Acura’s sales jumped to 12,689 in May 2025. The brand’s newly launched ZDX EV alone sold 1,873 units that month – a strong showing in the luxury EV segment. But experts caution that this upbeat news masks underlying trouble.

A quiet shift in the market and policy environment was already taking shape behind the scenes.

Sudden Reversal

Honda shocked the industry by axing the ZDX. In late September 2025, the company confirmed that ZDX production would end after roughly a year on the market.

In total, only about 19,000 ZDXs had been sold in North America by that time.

This is unusually brief for a new luxury model – it means the ZDX will be “one and done”.

Partnership Genesis

In 2020, Honda and GM launched a joint EV venture. Under the alliance, Honda agreed to use GM’s Ultium battery platform while providing its own vehicle designs.

Honda exec Rick Schostek said the deal would “put together the strength of both companies” and use the combined scale to accelerate electrification.

The partnership was touted as a way for each automaker to share costs and speed up EV development in a rapidly changing market.

Market Pressures

Analysts have become more skeptical about EV growth. Goldman Sachs now projects EVs will make up only about 25% of new car sales globally by 2030, down from 28% previously.

The firm cites loosened regulations and the early phase-out of incentives. In other words, rising EV costs and slower consumer uptake – along with spotty charging infrastructure – have forced many automakers to temper their EV ambitions.

Production Ends

Honda announced it would end ZDX production. The company’s spokesperson said this change was to “better align our product portfolio with the needs of our customers and market conditions” and confirmed “the Acura ZDX has ended production”.

The timing was notable: it came just days before the $7,500 federal EV tax credit expired. The sudden halt highlights how quickly market signals can shift.

Regional Impact

The closure of ZDX production will ripple through local plants. GM’s Spring Hill, Tennessee assembly (which built the ZDX alongside gas SUVs) is slated to switch back to making more Chevy Blazers and engines by 2027.

GM says this retooling will not lead to permanent job cuts at Spring Hill, focusing instead on retraining workers.

GM plans to replace the ZDX with conventional models on the same line.

Dealer Perspective

Local dealers scrambled to adapt. Brian Benstock, GM of the top-rated Paragon Acura, praised the pivot: “Acura adjusted appropriately to the changing political and market conditions.

It takes true leadership to be able to do this,” he said. He added optimistically, “The best is yet to come.” Benstock’s comments suggest dealers are rapidly refocusing on Honda’s next products.

Competitive Response

Acura’s retreat mirrors wider industry pullbacks. In Europe, Stellantis announced it would no longer aim for 100% EV sales by 2030.

Nissan cut planned production of its next Leaf amid supply issues. And Ford delayed two major EV launches (an electric pickup and a van) from 2026 to 2028 to focus on smaller, cheaper models.

By mid-2025, many automakers were publicly scaling back EV plans, citing high costs and weak demand across the market.

Macro Context

Beyond single-model issues, structural factors cloud the EV outlook. For example, a U.S. DOT report forecasts EV charging could push U.S. power demand from 0.2% up to 23% by 2050, straining grids unless renewable capacity expands.

Meanwhile, consumers cite high prices and charging gaps as adoption barriers. Many experts argue that a robust EV future requires major upgrades to energy infrastructure and incentives.

Prologue Partnership

Honda’s other EV venture will proceed: its Prologue (an Ultium-based SUV) will continue at GM’s Mexican plant. But Honda did shrink its volume – prompting GM to cut one shift and about 800 jobs.

A Honda spokesman said such production tweaks are “quite normal for our business”.

The episode showed that Honda is choosing which joint projects to pursue as it focuses on select collaborations.

Internal Tensions

The ZDX’s end hints at internal debates. Honda’s CEO Toshihiro Mibe had already trimmed the company’s EV R&D budget, reportedly cutting EV investment by 30% through fiscal 2031 due to slowing market growth.

Honda is pivoting back to its own technology: hybrids are in the pipeline, and an Ohio-built RSX is on the way.

The move underscores that Honda is prioritizing long-term control of its electrification strategy over short-term volume.

