Cracker Barrel has permanently closed 14 Maple Street Biscuit Company locations across six states, eliminating roughly 21% of the fast-casual breakfast chain’s footprint.

The shuttered restaurants span Texas, Florida, South Carolina, Tennessee, Kentucky, and Ohio, with Texas bearing the brunt at seven closures. The decision follows a catastrophic year that saw the parent company’s stock plummet over 50% amid mounting financial pressures.

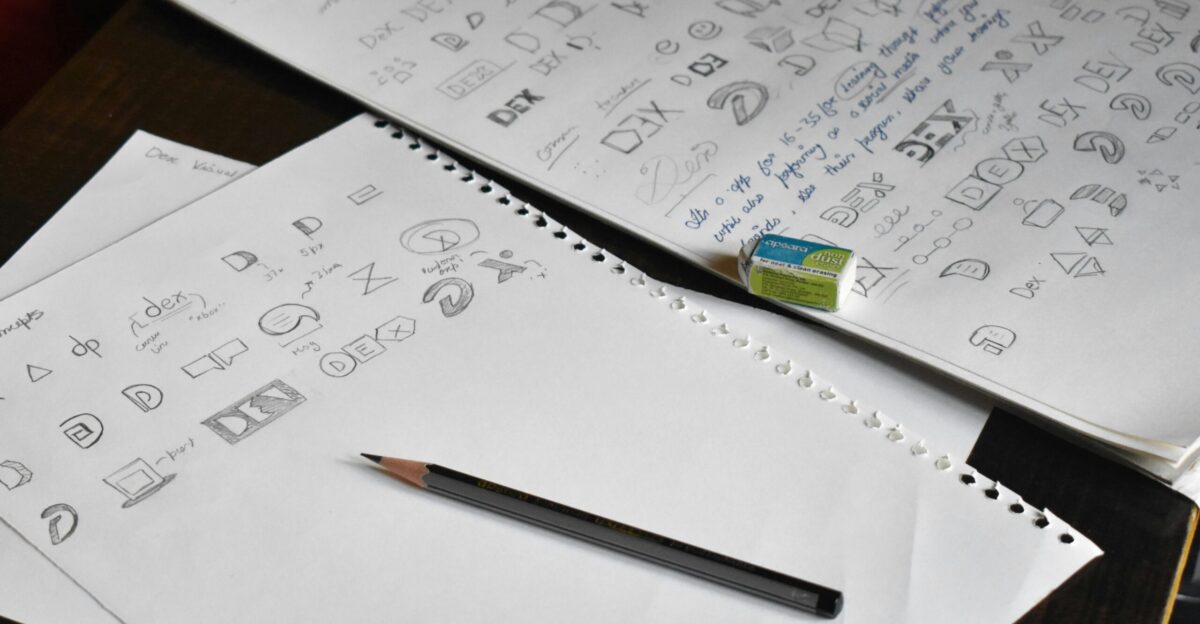

Logo Redesign Triggers Traffic Collapse

The closures follow a disastrous August 2025 logo redesign that triggered an 8% traffic collapse and widespread customer backlash, forcing management to reverse course within seven days. Cracker Barrel’s stock, which traded above $70 in early 2024, has crashed to $28.33 by January 2026.

The logo controversy exposed deeper organizational dysfunction and accelerated the company’s financial deterioration throughout 2025.

$36 Million Acquisition Turns Sour

Cracker Barrel acquired Maple Street Biscuit Company in October 2019 for $36 million, viewing the fast-casual breakfast concept as strategic entry into the growing brunch segment. The brand expanded from 33 locations at acquisition to 68 by fiscal 2025.

However, deteriorating unit-level economics forced management to record over $20 million in impairment charges and goodwill write-downs, acknowledging the acquisition failed expectations.

Texas Bears the Brunt of Closures

Seven of the 14 closed locations were concentrated in Texas, particularly the Dallas-Fort Worth metropolitan area, including two each in Frisco and McKinney.

