured restaurants before—over wages, environmental harm, labor violations. However, this was unprecedented: a national backlash explicitly rooted in a billionaire’s personal donation to an ICE agent’s legal defense fund.

The precedent shifted something fundamental. Corporate leaders now understood that their investors’ political choices weren’t private matters. They were brand vulnerabilities.

The Minneapolis Context That Made Everything Worse

Good’s death occurred in a state where the governor and mayor publicly disputed the official account. In a nation already fractured over ICE enforcement, immigration policy, and police accountability. In a moment when Trump had just returned to office, vowing stricter enforcement.

Ackman’s donation, framed as a defense of due process, was perceived as a political statement in support of the administration’s immigration agenda.

Ackman’s Past Legal Battles

The billionaire referenced his own history with legal jeopardy, as though past regulatory battles over short-selling validated his principle-based stance. Critics noted the asymmetry. Ackman’s past battles have centered on financial regulations and market rules.

Good’s death involved the alleged use of force, a mother’s body, and three orphaned children. The comparison underscored his isolation from the human dimensions of the moment.

The Rapid Response

Corporate response time had become the first line of defense. Chipotle’s public statements distancing itself from Ackman signaled recognition, urgency, and decisive action. It provided journalists and social media users with a clear fact to anchor their reporting.

A delayed response would have amplified conspiracy theories: Was Chipotle secretly supporting Ackman? Did the company tacitly agree with his donation?

When Billionaires Exit But Their Ghosts Stay

Chipotle’s crisis revealed an emerging vulnerability for public companies. When billionaire investors with deep historical stakes make controversial personal donations, corporate distance becomes mandatory but emotionally insufficient.

Chipotle couldn’t retroactively undo Ackman’s involvement in its strategic evolution from 2016 to 2025. It could only deny current affiliation, a technically accurate but hollow statement for consumers processing Good’s death and questioning whether their lunch order funded something they morally opposed.

The Activist Investor’s New Liability

Ackman’s experience created a chilling precedent for activist shareholders everywhere. Future personal political decisions would be weaponized against portfolio companies, even after they’ve reduced their stakes. Selling your shares no longer guarantees freedom.

The new equation was brutal: activist investors should anticipate that exit timing has nothing to do with when your past decisions will haunt your former companies.

The Moral Arguement

Six words—”reward for shooting a mother of three in the face”—distilled the moral argument into something that couldn’t be debated on principle or legal theory. The framing shifted the conversation from Due Process to Consequences, from Ackman’s intentions to Good’s death.

People didn’t argue about the legal facts. They articulated the emotional truth: a billionaire had used his wealth to support a cop involved in a controversial shooting. That resonated. That went viral.

The RBI Bomb That Hasn’t Detonated Yet

As of January 14, 2026, no explicit boycott calls had targeted Burger King, Popeyes, Tim Hortons, or Firehouse Subs over Ackman’s ongoing 8.5% stake. But savvy activists recognized the ammunition. One coordinated push—a social media campaign designed to pressure all RBI brands simultaneously—could replicate the Chipotle playbook at an exponential scale.

The fast-food industry understood that the clock was ticking. Ackman’s portfolio had become politically radioactive.

The Broader Reckoning

Ackman’s crisis exposed a fundamental shift in corporate vulnerability. Billionaire capital is no longer private. Every transaction, every stake, and every donation is scrutinized and weaponized in real-time. Companies can’t hide their investors’ political choices behind corporate firewalls anymore.

The era of anonymous billionaire influence is coming to an end. Activists, journalists, and consumers now understand that identifying a company’s largest shareholders is a crucial first step toward understanding its values.

Moral Authority In Markets

Chipotle has $11.3 billion in annual revenue. Ackman can donate $10,000 without noticing the deduction. Yet the billionaire’s choice forced the corporation to respond with urgency. That inversion of power revealed something about modern capitalism: when individuals’ moral authority is weaponized through social media, it can exceed corporate resources.

A shooting victim’s family can trigger national outrage that reaches millions in hours. The billionaire’s lawyers can’t erase that.

The Uncertainty Haunting Corporate Boardrooms

Image by OGO.svc, Public domain, via Wikimedia Commons

Chipotle’s rapid response bought breathing room, not safety. The company is unsure whether the backlash will stabilize or intensify. It is unclear whether RBI brands will face similar pressure. It is unclear whether other activists will adopt the Ackman playbook and target companies based on their investors’ personal political choices.

Uncertainty is now the new permanent condition of corporate America. That’s the real cost of the past week.

Where This Ends, No One Knows

On January 14, 2026, Chipotle remained standing but shaken. Ackman remained unbowed but compromised. Good’s family remained grief-stricken and suddenly visible. The billionaire class remained convinced that wealth insulates intention from consequence.

Social media remained convinced otherwise. Somewhere in that collision of certainties, the future of corporate accountability was being written—one viral post, one boycott call, one donation at a time.

Sources

Fox Business: ‘Chipotle clarifies Bill Ackman ‘not affiliated’ with chain after billionaire’s ICE agent donation’ (January 13, 2026)

Newsweek: ‘Chipotle Reacts To Boycott Calls Over Bill Ackman’s $10K ICE Agent Donation’ (January 13, 2026)

Komo News: ‘Billionaire donates $10K to ICE agent in deadly Minneapolis shooting’ (January 11, 2026)

Institutional Investor: ‘Facing Losses, Ackman Exits Chipotle and Nike’ (November 20, 2025)

Bored Panda: ‘Bill Ackman’s ‘Shameful’ Donation To ICE Agent’ (January 13, 2026)

The Hill: ‘Bill Ackman defends $10K donation to ICE officer fund’ (January 14, 2026)