General Motors’ announcement of indefinite layoffs for 1,750 workers in Michigan and Ohio marks a pivotal moment for the Midwest’s auto industry, as the company recalibrates its electric vehicle (EV) strategy amid shifting market forces and regulatory uncertainty. The move, which includes major reductions at Detroit’s Factory Zero and the Ultium Cells battery facility in Ohio, signals deeper challenges for workers, communities, and the broader regional economy.

Factory Closures and Workforce Impact

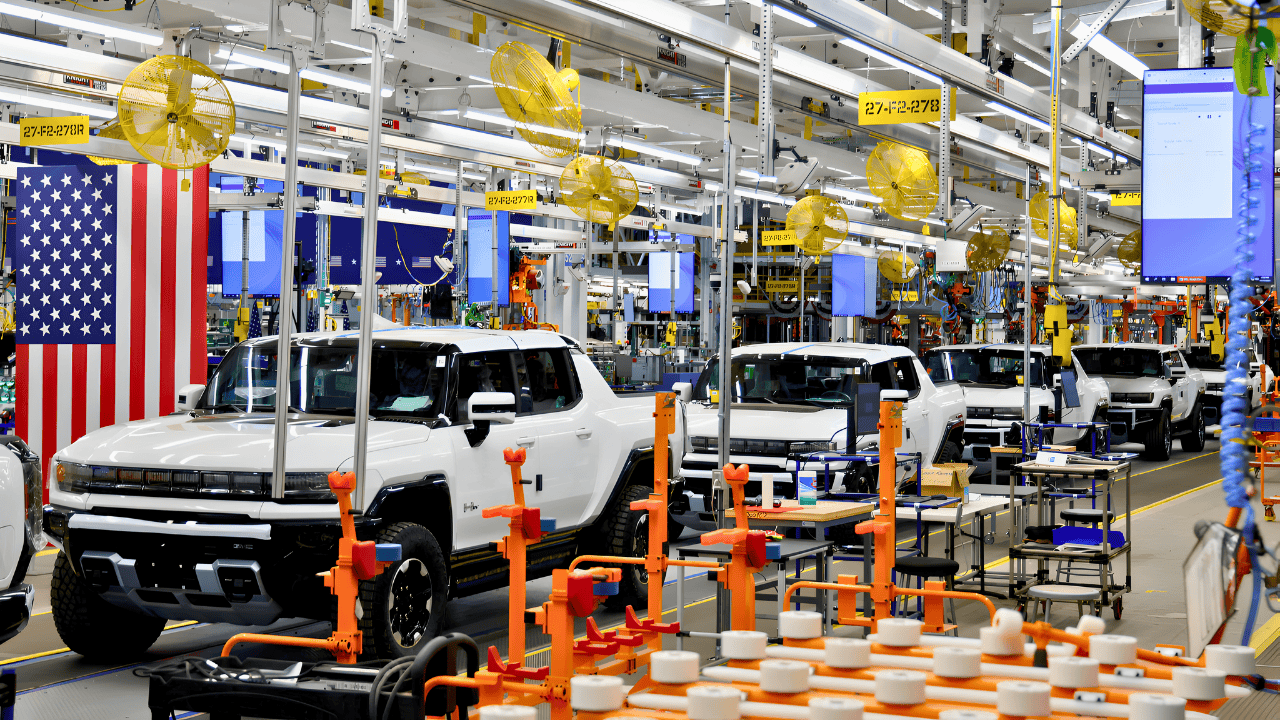

GM’s restructuring centers on two key facilities: Factory Zero in Detroit, which will cut 1,200 jobs as it moves to a single shift, and Ultium Cells in Warren, Ohio, where 550 positions are eliminated. Temporary production halts are also scheduled for Ultium Cells sites in Ohio and Spring Hill, Tennessee, resulting in 850 and 700 temporary layoffs, respectively. A Michigan stamping and components plant faces 120 temporary layoffs as well. These closures and furloughs are expected to last through mid-2026, as GM upgrades infrastructure and reassesses its EV production capacity to better match actual market demand.

