In 2025, Arby’s closed 14 stores across eight U.S. states, including Tennessee and California.

This followed 48 closures in 2024. Chains like Wendy’s, Denny’s, and Starbucks also announced major cutbacks.

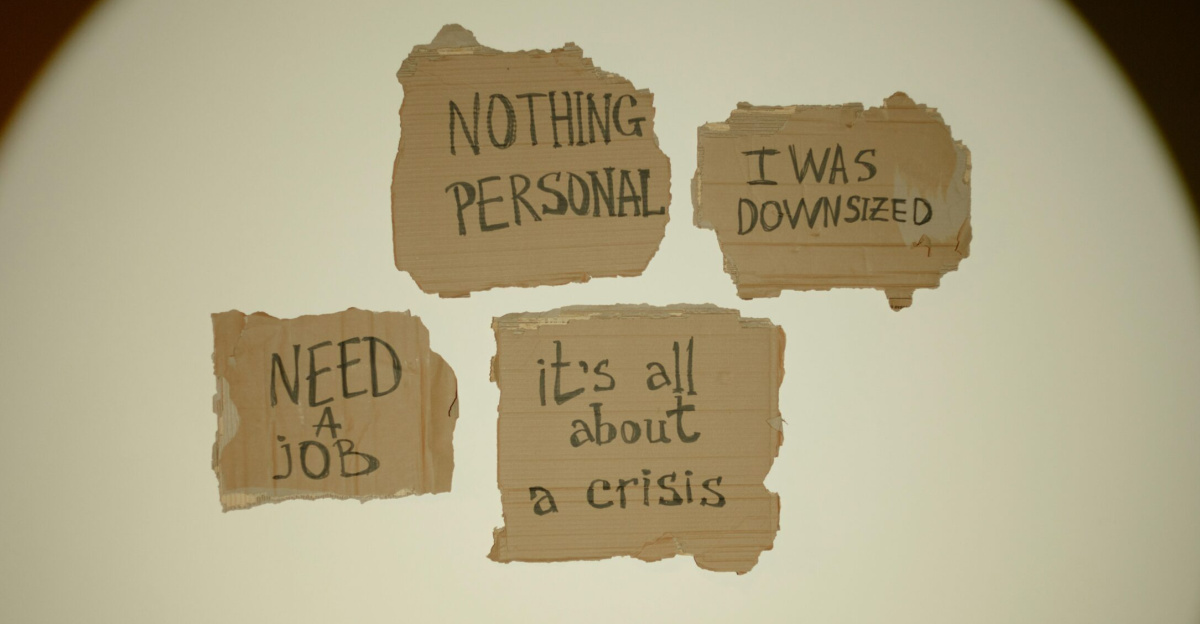

Experts say these moves reflect higher costs and less money spent at restaurants.

Big names are shrinking as inflation changes how people eat out.

January Through November

Arby’s didn’t shut all 14 stores at once. Closures started in New Jersey in January and ended in California in November.

This slow pace counters rumors of “overnight” losses. Records confirm eight affected states.

With approximately 20–30 employees per store, 2025 resulted in 280–420 job losses.

Total cuts from 2024 to 2025 could result in the loss of 1,860 jobs.

The Financial Context

Arby’s parent company, Inspire Brands, saw total 2024 sales hit $29.5 billion.

Still, Arby’s posted the biggest sales drop, losing 6.3%.

At the end of 2024, Arby’s had 3,365 stores, most run by independent owners.

Arby’s ranked third in the sandwich market. Strong competition and falling profits raised questions about its future.

Economic Pressure on Franchisees

Experts say that rising wages, higher food costs, and expensive rents are hurting Arby’s owners.

Many Arby’s customers earn less than $75,000 per year.

Menu prices have gone up 55% since 2014. Even so, higher prices don’t fully cover the business costs.

Hard decisions on closing stores followed these tough financial pressures.

14 Closures, 8 States, 2025

Arby’s closed 14 restaurants in 2025: 4 in Tennessee, 2 in California, and one each in Delaware, Florida (4 near Jacksonville), Maryland, New Jersey, Washington, and South Carolina.

Closures were permanent and affected both franchise and company-owned stores.

The company gave no official explanation, leaving workers and local communities uncertain.

Regional Impact: Tennessee

Tennessee felt Arby’s cuts most. Four local stores closed between July and October, resulting in the loss of 80–120 jobs in that state.

Tennessee’s lower incomes made it harder for Arby’s franchises to stay open.