Additional closures hit tourist-heavy markets like Charleston, Myrtle Beach, Clearwater, and Seminole, plus single locations in Knoxville, Lexington, and Powell. The geographic concentration suggests either market-specific challenges or overexpansion into territories where Maple Street couldn’t compete effectively.

Financial Performance Collapses Dramatically

Cracker Barrel’s first-quarter fiscal 2026 results revealed catastrophic performance: total revenue declined 5.7% year-over-year to $797.2 million, missing Wall Street’s $800 million expectation. Adjusted EBITDA collapsed 84% from $45.8 million in the prior-year quarter to just $7.2 million.

The company swung from $4.8 million net income to a staggering $24.6 million net loss, shocking investors and analysts.

Revenue Guidance Slashed Dramatically

Management slashed full-year revenue guidance by $150-250 million to $3.2-3.3 billion and cut adjusted pre-tax earnings expectations in half from $150-190 million to $70-110 million.

CFO Craig Pommells stated: “Our top capital allocation priority is investing in the core Cracker Barrel business. Therefore, we have decided to slow down Maple Street’s unit growth.” The revised guidance reflects management’s grim assessment of near-term prospects.

Iconic Logo Eliminated in Redesign

On August 19, 2025, Cracker Barrel unveiled a minimalist logo redesign eliminating the iconic “Old Timer” character—Uncle Herschel—as part of a $700 million transformation plan created by San Francisco-based Prophet agency.

The redesign removed “Old Country Store” branding and attempted to modernize the 56-year-old brand with contemporary aesthetics. Customer backlash proved immediate and ferocious, with accusations the company abandoned its Southern heritage.

Swift Reversal After Customer Backlash

Traffic declined 1% in early August but plummeted 8% after the August 19 logo change, forcing management to reverse course after just seven days. CEO Julie Masino stated: “We appreciate our customers for expressing their opinions. We committed to listening, and we have.

Our new logo is being discarded.” President Trump criticized the decision on Truth Social before the reversal, amplifying the controversy.

Design Firm Relationship Terminated

In October 2025, Cracker Barrel severed ties with Prophet, the design firm responsible for the failed rebranding, and suspended store remodeling plans after implementing changes at just four of 660 locations.

The company abandoned the $700 million transformation initiative that sought to replace traditional Southern décor with contemporary aesthetics. The swift reversal demonstrated responsiveness but revealed absence of strategic conviction.

Consumer Spending Patterns Shift Dramatically

The breakfast and brunch category opened 6,421 new establishments in 2024—23% more than 2019—yet consumer spending shifted toward value. Searches for “cheap eats” surged 21%, “meal deal” jumped 117%, and “value meal” climbed 22%, reflecting heightened price sensitivity.

This trend squeezed fast-casual concepts between value-focused quick-service restaurants and experience-driven full-service dining, leaving Maple Street without competitive advantage.

Competitors Outperform Maple Street Brand

First Watch, the segment leader with approximately 575 locations, continues aggressive expansion toward 2,200 units with superior unit economics averaging $1.8 million annually and restaurant-level EBITDA margins of 18.9%.

Keke’s Breakfast Café posted 3.9% same-store sales growth while expanding to 69 locations. Another Broken Egg reached 101 units with 19 additional franchise agreements signed, demonstrating well-positioned breakfast concepts still thrive.

Stock Price Hits Decade Lows

Cracker Barrel shares lost over 50% of their value during 2025, falling from above $70 in early 2024 to $28.33 by January 2026—near decade lows.

The stock dropped approximately 7% immediately following the logo announcement and continued declining throughout the year as financial results deteriorated. Market capitalization has shrunk from over $1.2 billion in 2024 to approximately $631 million, leaving the company vulnerable.

Heavy Debt Constrains Strategic Flexibility

With total debt of approximately $1.35 billion and a P/E ratio of 38.28—elevated relative to negative growth and deteriorating fundamentals—the balance sheet provides limited flexibility to weather extended weakness.

