Nearly 600,000 truck owners woke to a chilling reality: their engines could fail without warning. General Motors had been aware of the defective 6.2L V8 engines since late 2021, yet sales continued for more than three years.

By early 2025, a Michigan federal judge consolidated 11 lawsuits into a mega class action, highlighting the recall’s shortcomings. With thousands of failures already reported, this isn’t just a technical glitch—it’s one of the most significant automotive crises in recent memory. Let’s look into what triggered it.

The Hidden Problem That Started Years Ago

In December 2021, GM issued Technical Service Bulletin 19-NA-218, revealing knowledge of bearing failures. Internal investigations followed in February 2022, June 2023, and July 2024, but no recall occurred. By January this year, the NHTSA had begun investigating 877,710 vehicles. With 28,102 field complaints, the scale dwarfed similar Toyota defects, highlighting that government pressure, not GM initiative, triggered any action.

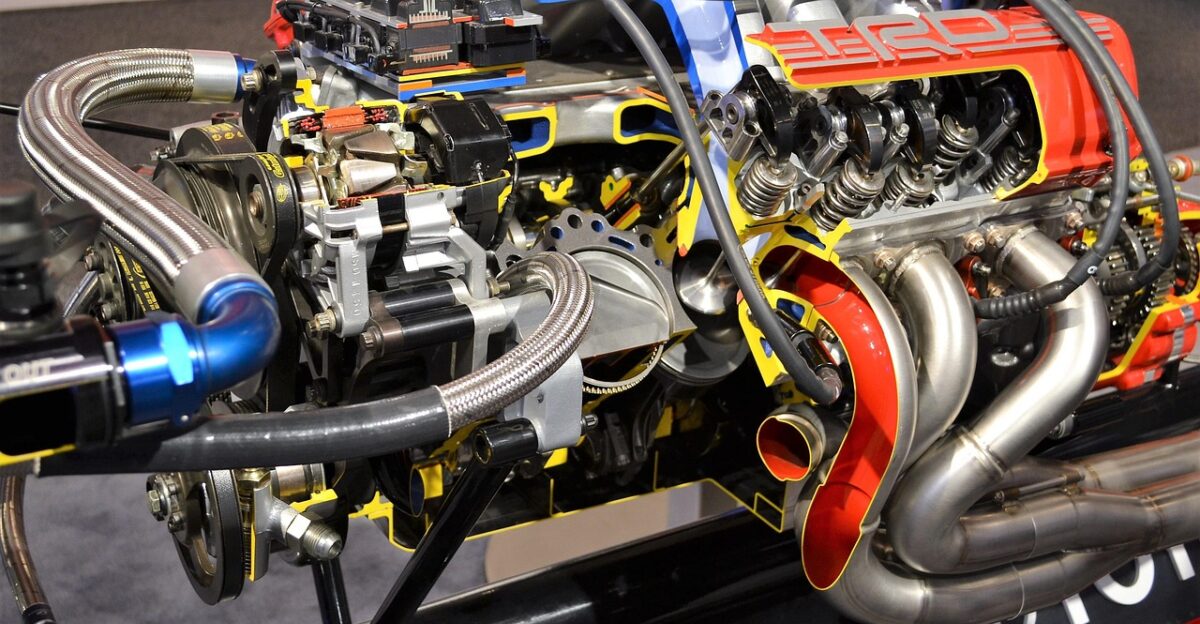

Crankshafts, Bearings, and Metal Contamination

The 6.2L V8 L87 engines had two major failures: sediment on connecting rods and oil gallery contamination damaged bearings, while crankshaft dimensions were out of specification. Owners reported sudden power loss and complete engine shutdowns. One driver said, “I was in the middle of the freeway with my family in the truck,” on May 18, 2025. Design flaws, not wear, caused these issues.

600,000 Vehicles, 28,000 Failures, One Enormous Crisis

GM’s April 2025 recall affected 597,630 U.S. vehicles, 721,000 globally, citing 28,102 incidents with 14,332 total propulsion losses. Notably, 2019-2020 models were excluded despite failures. NHTSA’s October 2025 investigation added 286,000 vehicles, questioning recall adequacy. The official numbers confirmed what plaintiffs argued: the problem wasn’t isolated, and the recall’s original scope left many owners exposed.

An Oil Change Cannot Fix a Broken Design

GM’s remedy involved inspection, higher-viscosity 0W-40 oil, and engine replacement for 3% of vehicles. Plaintiffs stated that this addressed symptoms, not the root cause. One owner noted, “If 3% of engines are estimated defective, why does the ‘fix’ include higher-viscosity oil for all units?” July 10, 2025. Contaminated engines and out-of-spec parts persisted, even in replacement units, leaving fundamental defects unresolved.

11 Separate Lawsuits Become One Unified Battle

The first class action, Powell v. General Motors, LLC, began in February 2025. By June, multiple identical lawsuits followed. In August, Judge Kumar consolidated 11 cases into a single mega class action, signaling a systemic defect affecting all vehicles similarly. Consolidation reflected judicial recognition that the engines’ failures weren’t isolated. The legal battle now represented collective owner grievances, not scattered complaints.

