General Motors just cut nearly 3,000 jobs across Midwest plants right before Christmas, hitting union workers hard with tough decisions. About 1,700 at one key site must move far away or face unemployment as the factory shuts down. More cuts ripple through Detroit and Ohio, reminding everyone of past auto industry slumps.

Families that counted on steady paychecks now scramble amid holiday lights and cheer. Local leaders worry about empty tables and lost dreams. As snow falls on quiet parking lots, the real story is how one company’s moves shake entire towns. Will relief come before the new year?

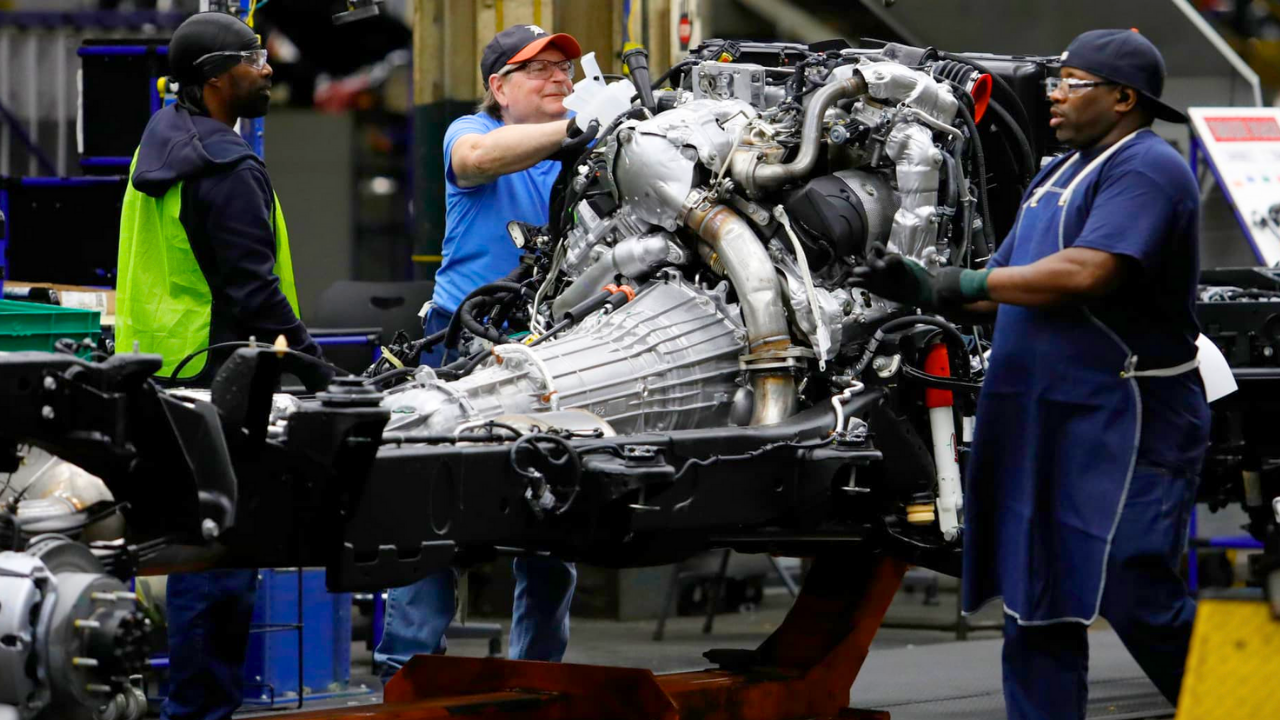

Factory Doors Slam Shut

GM is closing a $102 million factory in the Midwest, putting 1,700 union workers out of work just weeks before the holidays. These folks now face a heart-wrenching choice to either pack up families for jobs hundreds of miles away or hit the unemployment line. The shutdown could wipe out millions in local payroll each year, gutting communities already hit by factory losses.