These stores closed earlier than in some other states, indicating that the financial strain affected certain regions first.

Job Impact Analysis

Most Arby’s workers earn $15,000–$25,000 a year and get few benefits.

Closures in 2025 resulted in job losses for up to 420 people, directly affecting families in several states.

There are no reports of severance packages or training programs to help workers find new employment, unlike some other chains that offer more comprehensive support.

Industry-Wide Context

Big fast-food chains are shrinking. Wendy’s plans to shut 200–350 stores.

Denny’s closed 70–90 restaurants earlier in the year.

Starbucks laid off 900 corporate staff in September.

These moves suggest it isn’t just an Arby’s problem, but a broader challenge for the fast food industry as Americans change their eating habits.

Market Analysis: Why Value Chains Are Struggling

Three big reasons stand out: rising menu prices, new delivery and ghost kitchen options, and less spending by families earning under $75,000.

Premium brands like Panera and Chipotle tend to outperform value-focused chains.

With higher costs and less traffic, traditional “cheap eats” no longer guarantee profits for chains like Arby’s.

Historical Data: 62 Combined Closures

Arby’s closed 48 stores in 2024 and 14 more in 2025.

That adds up to 62 closed in two years—about 1.8% of all Arby’s restaurants. With 20–30 jobs per store, approximately 1,240–1,860 jobs were lost during this period.

The often-quoted number, “1,400 jobs,” is the midpoint of this estimate, covering both years.

Corporate Response: The Silence Strategy

Arby’s and Inspire Brands gave no public statement about the closures or layoffs.

In contrast, Wendy’s explained its decisions through press releases.

This silence left many to wonder what Arby’s leaders plan next.

Some experts believe the lack of answers indicates that management is not yet ready to announce significant changes.

Franchise Model Dynamics

Most Arby’s stores—2,286 out of 3,365—are run by franchisees, not the parent company.

These local owners bear the risk that their restaurant may not be able to turn a profit.

That’s why closures didn’t all happen at the same time.

Franchisees decided store by store, based on local costs and sales, when to close.

Inspire Brands Portfolio Performance

Inspire Brands owns six chains, including Arby’s, Sonic, and Jimmy John’s.

Arby’s stores experience the largest decline in sales, despite having the most locations.

Now the parent company must decide: should it invest more to help Arby’s recover, or accept that the chain will shrink?

That future is still unclear.

Franchisee Community Response

Franchisees have mixed feelings. Some view closing weak stores as a good business move.

Others want more help from the corporate side, such as better marketing or support.

Rumors suggest that a few are considering switching to other chains, such as Subway.

Since few have spoken publicly, these views are based on industry research rather than direct quotes.

Forward Look: 2026 Projections

Industry analysts expect more change ahead.

If prices stay high and wages don’t keep up, more Arby’s stores could close.

Chains like Chipotle may grab a bigger share of the market.

What Inspire Brands decides in late 2025 will shape whether Arby’s shrinks further or makes a comeback.

Regulatory Developments and Policy Watch

No federal agency has launched a formal probe into Arby’s closures as of late 2025.

However, the Department of Labor is paying closer attention to how restaurants notify workers about job losses.

New rules could require companies to provide notice or offer assistance with severance if closures become more common in the future.

Industry Precedent: Fast-Casual Competition

Arby’s faces stiff challenges from “fast casual” chains like Chipotle and Sweetgreen.

These brands charge more but offer different menus and fresher food.

Some fast-food chains, such as Taco Bell, have successfully moved “upmarket” and attracted new customers.

For Arby’s, standing out will require patience and smart marketing.

Social Media Claims vs. Verified Facts

Social media spreads claims like “1,400 jobs gone overnight” and “biggest fast food collapse,” but these aren’t true.

Arby’s still operates in all eight states affected. Job cuts in 2025 are fewer than cuts by Hudson’s Bay or Starbucks.

Posts combine two years of closures instead of just 2025.

Chains That Survived Contraction

Chains have gone through hard times and survived. Subway lost over 5,000 U.S. stores in a decade but kept its brand strong.

Denny’s also closed outlets before coming back. Red Lobster went bankrupt and restructured.

Businesses that rethink their strategy can survive—even if they temporarily shrink in size.

What This Means

Arby’s closed 14 stores in 2025, affecting up to 420 workers. Other chains made even bigger cuts.

The fast-food industry is evolving, with inflation and shifting eating habits shaping its future.

Arby’s can still recover if the company invests wisely and adapts, but staying the same is not an option.