PepsiCo is closing its Orlando bottling plant. This marks a major shift in how big companies view regional factories. Companies are closing plants across Florida as consolidation pressures intensify.

Beverage companies have long anchored Central Florida’s economy. A facility that has been operating since the mid-1960s now faces shutdown.

The closure has stronger effects on the region’s future than most people realize.

The Cost-Cutting Cascade

Major food and beverage companies are rapidly restructuring their operations across North America. Cost pressures and supply-chain optimization drive this consolidation.

PepsiCo’s move reflects an industry-wide trend toward fewer, larger production centers. Regional plants increasingly struggle for corporate investment.

Smaller operations are facing closure as parent companies rationalize their production networks. The Orlando plant’s closure signals a broader pattern reshaping the entire industry.

A Six-Decade Legacy

PepsiCo opened the Orlando plant in 1965. It operated continuously for 60 consecutive years.

The plant remained a stable employer and community anchor through booms and recessions. Generations of families built careers there.

Local suppliers, logistics networks, and service vendors grew around it. Its closure shocked residents and officials who viewed it as a symbol of corporate commitment to the region.

Mounting Pressure on Legacy Assets

Beverage companies face intense pressure on margins due to rising energy costs and labor expenses. Legacy plants operate with higher per-unit costs than modern facilities.

Frito-Lay plants, in particular, face restructuring pressure as PepsiCo integrates its snack and beverage operations.

Orlando’s aging infrastructure cannot compete with newer distribution hubs. Corporate efficiency models penalize older, standalone operations.

The plant’s operational model became unsustainable within PepsiCo’s optimization strategy.

The Closure Announcement

PepsiCo officially announced the closure in November 2025. The facility closes in phases through May 2026.

Approximately 500 employees will lose their jobs as operations move to other regional and national centers.

PepsiCo filed WARN notices with Florida regulators for the purpose of providing legal worker protections. Operations transfer to distribution centers in other states.

This represents one of the largest layoffs in Florida’s beverage industry in recent memory.

The Local Economy’s Shock

Orlando’s economy is expected to lose an estimated $300 million in annual direct revenue. Tax revenues, property values, and municipal budgets depend on ongoing commercial activity.

The facility closure removes a major anchor tenant from the industrial real estate market.

Downstream suppliers—such as packaging vendors, logistics providers, and utility companies—face immediate revenue losses.

Local officials scramble to find replacement investments and industrial tenants. This ripple effect threatens economic stability across Central Florida’s manufacturing sector.

Jobs Lost and Families Displaced

Five hundred workers face immediate job displacement. WARN filings confirm layoffs in two phases: 454 positions and 46 additional positions.

Severance packages and transition assistance help, but do not restore lost income. Many employees have 10, 20, or more than 30 years of service at the plant.

Retirement plans and seniority benefits face disruption. Families who built lives around stable plant employment now face uncertainty and financial stress.

Multiplier Effect and Hidden Job Loss

Economic studies suggest that 1,500–2,000 indirect jobs are at risk across suppliers, transportation, warehousing, and retail. Local payroll in the supply chain reaches $25–50 million annually.

When you combine direct and indirect job losses, the regional impact could exceed 2,500 jobs. Landscaping companies, janitorial services, restaurants near the plant, and office suppliers all face reduced demand.

This secondary unemployment wave may develop over months as vendor contracts end. The true disruption extends far beyond the 500 announced layoffs.

Market Concentration and Competitor Response

Larger beverage producers, including Coca-Cola, undertake similar consolidation. Smaller regional bottlers cannot compete with national scale economics.

The closure accelerates market concentration in the beverage sector. Remaining Florida operations face increased pressure to improve efficiency or risk closure. PepsiCo’s move sends a signal: legacy, standalone facilities are vulnerable.

Competitors likely weigh similar network optimization decisions. Industry analysts anticipate continued consolidation over the next 24 to 36 months.

Regulatory Compliance Theater

PepsiCo offers severance and job placement assistance—a shield against criticism. WARN Act filings provide legal protection for workers but do not prevent layoffs.

The company frames closure as “responsible management” and offers career counseling and transition support. However, PepsiCo makes no commitment to preserve jobs or retrain employees.

This pattern—protective messaging wrapping irreversible decisions—appears standard in large-scale closures. Workers receive notice and benefits, but the outcomes rarely match the company’s rhetoric.

Support messaging masks the finality of displacement.

Local Leadership’s Frustration

Orlando city officials and Orange County commissioners express deep concern. PepsiCo announced the closure publicly before engaging municipal leaders.

Local officials were unable to negotiate retention or partial operation preservation. Officials view the decision as treating the facility as a financial line item rather than a community asset.

Economic development officials now compete nationally for replacement industrial tenants.