Despite swinging to a $24.6 million quarterly loss, management maintained the $0.25 quarterly dividend. This decision signals commitment to shareholder returns while constraining capital available for turnaround initiatives, technology upgrades, or marketing campaigns.

Retail Sales Plummet Faster Than Dining

Cracker Barrel’s distinctive country store retail component collapsed 8.5% in the first quarter of fiscal 2026—significantly worse than the 4.7% decline in same-store restaurant sales.

The deterioration indicates consumers no longer browse Cracker Barrel’s stores for nostalgic gifts and home décor as shopping shifts online. This proves particularly concerning because retail historically provided higher margins and reinforced unique brand positioning.

Poor Unit Economics Trigger Write-Downs

The $16.2 million impairment charge spread across 14 closed locations suggests average write-downs of approximately $1.16 million per store, indicating units generated insufficient cash flow to justify continued operations.

For acceptable profitability, individual Maple Street locations needed to generate annual revenues of $1.5-2.0 million with restaurant-level EBITDA margins of at least 15-18%. Many failed to achieve these thresholds in competitive markets.

Industry-Wide Restaurant Closure Wave Accelerates

Cracker Barrel’s closures join a broader 2025 restaurant contraction wave sweeping the industry. Starbucks announced plans to close 500 North American locations as part of a $1 billion restructuring.

Wendy’s indicated it would shutter hundreds of restaurants, while Denny’s closed 70-90 stores, Jack in the Box eliminated 86 units, and Bloomin’ Brands closed two dozen locations. This reflects reckoning with overexpansion and changing consumer preferences.

Management Refocuses on Core Brand

CEO Julie Masino articulated strategic priorities during earnings calls: “We are insanely focused on Cracker Barrel and working very hard on the strategic transformation.

There’s a lot to love about Maple Street. But right now we are really focused on growing Cracker Barrel and returning it to strength.” The statement acknowledges that Maple Street became a capital-draining distraction from existential challenges facing the parent brand.

Wall Street Analyst Confidence Wanes

Wall Street analysts maintain a “Hold” consensus rating on Cracker Barrel stock despite average price targets of $51 implying 80% upside from current levels. However, forecasts range dramatically from $12 to $93 per share, reflecting profound uncertainty about management’s turnaround capabilities.

The wide dispersion indicates analysts cannot confidently project whether the company stabilizes, continues declining, or faces distressed restructuring scenarios.

Limited Strategic Alternatives Remain

Cracker Barrel faces constrained strategic options as its market capitalization shrinks and financial performance deteriorates.

Potential scenarios include private equity acquisition to harvest cash flow and real estate value, strategic merger with another struggling casual dining player for cost synergies, continued independent turnaround efforts, or distressed restructuring if debt covenant pressures intensify. Each path carries significant execution risks.

Make-or-Break Year Lies Ahead

Fiscal 2026 represents a critical inflection point for the 56-year-old brand facing existential challenges. Management must simultaneously rebuild traffic following the logo catastrophe, attract younger demographics while retaining aging core customers, defend against intensifying competition across multiple restaurant segments, and manage significant debt while generating minimal profitability.

Success requires execution capabilities and strategic vision leadership has yet to demonstrate convincingly throughout this crisis.

Sources:

“Cracker Barrel plans to close 14 Maple Street locations.” Nation’s Restaurant News, September 2025.

“Cracker Barrel reports first quarter fiscal 2026 results and updates fiscal 2026 outlook.” PRNewswire, December 2025.

“Cracker Barrel dumps the design firm behind its disastrous logo redesign.” CNN Business, October 2025.

“Cracker Barrel scraps new logo after backlash.” BBC News, August 2025.

“These restaurant chains closed locations in 2025.” CNBC, December 2025.

“Two Breakfast and Brunch Competitors Push Toward More Growth.” FSR Magazine, June 2025.

“State of the Restaurant Industry Report, 2025.” Yelp Trends, June 2025.