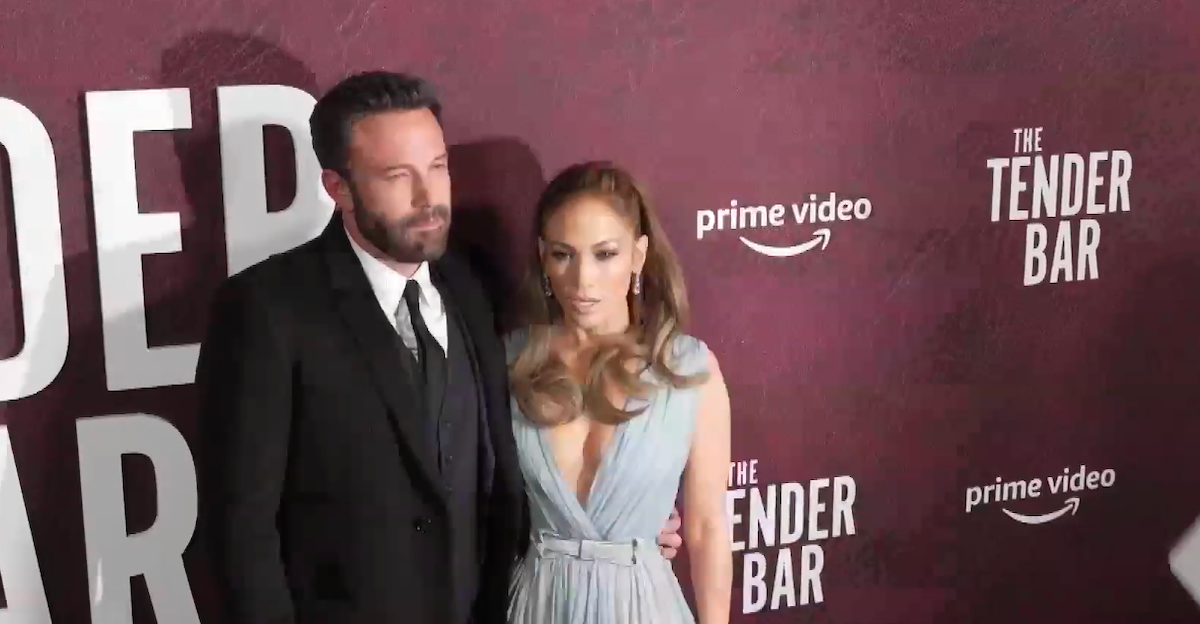

Jennifer Lopez and Ben Affleck’s sprawling Beverly Hills estate, once envisioned as their ultimate marital retreat, has turned into a post‑split burden, combining eye‑watering monthly carrying costs with steep price cuts and a stubbornly small pool of ultra‑wealthy buyers.

Size, Setting, and Purchase

The compound, often referred to as Crestview Manor, sits on roughly 5.2 acres in a secluded Beverly Hills Post Office enclave and spans about 38,000 square feet of interior space, with 12 bedrooms and 24 bathrooms spread across multiple structures. Lopez and Affleck, who bought the property in May 2023 for approximately $60.8–$60.85 million via a trust, chose it after an extended house‑hunt as a long‑term family base for their blended household. At the time, the purchase price was already a discount compared with the estate’s earlier $135 million asking price in 2018.

Layout, Interiors, and Outdoor Space

Beyond its sheer size, the estate is designed to function like a private resort. The main house is a grand Georgian‑style manor with formal and informal living spaces, high ceilings, and large windows opening to manicured gardens and canyon views. The interiors include multiple lounges, dining areas, and family rooms, and a primary suite configured as a private wing, with its own sitting area, spa‑style bathroom, and custom closets. For extended family and guests, the property adds a separate 5,000‑square‑foot guest penthouse, a dedicated caretaker house, and a two‑bedroom guardhouse near the entrance, creating a small campus of stand‑alone buildings around the main residence.

One of the estate’s standout features is a large indoor sports complex that functions as a personal athletic club. Inside this wing, there are full basketball and pickleball courts, a fully equipped gym with professional‑grade fitness machines, a boxing ring, and a sports lounge complete with bar seating for post‑workout gatherings. Outside, the grounds include a zero‑edge pool and spa positioned to capture hillside and canyon vistas, expansive lawns framed by tall hedging for privacy, and multiple patios and terraces for outdoor dining and entertaining. The estate’s infrastructure is equally oversized, with a 12‑car garage and additional motor‑court capacity bringing total parking to about 80 vehicles, a scale suited to a major celebrity compound with staff and security.