Strategic Pivot

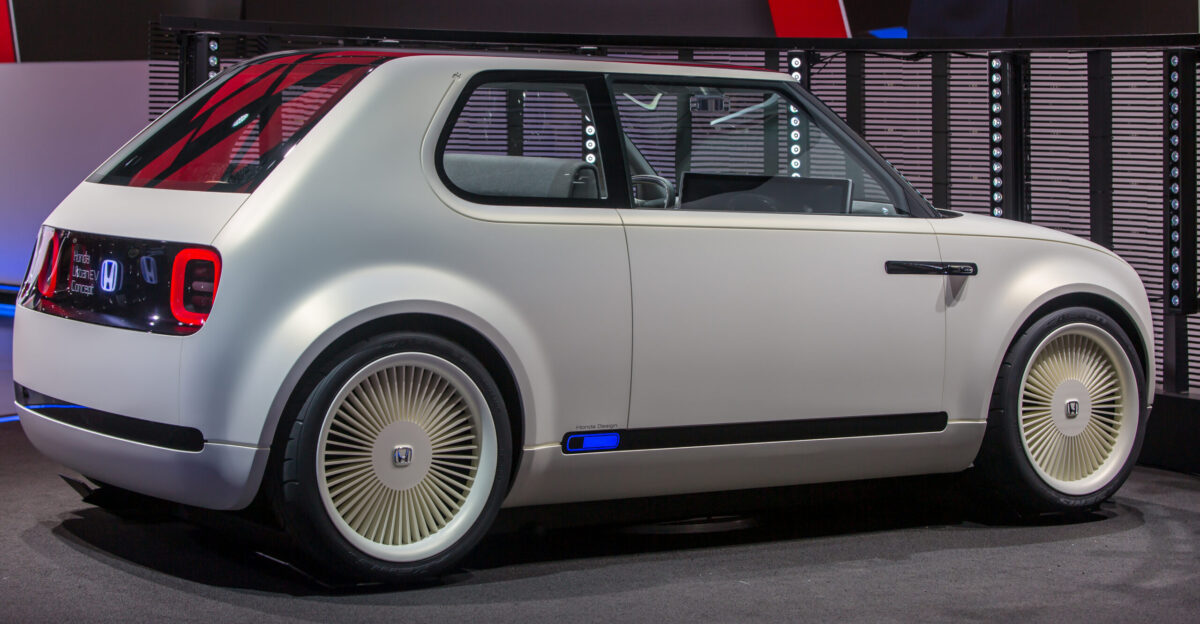

Looking ahead, Honda is launching a wholly new EV. The 2026 Acura RSX is a compact, performance-oriented SUV built entirely in-house. Honda says it’s engineered on a “new Honda-developed EV platform” at its Ohio EV Hub.

Acura design chief Lance Woelfer hailed the RSX’s look, noting its “dramatic styling… demonstrates that it’s not just a new EV, but a compelling all-new Acura model”.

The RSX will debut Acura’s in-house ASIMO software and dual-motor AWD systems, signaling a return to independent EV development.

Recovery Blueprint

Honda says the RSX will use its new global EV platform – shared with upcoming Honda and Sony Honda (Afeela) models – and domestic parts.

Production is set for late 2026, marking a clean break from GM’s Ultium ecosystem.

This represents a reset of Honda’s EV program: blending the company’s engineering roots with a software-driven architecture. In short, Honda plans to leverage its brand and technology on its own terms.

Expert Skepticism

Not everyone is convinced this strategy will pay off. Analyst reports note that without GM’s volume, Honda may struggle with high battery costs and limited scale. EV batteries alone can add tens of thousands to sticker prices, and new platforms require enormous investment.

McKinsey researchers observe that “EV sales growth has slowed in many regions” and faces new competition from cheaper, tech-savvy rivals.

In a market now more sensitive to price and incentives, critics say Honda is doubling down on EVs just as conditions become tougher.

Forward Question

The ZDX cancellation raises a fundamental question: can automakers rely on joint strategies in an era of shifting incentives and fickle demand? With federal EV subsidies ending and emissions mandates loosening, some industry leaders wonder if the era of broad EV partnerships is fading.

Honda’s break from GM suggests that even well-planned alliances can fray when politics and markets change. Will other manufacturers follow by focusing more on their own platforms?

Policy Implications

The ZDX’s demise is bookended by policy changes. Congress’s “One Big Beautiful Bill” accelerated the phase-out of federal EV tax credits, ending the $7,500 subsidy on Sept. 30, 2025.

Dealers rushed “last chance” sales campaigns, but analysts warn of a sharp demand drop without subsidies. In fact, one observer predicts the U.S. EV market share could fall below 4% once those credits vanish.

This dynamic – where a tax law directly influences production decisions – highlights how crucial government incentives remain to the EV transition.

International Ripples

These trends play out globally. Chinese automakers are rapidly expanding: China now accounts for over half of world EV sales. In Europe, Chinese brands have begun grabbing market share in 2025 amid overall sales declines.

BloombergNEF projects that China will dominate the EV market even as U.S. and European adoption slows.

At the same time, trade tensions (e.g. tariffs on EVs and batteries) are complicating cross-border deals, suggesting Honda and GM’s split may reflect larger geopolitical headwinds.

Environmental Angle

Honda says it’s staying green. The RSX is designed to be bi-directional: EV.com reports it will “serve as a mobile energy storage system, powering devices and providing home backup electricity”.

Switching to its own platform should let Honda better integrate renewables. Industry analysts note that future EVs must do more than transport people – they can also stabilize the grid by storing solar power and feeding it back to homes.

The RSX’s design reflects this shift toward EVs as distributed energy resources, not just cars.

Cultural Shift

The ZDX’s brief lifespan symbolizes a generational change. Long model lifecycles are giving way to rapid iteration. Younger buyers see cars less as static machines and more as continually updated tech platforms.

Automakers and dealers must adapt: vehicles now require frequent software updates, online features and flexible designs.

In this sense, the ZDX saga highlights that car launches increasingly resemble tech product rollouts, with constant feedback loops from customers guiding next versions.

Broader Reflection

Ultimately, the Honda–GM story suggests the EV transition will be a patchwork. With subsidies gone, consumer demand – not policy mandates – will dictate success.

As one commentator put it, “moving forward, America’s EV market will be driven more by pure customer demand and automakers’ desire to remain competitive in technologies of the future”.

In other words, carmakers may revert to leveraging their own strengths (battery tech, branding, software) rather than relying on sweeping joint projects. The ZDX’s short run hints that the electric future will be shaped more by strategic independence than by broad collaborations.