The “Miller Slate” Brings Serious Firepower

Judge Kumar appointed the Miller Slate as lead counsel: Miller Law Firm, DiCello Levitt, Hagens Berman, Lieff Cabraser, and Cohen Milstein. DiCello Levitt secured a $175 million settlement in the Siqueiros v. General Motors case on October 28, 2025. Judge Kumar noted their extensive experience with automotive defects. The appointment signaled a sophisticated, experienced team aiming for accountability, not a quick settlement.

12 Crashes, 12 Injuries, Countless Broken Dreams

The defect caused 12 crashes and injuries, as well as 42 potential fires. One driver recalled, “I was driving 65 mph down the freeway when the truck suddenly turned off… I was stopped in the middle of the highway with my family,” May 18, 2025. These numbers reflected real danger, illustrating that the crisis extended beyond finances into families’ physical and emotional well-being.

$300 Million in Warranty Costs Hit in a Single Quarter

GM CFO Paul Jacobson reported Q2 2025 warranty costs spiked $300 million due to L87 claims, while Q4 2024 net losses totaled $3.0 billion. He stated, “We are facing these challenges head-on with the top priority always being our customers,” July 23, 2025. Analysts projected total recall-related costs could exceed $500 million. The defect’s financial weight compressed GM’s profit margins dramatically.

A Recall Exposed Vulnerabilities Across the Industry

The Tonawanda Engine Plant faced unprecedented demand for replacements, implementing overtime that proved insufficient. Dealers struggled to source engines. One owner complained, “I’ve been waiting on my engine replacement for 5 weeks so far with no ETA.” The bottleneck disrupted service bays and vehicle production, undermining consumer confidence. The recall highlighted not just GM’s failures but vulnerabilities across automotive supply chains.

10 Years of Coverage Cannot Erase Three Years of Silence

GM offered 10-year, 150,000-mile warranties for inspected vehicles, exceeding standard coverage. Plaintiffs argued this did not repair years of deception or lost resale value. Legal filings stated, “Plaintiffs are entitled to recover damages for breach of warranty and fraudulent concealment,” on December 10, 2025. Extended coverage acknowledged guilt but did not restore trust, highlighting that protection alone cannot erase the consequences of prolonged concealment.

2019–2020 Models Excluded Despite Identical Failures

GM claimed crankshaft and rod improvements implemented by June 1, 2024, excluded older models. Yet 2019-2020 vehicles shared the same defects. NHTSA’s October 2025 engineering analysis added 286,000 vehicles, confirming recall inadequacy. The regulator’s investigation supported plaintiffs’ core argument: many affected vehicles remained unaddressed. GM’s explanation created more questions than answers, deepening uncertainty for owners and amplifying concerns about systemic oversight failures.

$175 Million Siqueiros Case Sets Compensation Benchmark

DiCello Levitt’s $175 million Siqueiros settlement involved comparable engine defects finalized on October 28, 2025. Analysts predict L87 compensation could range $150 million to $450 million. L87 aggravating factors include GM’s knowledge since 2021, 28,102 complaints, and safety incidents. These elements may strengthen plaintiffs’ leverage and support higher settlements. With discovery ongoing, the litigation’s outcome could redefine industry expectations for timely disclosure and accountability in automotive defects.

GM’s Crisis Signals Systemic Quality Control Failures

GM’s six-year defect oversight exposed industry-wide quality issues. An October 30, 2025, analysis noted recalls test “supply chain agility and customer-trust capability,” with average scope surging 60%. GM’s 28,102 complaints contrast with Toyota’s 824 claims, revealing broken monitoring or ignored warnings. The broader implication is that if GM missed this, other latent defects may also exist. Investors and consumers are now questioning the reliability of modern automotive production.

The Road Ahead Remains Uncertain for 600,000 Families

Only 198,000 vehicles have received recall remedies; 400,000 remain pending, facing months-long waits. Litigation in Michigan continues, with discovery underway. Owners confront uncertain reliability, damaged resale value, and ongoing legal participation. One driver lamented, “I was a lifetime GM customer, having purchased more than 20 new cars… but with this I am done,” July 10, 2025. For affected families, trust restoration requires accountability.

Sources:

“GM Recalling Nearly 600,000 U.S. Vehicles Over Engine Issue,” Reuters, April 29, 2025

“Part 573 Safety Recall Report 25V-274,” NHTSA, April 24, 2025

“GM L87 Engine Recall: GM Has Started Notifying Vehicle Owners,” GM Authority, July 10, 2025″L87 Engine Recall Drove Up GM Warranty Expenses in Q2 2025,” GM Authority, July 23, 2025

“General Motors’ Engine Recall: A Costly Road Ahead for Investors,” Aon Invest, June 25, 2025

“Federal Judge Consolidates GM L87 Engine Lawsuits Into One Class Action,” Court Listener, August 2025