The sense of betrayal runs deep: a six-decade relationship ended without a word of dialogue or negotiation.

Corporate Consolidation Strategy

PepsiCo’s restructuring reflects broader shifts in its ownership strategy. The company prioritizes capital efficiency and margin expansion over regional employment.

North American beverage operations consolidate into six major distribution hubs, rather than dozens of regional plants. This redesign improves logistics and reduces overhead but eliminates redundancy—and the jobs.

Senior leadership views the Orlando closure as necessary to achieve profit targets and shareholder benchmarks. The decision is final; there is no reversal.

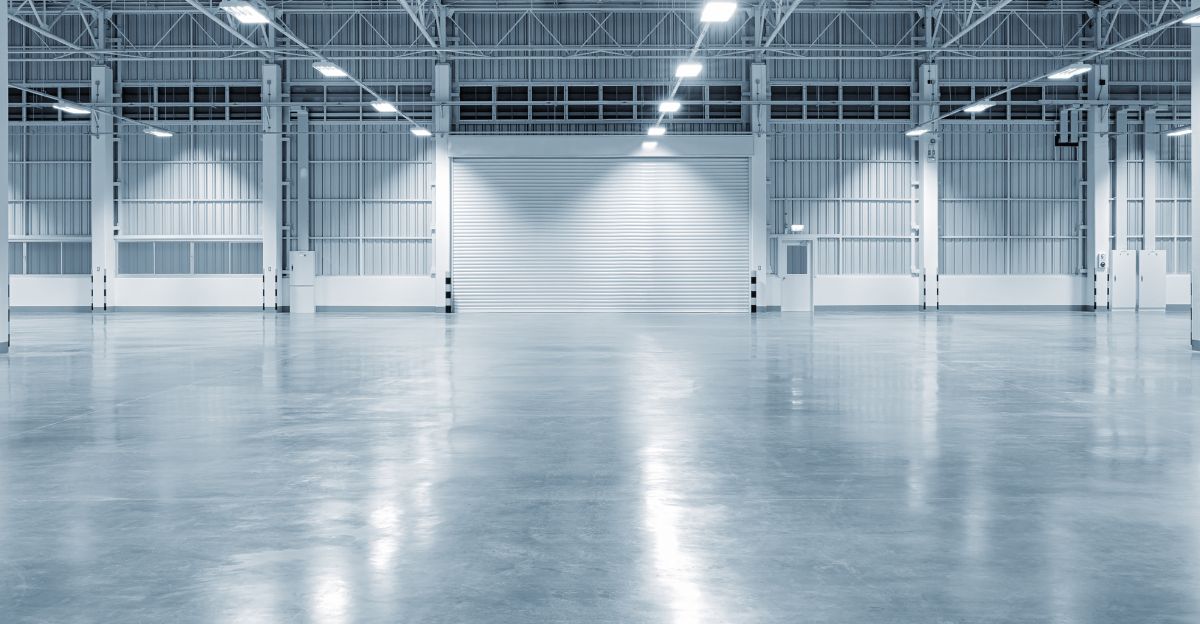

Economic Development’s Difficult Pivot

Orlando’s economic development authority must now market the 60-year-old facility to replacement tenants.

The industrial real estate is well-located but aging, with specialized bottling and distribution infrastructure. Conversion to alternative uses—such as light manufacturing, warehousing, and logistics—is possible but requires capital investment.

Few industrial operators want to take on a 60-year-old facility. Real estate values may decline due to extended vacancy and market uncertainty. Recovery timelines stretch to 12–24 months or longer.

Expert Skepticism on Recovery

Industry analysts doubt traditional beverage manufacturing will return to Orlando. The consolidation trend is structural, not temporary. Replacement industries may not generate equivalent wage levels or employment density.

Workforce retraining programs can help retool displaced workers, but alternative employment opportunities in Central Florida often pay 20–40% less. Community leaders acknowledge a painful transition ahead.

Economic recovery requires diversification beyond the beverage manufacturing sector. The region must compete nationally for new investment in technology, healthcare, and advanced manufacturing.

The Larger Question

PepsiCo’s Orlando closure raises a defining question for American manufacturing: Can regional economic anchors survive in a globalized, efficiency-optimized economy?

The plant’s 60-year run represented an implicit social contract: stable employment in exchange for community commitment. That contract is now void. Thousands of closures reshape regional labor markets and municipal finances across the nation.

What obligations do multinational corporations owe to the communities that built them? The answer appears increasingly clear: none. As PepsiCo exits Florida, other regions watch nervously.

Sources:

Click Orlando, November 4, 2025; Food Dive, November 6, 2025

Food Engineering Magazine, November 2025;

Powder & Bulk Solids, November 10, 2025

La Grada Online, November 24, 2025

Food Dive, November 6, 2025; TheStreet, November 10, 2025