Elected officials call it an economic blackout as shops and schools brace for the fallout. What pushed GM to this drastic step? The answer lies in a fast-changing car world.

Why the Auto Giant Is Hurting

Once the powerhouse of American cars, General Motors built Midwest towns from the ground up. But today, it’s wrestling with huge shifts due to electric vehicles (EVs) that aren’t selling fast enough, tough global rivals, and supply chain headaches. Decades of dominance are giving way to tough choices, like idling plants.

Federal rules and buyer habits add pressure, echoing the WARN Act’s job-loss warnings. From rusty factories to shiny EV dreams, GM’s story mirrors America’s manufacturing heartland. How did bold plans for all-electric fleets turn into quiet assembly lines?

EV Sales Hit a Wall

Buyers aren’t rushing to electric vehicles as fast as GM hoped, forcing the company to cut back on production. Gone federal tax credits worth $7,500 cooled demand, leaving lots full of unsold EVs under gloomy skies. GM blames changing rules and market vibes, pausing battery making in Ohio and Tennessee plants.

Could gas-electric hybrids save the day? Factories slow down, jobs hang in limbo, and the auto world recalibrates. It’s a wake-up call as green dreams meet real-world roadblocks. As rivals scramble too, one question burns, will America charge ahead or pump the brakes on EVs?

Heart of the Shutdown

In December 2025, GM closes its $102 million Midwest factory, idling 1,700 union workers who get transfer offers or pink slips. Add 1,200 cuts at a Detroit EV plant, and 2,900 jobs vanish total. This hub of manufacturing stops cold amid EV woes, with WARN notices giving 60 days’ heads-up.

Production halts, machines go silent, and holiday plans shatter. Workers stare at gates locked tight, wondering what’s next. Can new plans bring these jobs roaring back?

Town’s Economy in Freefall

Midwest towns anchored by GM plants now teeter on the edge as layoffs erase thousands of paychecks, slashing local payrolls and tax revenues in areas like Detroit and Warren, Ohio. Factory Zero’s 1,145 permanent cuts and 550 indefinite Ultium Cells losses in Ohio threaten diners, hardware stores, and schools serving 4,000-6,000 residents tied to those jobs.

Small businesses face closures without factory spending on lunches and supplies and schools may trim sports and programs as property taxes dip. Suppliers from tool shops to trucking firms feel the chain reaction, echoing 2008’s pain. Recovery hinges on new employers or recalls, but experts warn of years-long blight without diversification.

