Home Depot faces unprecedented pressure as grassroots organizations launch a coordinated boycott targeting Home Depot, Amazon, and Target from November 27 to December 1, 2025. Thanksgiving week, when retailers capture nearly 20% of annual sales, makes this boycott unusually consequential.

Organized by Black Voters Matter, Indivisible, and Until Freedom, the campaign protests corporate practices seen as undermining worker protection and democratic values. Analysts estimate that even 5–10% participation could translate to $100–300 million in lost revenue. However, reviewing Home Depot’s sales trends over the last decade hints at the stakes involved.

Americans Weaponize Shopping Power Like Never Before

Consumer behavior increasingly reflects values-based decision-making. Lending Tree research on over 2,000 Americans shows 45% research company values before purchasing, 31% have boycotted for ethical reasons, and 37% are more likely to boycott large corporations.

Holiday spending is near record highs: $890.49 average per consumer. With 186.9 million expected shoppers during Thanksgiving weekend, consumer choices carry unprecedented economic weight. Still, these numbers only hint at the potential influence of coordinated boycott campaigns on retail power.

Home Depot’s 46-Year Journey Turns Contentious

Founded June 22, 1979, in Atlanta, Home Depot now operates 2,300 stores nationwide. Its 46-year journey from startup to largest home improvement retailer has historically been a success story.

In 2025, controversy mounted after the March DEI page removal and ICE concerns. Early boycotts built momentum into the current November campaign, showing that decisions meant to quiet criticism instead fueled activist mobilization. Could past missteps forecast the impact of current actions?

Coalition of Conscience: Multi-Group Alliance Forms

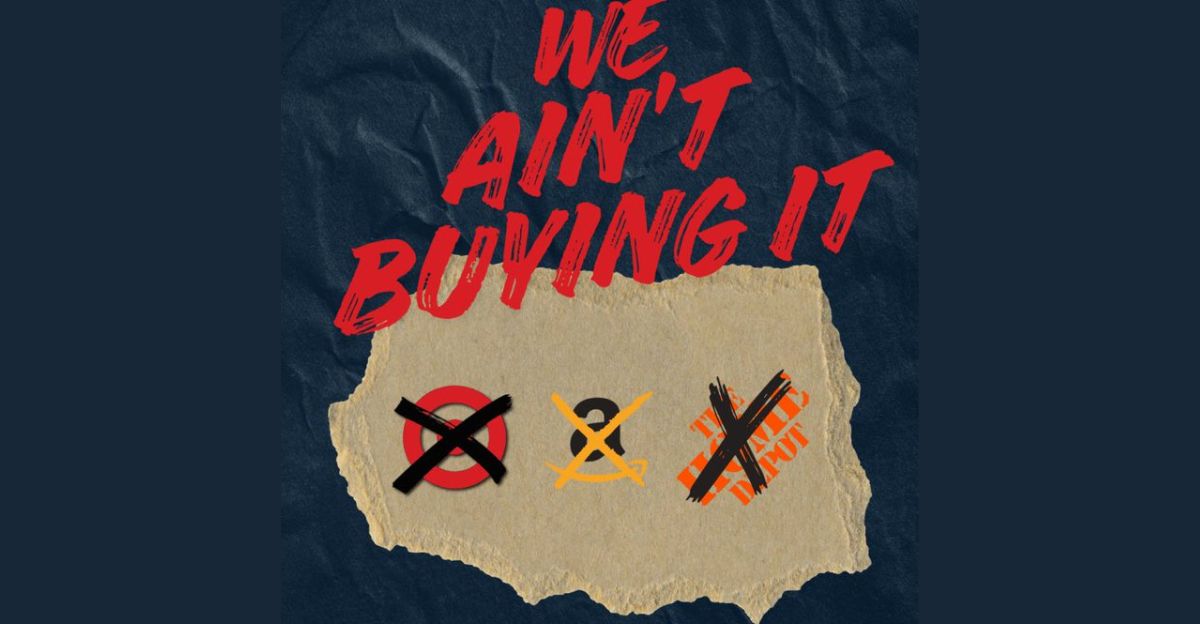

This month’s “We Ain’t Buying It” campaign unites Black Voters Matter, Indivisible, Until Freedom, and supporters to challenge corporate complicity with Trump administration policies.

The campaign targets immigration enforcement at store locations and corporate DEI rollbacks. This coordinated multi-retailer boycott during peak sales is unprecedented, signaling that activism has evolved from isolated protests into a strategic, nationwide economic lever.

Thanksgiving Week Revenue At Risk for Home Depot

Thanksgiving week generates approximately 20% of annual retail sales. For Home Depot, November 27–December 1 could bring $2–3 billion in revenue.

Depending on boycott participation: 5% equals $100–150 million loss; 10–15% could reach $200–450 million. Target’s 2025 boycott precedent shows measurable drops in sales are possible. Yet the real question is whether Home Depot will feel the full financial pressure.

Atlanta Ground Zero: Symbolism Meets Activism

Atlanta, Home Depot’s birthplace, serves as a focal point for protests. The symbolism reinforces that activists are targeting a company built on American enterprise while holding it accountable for worker protections.

Regional campaigns in Los Angeles and New York coordinated with national organizers, making urban centers sites of concentrated boycott activity. How these localized actions ripple nationally could determine overall boycott effectiveness.