The layoffs come with immediate consequences for affected workers. While some employees may qualify for temporary wage continuation and benefits under union agreements, those facing indefinite layoffs have no guaranteed recall date, creating long-term uncertainty for 1,750 families. The company’s official statements emphasize eligibility for continued pay and benefits during temporary closures, but the scale and indefinite nature of the cuts underscore the precariousness of manufacturing employment in the region.

Federal Incentives and Market Shifts

GM’s decision follows the September 2025 expiration of the federal $7,500 EV tax credit, a policy change that abruptly removed a key incentive for buyers of new and used electric vehicles. The loss of this credit, combined with ongoing regulatory uncertainty and slower-than-expected consumer adoption of EVs, prompted GM to record a $1.6 billion impairment charge related to declining plant valuations and restructuring costs. The company cited an “evolving regulatory landscape” and lagging EV demand as central reasons for its capacity reductions.

The end of federal incentives has had a pronounced effect on the market. Without the tax credit, prospective buyers lost significant financial motivation, leading to a drop in EV sales. Elevated vehicle prices, persistent battery costs, and supply chain pressures have further dampened consumer enthusiasm. Surveys indicate that many buyers are waiting for more affordable models and improved charging infrastructure before committing to electric vehicles, contributing to the slowdown in adoption.

Economic Ripple Effects in the Midwest

The layoffs represent a direct annual payroll loss of approximately $87-105 million, based on conservative wage estimates for unionized workers. This immediate income reduction translates into lower local and state tax revenues, affecting schools, public services, and small businesses. Communities dependent on manufacturing face declining property values, reduced consumer spending, and increased out-migration as employment uncertainty spreads.

The economic impact extends beyond GM’s workforce. Multiplier effects typically result in two to three times the initial job loss across suppliers, logistics, and service sectors. As a result, the 1,750 direct layoffs may trigger an additional 3,500-5,250 job losses among companies reliant on manufacturing payrolls. Parts suppliers report reduced orders, transportation firms anticipate lower shipping volumes, and local retailers brace for declining customer traffic. The supply chain ripple effects threaten the stability of smaller suppliers, some of whom may face insolvency if they cannot adapt to reduced demand.

Union Contracts and Worker Options

The layoffs arrive just months after GM ratified a new UAW contract that included wage gains, cost-of-living adjustments, and improved job security language. While the contract provided protections for workers at specific plants, it did not prevent restructuring or capacity reductions at facilities operating below target volumes. This contradiction—union victories followed by major layoffs—has raised questions about the durability of manufacturing jobs and the effectiveness of contract protections.

UAW-represented workers have several options, including transfers to other GM facilities, retraining programs, and income security provisions. However, transfers often require relocation, which can be costly and disruptive for families. Retraining offers a path to new roles but does not guarantee comparable wages or long-term employment stability. The demographic impact is uneven, with less-senior workers, minorities, women, and those with disabilities facing higher risks and additional barriers to reemployment.

Long-Term Implications and Regional Outlook

GM’s restructuring is part of a broader industry trend, as automakers across the globe reassess EV investment timelines in response to slower adoption and regulatory uncertainty. Rivian, Volkswagen, Ford, and Stellantis have all announced similar workforce reductions or production pauses. Meanwhile, international competitors, particularly Chinese firms, are gaining market share, further eroding the Midwest’s traditional manufacturing advantage.

The paradox of billions invested in EV capacity and infrastructure, only to see job losses and economic disruption, has led communities to question the viability of transition-based economic development strategies. The region’s long-term competitiveness depends on its ability to manage structural change, support affected workers, and diversify its economic base beyond legacy manufacturing.

As the Midwest confronts these challenges, success will require coordinated efforts among workers, companies, educational institutions, and government. The stakes are high: the future of regional prosperity hinges on thoughtful transition planning, generous support for displaced workers, and strategic investment in new economic opportunities.

Sources:

Associated Press/Reuters reporting on GM layoffs (October 29, 2025); AP News, Reuters wire service

General Motors Q3 2025 Earnings Disclosure and SEC Filing (October 14, 2025); CNBC, CPA Practice Advisor, Detroit News

One Big Beautiful Bill Act and EV Tax Credit Termination (September 30, 2025); HR Block Tax Center, Plant E Moran LLP, CBT News

Chinese EV Market Share Growth and International Competition (2025); Forbes, CNEVPost, Schmidt Automotive Research