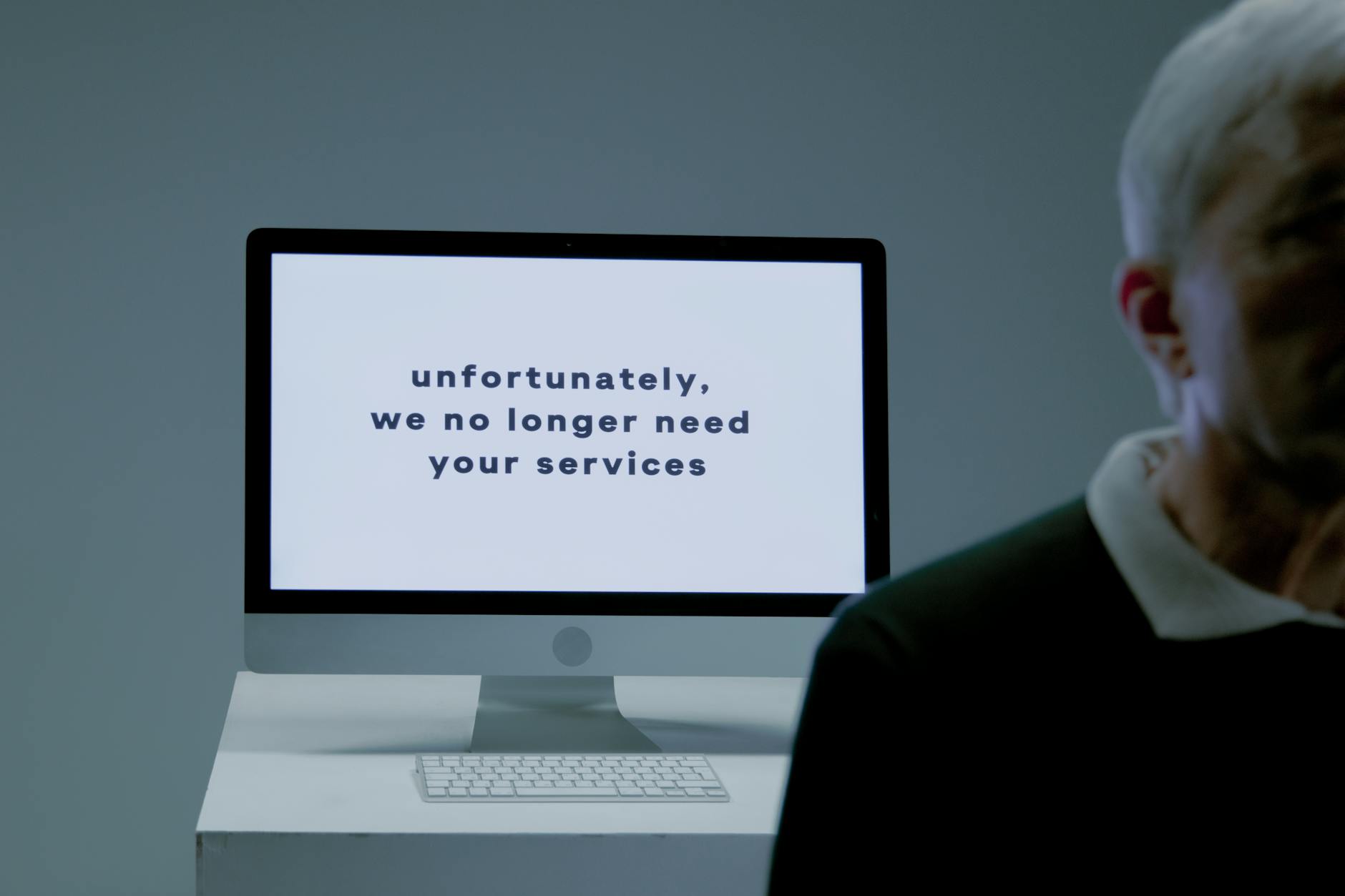

Workers Face Tough Calls

Hundreds of union workers at GM’s affected plants, including Factory Zero in Detroit and Ultium Cells sites in Ohio, now grapple with agonizing decisions, either relocate families hundreds of miles away for uncertain transfers or accept indefinite layoffs just before Christmas 2025.

The United Auto Workers (UAW) rallies fiercely, demanding enhanced relocation aid, recall priority rights, and extended benefits amid the brutal timing. Tensions peak with strike threats looming if GM doesn’t budge.

Rivals Feel the Freeze Too

GM isn’t facing this storm alone as competitors across the auto industry are hitting the brakes on electric vehicle ambitions amid the same harsh realities. Stellantis scrapped multiple EV models in late 2025, citing weak demand and rising costs, while Nissan delayed its Ariya production and paused battery investments in Tennessee plants.

Ford idled its Michigan EV battery facility for weeks, furloughing hundreds due to supply chain snarls from chip shortages and tariff hikes. Plants from Missouri’s Wentzville Assembly (GM supplier impacts) to California’s battery hubs sit quieter, as parts delays compound the pain. This isn’t isolated, it’s a sector-wide chill signaling a pivot to hybrids and cost-slashing.

Big-Picture Trends Unfold

U.S. electric vehicle sales, which peaked at over 10% of total vehicle market share in early 2025, have dipped sharply following the expiration of the $7,500 federal tax credits under new policy shifts. General Motors reported a $1.6 billion strategic charge in its latest earnings to cover EV production realignments, even as overall company profits held strong at around $13 billion annually.

