In June 2025, Japan’s Nippon Steel Corp. closed a landmark deal to acquire Pittsburgh-based U.S. Steel. Nippon will pay about $55 per share (roughly $14.2 billion total).

The purchase – tied to tens of billions in planned upgrades – “sent shockwaves through Washington, Pittsburgh and boardrooms across the globe”. This takeover marks a dramatic shift for an American industrial icon.

Unprecedented Investment Scale

Nippon’s bid values U.S. Steel at ~$14.2 billion. On top of the purchase price, Nippon pledged roughly $11 billion for U.S. Steel capital projects through 2028, making the combined commitment nearly $25 billion.

This is one of the largest foreign investments in U.S. manufacturing history. Such scale underscores the high stakes: new technology, plants, and protections will be on the table to boost competitiveness.

Centennial Legacy and Rivalry

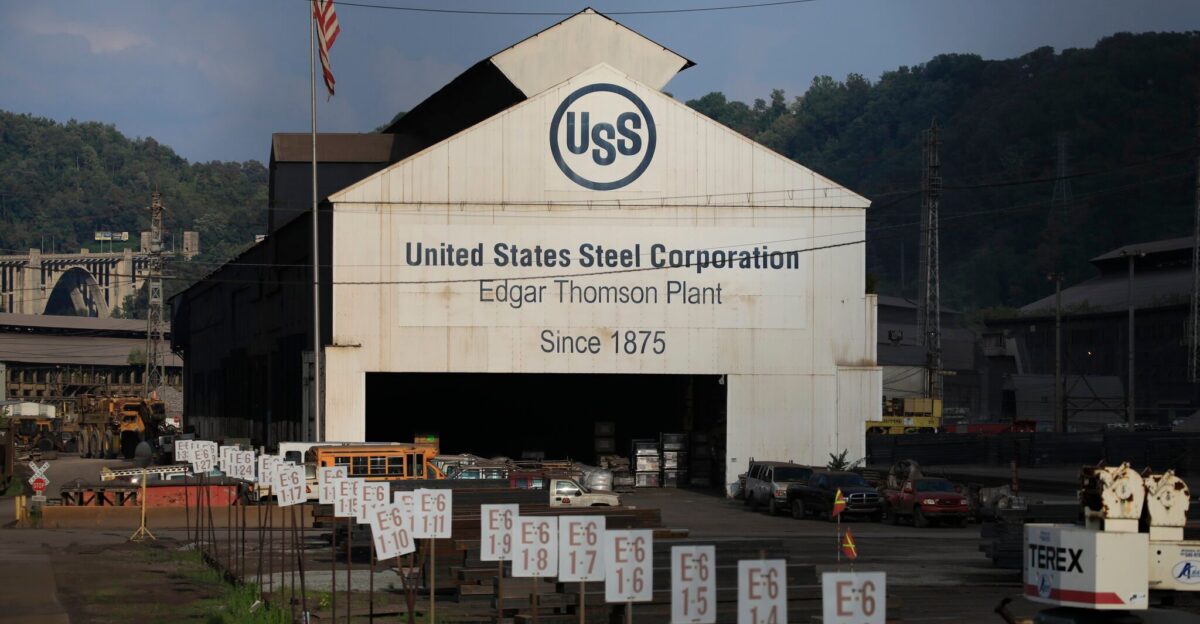

U.S. Steel was founded in 1901 when financier J.P. Morgan merged Andrew Carnegie’s steel empire into the first $1 billion corporation. For decades, it dominated U.S. industry. Today, however, it competes against newer domestic peers and global mills.

Nippon Steel itself is now a world-class giant: it produces over 44 million metric tons of steel a year, compared to U.S. Steel’s ~14.5 million (2022). Rival Cleveland-Cliffs (Ohio-based) and other foreign giants have pursued U.S. Steel, reflecting intensified competition on multiple fronts.

Mounting Industrial Pressures

Over recent years, U.S. Steel’s aging plants and slim margins have become a liability. The company faced declining demand for traditional steel and cutthroat competition from U.S. mini-mills and imports. As one analysis notes, “U.S. Steel has struggled with aging facilities, intense competition from mini-mills and the cyclical nature of the steel business”.

With profits squeezed, U.S. Steel needed massive modernization that its balance sheet couldn’t fund, setting the stage for a major deal.

Merger Finalized with Oversight

On June 18, 2025, after extensive review, Nippon Steel and U.S. Steel announced a finalized merger deal. Nippon will acquire 100% of U.S. Steel (100% of stock) for ~$14.189 billion.

Crucially, Nippon agreed to invest about $11 billion in U.S. Steel facilities by 2028. The pact also grants the U.S. government a “golden share,” giving the president veto rights over key actions (e.g., closing plants or moving operations offshore).