Human Toll: ICE Enforcement Raises Ethical Stakes

Day laborers gather daily at Home Depot lots for work opportunities. Activists highlight ICE raids, including June in Los Angeles. The campaign asserts: “Home Depot is allowing ICE agents to illegally detain and kidnap laborers from their stores. The laborers in our communities are not able to look for work safely.”

Home Depot maintains non-coordination and legal compliance. Yet consumer ethics now demand corporate responsibility beyond legality. Will this reputational gap undermine trust among values-driven shoppers?

Multi-Target Strategy: Amazon and Target Also Under Pressure

Activists coordinate pressure across retailers. Target faces DEI rollbacks, while Amazon is criticized for monopoly power and working conditions.

Simultaneous boycotts aim to create cascading pressure: if one company concedes to demands, competitors follow. The 2025 wave suggests structural shifts in consumer expectations for corporate ethics and worker protection, far beyond symbolic protest.

Can Boycotts Really Move the Revenue Needle?

Thanksgiving week accounts for roughly $2–3 billion in Home Depot revenue. Even 5–10% participation could translate to $100–300 million losses.

Target’s 2025 DEI boycott showed measurable impact on sales and foot traffic, demonstrating that coordinated consumer action during peak periods can influence corporate behavior. Could Home Depot’s response confirm or challenge this precedent?

DEI Controversy Sparks Second Boycott in Eight Months

Home Depot removed its DEI page in March, shifting focus to “Respect For All People.” Early boycotts arose after The People’s Union criticized this move and ICE activity.

Research shows 45% support DEI initiatives, while 37% are inclined to boycott large corporations. The removal alienated multiple customer segments, unifying progressive activists. Will this strategy backfire during peak holiday shopping?

Plausible Deniability vs. Moral Responsibility

Home Depot insisted in August : “We do not engage with ICE or federal immigration enforcement.” Legal compliance, however, increasingly fails to satisfy consumer ethical expectations.

With 45% of Americans researching company values and 31% having boycotted for ethics, consumers expect moral responsibility for events on corporate property. How the company manages this perception gap is critical.

Regulatory Compliance Becomes a Liability

Home Depot’s adherence to federal law is now framed as ethical indifference. The message: compliance alone is insufficient to protect vulnerable workers.

With shifting consumer expectations, failure to implement proactive protocols signals corporate indifference, creating reputational risk. Regulatory correctness does not equal consumer approval. Will this gap influence shopper behavior during Thanksgiving week?

Financial Warning Signs: Foot Traffic Declines

Q2 2025 sales rose 1.4%, but same-store foot traffic dropped 2.6% year-over-year. Revenue growth relies on price hikes, masking declining customer volume.

Mortgage rates above 6% further suppress discretionary spending. Even a 1–2% boycott impact could turn Q4 comparable sales negative, illustrating how financial and reputational vulnerabilities converge at a critical time.

Consumer Activism Precedent: When Boycotts Move Markets

31% of Americans have boycotted for ethical reasons; 37% target large corporations; 45% research values before purchase. Consumer activism is structural.

Target’s 2025 DEI boycott produced measurable declines, signaling Home Depot faces similar vulnerability. Even a modest 3–5% traffic reduction could reshape corporate strategy. The question now is how seriously companies will respond.

Three Scenarios: Capitulation, Weathering, Escalation

Home Depot may negotiate with activists, weather limited financial impact, or endure prolonged reputational erosion. Probabilities: 20%, 60%, 20%, respectively.

The November boycott tests whether American consumers have weaponized shopping power. A 5%+ impact could trigger a paradigm shift in corporate responsiveness, while minimal disruption may reinforce business-as-usual complacency.

Political Dimensions: Immigration Enforcement as a Battleground

The boycott intertwines immigration policy and corporate accountability. Home Depot’s neutrality risks reputational harm if consumers reject corporate silence on enforcement.

Proactive worker protection protocols could have mitigated exposure. In 2025, choosing neutrality is a public statement with tangible consequences. Will Home Depot learn to align corporate action with evolving ethical expectations?

International Reputational Exposure: Beyond U.S. Borders

Human rights scrutiny extends globally. International media critiques U.S. corporate complicity in ICE enforcement, signaling that compliance without ethical action damages brand prestige.

The optics threaten Home Depot’s international positioning, affecting expansion opportunities and market perception. Legal compliance may shield in court, but it cannot protect global reputation. Could overseas scrutiny intensify domestic pressure?

Regulatory Adequacy Crisis: Legal Is Not Ethical

Legal compliance is no longer sufficient. Regulations lag behind consumer expectations, exposing Home Depot to reputational harm despite formal adherence.

Consumers increasingly expect companies to protect vulnerable workers. The gap between law and ethics underscores the strategic risk of relying solely on regulatory defense. How companies respond now will set long-term precedent.

Cultural Shift: Holiday Shopping as Political Referendum

Shopping has become civic participation. 63% of Americans plan Thanksgiving weekend shopping, spending $890.49 on average. Consumer behavior is politicized, reflecting ethical considerations alongside traditional purchasing motives.

The boycott channels existing values-driven sentiment into action. Retailers now face structural expectations: aligning with consumer ethics fosters loyalty, misalignment triggers organized resistance. Will corporations adapt to this permanent cultural shift?

The Stakes: Will Corporate America Adapt or Resist?

Home Depot, Amazon, and Target face an unprecedented test of consumer activism. Even 5–10% participation could cost $100–300 million in lost revenue.

The market will judge whether corporate neutrality is sustainable or if values-based consumer action reshapes retail strategy. By December 1, 2025, the verdict will reveal the power of coordinated, ethical consumer pressure.