GM is pivoting toward hybrid vehicles and cost controls to bridge the gap, with plants like Factory Zero in Detroit and Ultium Cells in Ohio idled for upgrades into 2026. Despite layoffs affecting 1,700-1,750 workers, shares rose 35% year-to-date on profit resilience.

Payroll Losses Pile Up

GM’s layoffs at Factory Zero in Detroit and Ultium Cells plants in Ohio and Tennessee erase millions in annual wages for around 1,700 workers, based on average auto salaries of $60,000-$100,000. This triggers a chain reaction in local diners, suppliers, and shops lose business as families cut spending, while schools and services face budget shortfalls from declining tax revenues.

In Michigan and Ohio alone, payroll gaps could exceed $100 million yearly, per industry estimates tied to 1,750 indefinite cuts. Without quick replacements like new EV suppliers or hybrids, recovery drags into years.

Union Strikes Back Hard

The United Auto Workers (UAW) is firing back at General Motors over the holiday layoffs, slamming the company for slashing jobs despite reporting strong profits in 2025. Union leaders demand better relocation assistance, recall rights for furloughed workers, and renewed investments in both gas-powered and electric vehicle production to protect American manufacturing jobs.

Negotiations have heated up in Detroit, with rank-and-file members rallying for solidarity actions and potential strikes if GM doesn’t budge. Tensions are sky-high as the union weighs contract revisions amid the EV slowdown.

CEO Charts a New Course

GM CEO Mary Barra is steering the company through turbulent waters, openly admitting that electric vehicle adoption isn’t hitting the 2035 all-EV targets as quickly as planned. Recent moves include cutting hundreds of salaried engineers and closing IT centers, backed by a $1.6 billion writedown to fund strategic pivots amid slower demand.

The focus now shifts toward hybrids and stricter cost controls, even as shares climb 35% on strong overall profits. The board fully supports the shift, prioritizing profitability in a volatile landscape. Investors applaud the agility, but frontline workers question if it translates to job security.

Plants Go Quiet for Now

General Motors is pausing operations at key battery plants in Warren, Ohio, and Spring Hill, Tennessee, starting January 2026 for major upgrades, with production expected to resume by mid-year.

Workers receive wage subsidies during the downtime to ease the burden. The move blends short-term slowdowns with long-term fixes, as Ultium Cells joint ventures adapt to slumping electric vehicle sales post-tax credit changes.

Experts Sound Alarms

Industry experts warn of widespread job cuts as electric vehicle demand stalls, predicting slashed production and higher car prices across the sector. Analyst Sam Fiorani of AutoForecast Solutions forecasts more pain ahead, stating, “GM’s EV strategy needs a hard reset amid slower adoption than anyone expected,” as covered by Insurance Journal in October 2025.

Regulatory uncertainty, from expired tax credits to shifting federal policies, fuels doubts about quick recovery, with supply chain woes adding fuel to the fire. For workers in Michigan and Ohio, where layoffs hit Factory Zero and Ultium plants, it’s a stark signal of prolonged challenges.

What’s Next for the Midwest?

The Midwest’s manufacturing heartland faces a pivotal moment after GM’s 2025 layoffs, with Factory Zero in Detroit losing 1,145 permanent jobs and Ultium Cells sites in Ohio and Tennessee idling hundreds more amid EV slowdowns.

Michigan and Ohio pitch incentives for tech, renewables, and logistics hubs to replace auto dependency. Yet challenges persist as aging infrastructure and skill gaps slow pivots

Sources:

Insurance Journal – GM EV Strategy Shifts – October 2025

The Gazette – Battery Plant Pauses – October 2025

Autobody News – Industry Supply Chain Issues – September 2025

Reuters – GM CEO Earnings Call – October 2025

UAW Official Statement – Shawn Fain on Layoffs – December 2025