Local Facilities Upgraded

Nippon’s funds target U.S. Steel’s core plants in Pennsylvania and the Midwest. For example, the board approved two projects totaling $300 million from Nippon’s investment fund: $100 million to build a new slag-recycler and upgrade the Edgar Thomson Works (Braddock, PA), and $200 million to modernize Gary Works (Gary, IN).

These projects will increase energy efficiency and product capacity.

Union Reaction: Hope and Doubt

Steelworkers welcomed the money but remained wary. United Steelworkers President David McCall said the union “will remain. We will continue watching, holding Nippon to its commitments”. Many rank-and-file echo that caution.

As one union memo put it, “Trust nothing until you see it in writing”. Workers have seen promises broken in past deals, so they stress enforceable safeguards. Unions fought the takeover initially, reflecting concerns about long-term job security under foreign ownership.

Domestic Competitors and Cliffs

U.S. Steel’s sale also triggered competition at home. Ohio’s Cleveland-Cliffs once offered roughly $7.3 billion for U.S. Steel (about a 43% premium), backed by union support, but U.S. Steel rejected that bid. Industry watchers point out that Senator Sherrod Brown even urged that if sold, the “winning bid should go to Ohio-based Cleveland Cliffs”.

With Nippon now in the picture, Cliffs and other domestic players must reassess their strategies.

Global Steel Consolidation

Nippon Steel, already the world’s fourth-largest mill by capacity, instantly gains a top North American footprint. This move is part of a broader consolidation trend in steel, driven by scale economies and trade barriers. Analysts observe that by owning U.S. Steel’s integrated mills, Nippon can sell premium steel directly to U.S. automakers and infrastructure projects, circumventing tariffs that had long hindered Japanese steel exports.

Security Oversight Mechanisms

The deal’s national-security provisions are unprecedented. Under the agreement, the U.S. president holds veto power over vital decisions. Commerce Secretary Howard Lutnick explained the golden share “would prevent … transferring production or jobs outside the United States, or closing or idling plants” without presidential consent.

It also blocks any move of U.S. Steel’s headquarters or assets abroad.

Stakeholders on Edge

Tensions linger as stakeholders weigh risks versus promises. Unions and locals remember U.S. Steel’s history of plant shutdowns and missed commitments. In union communications, leaders cited a “history of broken commitments, including shutting down steelmaking” at facilities like Granite City, and noted a previous $1B technology pledge that never materialized.

Such examples fuel skepticism that Nippon’s pledges will be honored. With that backdrop, USW leaders stress any future layoffs or benefit cuts would provoke fierce pushback.

American Boardroom and Leadership

Despite foreign ownership, the merger structure keeps U.S. Steel American-led on paper. By agreement, U.S. Steel remains a U.S. corporation headquartered in Pittsburgh. A majority of its board members must be U.S. citizens. Nippon Steel may appoint up to eight directors (including two U.S. independent directors), but all are subject to CFIUS approval.

Key executives – including the CEO – are required to be U.S. nationals. These measures were written into the National Security Agreement to preserve an “American” executive team even under Japanese ownership.

Nippon Steel’s Upgrade Plans

Nippon Steel has outlined a multi-year revival strategy. In August 2025, it confirmed plans to pour its $11 billion commitment into U.S. Steel operations.

Vice Chairman Takahiro Mori highlighted projects like a new hot-strip mill at Mon Valley Works (PA) and a revamped Blast Furnace #14 at Gary Works (IN). He even mentioned the possibility of building a new greenfield mill – for instance, a 3-million-ton electric-arc furnace complex – to expand capacity. These investments are designed to raise U.S. Steel’s annual crude-steel output (from ~17 Mt toward 20 Mt) and unlock high-grade product lines, leveraging Nippon’s tech expertise.

Analysts Warn of Integration Risks

Industry experts caution that the road ahead will be bumpy. Former U.S. Treasury official Jim Secreto calls the deal’s oversight terms “risky and unprecedented,” warning it introduces “uncertainty for global investors”.

Others note that merging two very different corporate cultures will be a challenge. Technical integration, labor practices, and market swings could test the promised gains.

Regulatory Checkpoints Ahead

The companies must still clear final regulatory hurdles and honor various conditions. U.S. antitrust clearance came through, but state environmental permits and labor agreements remain on the horizon. Nippon Steel has committed to observing all U.S. trade laws and environmental regulations.

Congress and CFIUS will continue monitoring compliance with the agreement. Observers will watch for timely filing of new permits (for example, for the Mon Valley upgrades) and any adjustments that regulators may demand on the workforce or emissions.