Renovations and Changing Plans

Lopez and Affleck did not simply move in as‑is. Shortly after buying the property, they embarked on a months‑long renovation and customization program to tailor the interiors and amenities to their tastes, updating finishes and further enhancing the already extensive recreational facilities. The couple ultimately separated in 2024, and Lopez filed for divorce in August of that year, which shifted the narrative around the home from “forever house” to high‑stakes asset to be managed in the midst of a public split.

By mid‑2024, they moved to sell. The mansion was first publicly listed around July 2024 with an asking price of $68 million, positioning it among the most expensive homes on the Beverly Hills market. That price soon proved ambitious. In May 2025, the ask was brought down to $59.95 million, an $8 million cut reflecting softer demand at the very top of the market and concern about ongoing costs. When that still failed to produce a sale, the listing was removed in July 2025, only for the home to return to the market in September 2025 at $52 million—$16 million below the original 68‑million price tag and well under what comparable trophy properties were seeking a year earlier.

Carrying Costs and Financial Pressure

Even at the reduced price, carrying the estate is enormously expensive. An analysis by Realtor.com, which drew on public loan records and common cost assumptions, estimated the monthly costs at about $283,666, often rounded to roughly $284,000. That figure folds in an estimated mortgage payment on a $20 million loan, annual property taxes tied to the $60.8 million purchase price, homeowners insurance, security, utilities, and the regular maintenance required to operate a resort‑scale property, from landscaping to pool service. On a yearly basis, those outlays add up to more than $3.4 million before any sale‑related taxes or commissions come into play.

Expected Losses and the Mansion Tax

Real‑estate professionals note that, given the new $52 million asking price, Lopez and Affleck are likely to accept less than they paid—or might at best break even once transaction costs are included. Celebrity broker Jason Oppenheim and other market experts have said in interviews that the couple stands to lose several million dollars by the time a sale closes, factoring in the discount from their purchase price and the high costs incurred during ownership. And because the property sits within the city of Los Angeles, any sale above $10 million is subject to Measure ULA, a transfer tax that adds 5.5% on top of the transaction. At a $52 million closing price, the ULA charge alone would be in the neighborhood of $2.86 million, before standard agent commissions and other closing expenses.

Researchers who have examined Measure ULA’s effects on the high‑end market have found that the tax has meaningfully dampened transaction activity. Economic analysis published in 2023 and updated in 2025 concludes that the mansion tax has reduced transaction rates in the affected price brackets by about 38%, and that between 63% and 138% of the new tax revenue is offset over time by lower future property‑tax collections as owners delay selling and hold onto properties longer. In practice, that means sellers like Lopez and Affleck face a smaller pool of willing buyers and an added financial penalty if they do manage to strike a deal.

Ultra-Luxury Market Backdrop

All of this is playing out against a cautious backdrop for ultra‑luxury real estate in Beverly Hills and greater Los Angeles. Market reports and agent commentary heading into 2026 describe a landscape where homes at $50 million and above attract a tiny global buyer pool, often need many months on the market, and are frequently repriced before selling. Wealthy purchasers at this level tend to be patient, opportunistic, and aggressive in negotiations, especially when a property is widely known to be linked to a high‑profile divorce and expensive to carry, as in this case.

Public reporting indicates that, while Affleck has moved on to a separate home in the Pacific Palisades area, Lopez has continued to spend time at the Beverly Hills estate even as it remains for sale, underscoring the home’s dual role as both residence and financial obligation. For now, the mansion stands as a visible symbol of how even the most lavish real‑estate bets can become complicated when personal and market realities shift, leaving two global stars trying to thread the needle between emotional closure and financial pragmatism.

Sources:

“Ben Affleck and Jennifer Lopez Cut Price of Beverly Hills Marital Home with $8 Million Price Cut After 10 Months on Market.” People Magazine, May 2025.

“Jennifer Lopez and Ben Affleck Relist Marital Mansion for $52 Million After Major Price Decrease.” Realtor.com, September 2025.

“Jennifer Lopez and Ben Affleck are poised to lose money on their Los Angeles mansion thanks to the city’s tax.” Fortune Magazine, May 2025.

“Ben Affleck & Jennifer Lopez Slash Beverly Hills Mansion Price $8 Million.” TMZ, May 2025.

“The Effect of the Los Angeles Mansion Tax on Property Tax Revenue.” Cato Institute and UCLA Lewis Center, December 2025.

“Beverly Hills Housing Market: House Prices & Trends.” Redfin market data, January 2026.