Political Double Play

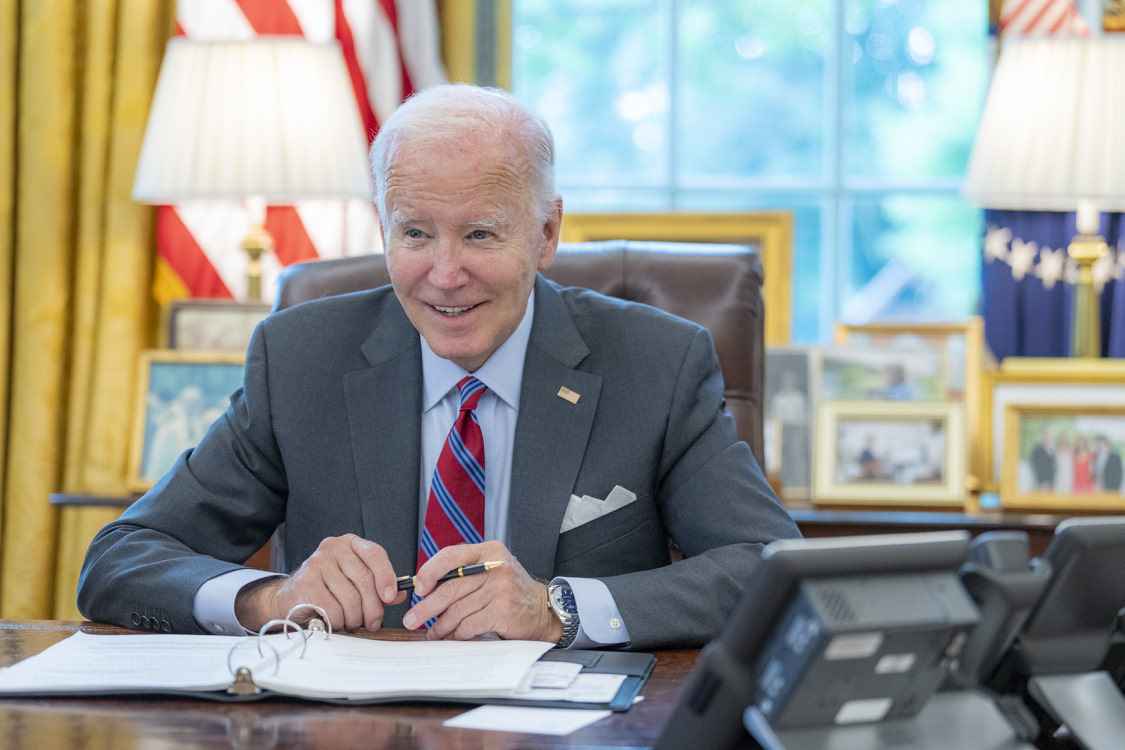

Politicians on both sides of the aisle inserted themselves decisively. President Biden initially blocked the acquisition on Jan. 3, 2025, citing national security. Yet just six months later, President Trump issued an executive order allowing the deal to proceed under his negotiated security framework.

That back-and-forth highlights the deal’s political weight: securing U.S. Steel became a test of national security authority.

Impacts on U.S.-Japan Relations

Observers see this as more than a corporate merger – it’s a milestone in U.S.-Japan economic ties. Commentators note it as much a victory for Japanese industrial diplomacy as for Nippon’s bottom line.

By committing to U.S. plants and jobs, Nippon Steel strengthens its role in the American market. Strategically, it may ease trade frictions: Washington saw that large Japanese investment (with strict safeguards) could be acceptable.

Legal and Green Requirements

The national security agreement explicitly ties Nippon to U.S. law. It must abide by all U.S. trade, labor, and environmental regulations. In practice, Nippon is already transferring its clean-tech to U.S. Steel. For example, it will deploy its COURSE50 furnace innovation (cutting carbon emissions by ~33%) at U.S. Steel blast furnaces.

Its announced projects emphasize energy efficiency and reduced footprints..

Cultural and Identity Implications

The transaction signals a generational shift in U.S. manufacturing identity. It effectively ends the 123-year run of U.S. Steel as an independent American titan. As one review put it, this is “the end of U.S. Steel as an independent American company” and “potentially the beginning of a new chapter where cross-border partnerships enable the investments needed to compete”.

For communities tied to the mills, it raises hard questions: is this a sign of decline or a necessary adaptation?

A New Chapter in Industry

Ultimately, the Nippon–U.S. Steel merger may become a benchmark for balancing foreign capital with U.S. interests. It blends a massive foreign infusion with unprecedented U.S. oversight provisions. If the promised upgrades succeed, it could reshape U.S. industrial policy on critical sectors.

As one analysis observed, this $15 billion deal “touched on national security, industrial heritage and the future of manufacturing in America”.