During an August 2025 podcast interview, Rivian CEO RJ Scaringe expressed his astonishment at the recent shift in America’s auto industry.

He noted that it was surprising to witness a significant amount of investment directed toward gas-powered vehicles, which he described as both unexpected and concerning for the future of electric mobility.

Money Flows

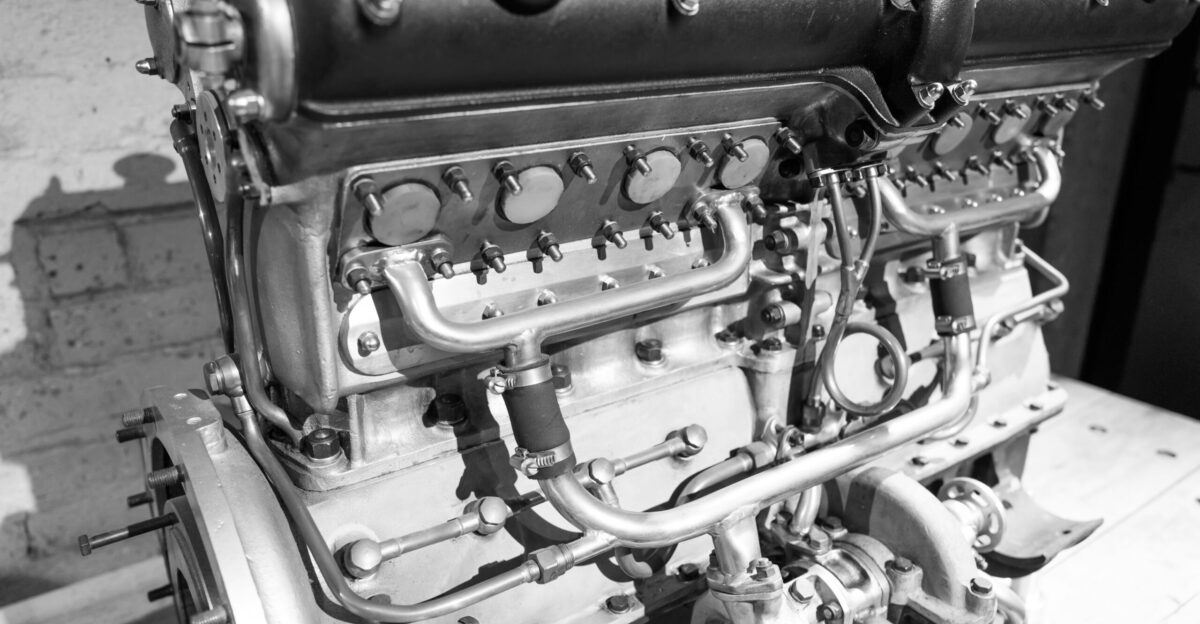

In a significant move, major automobile manufacturers have collectively pledged nearly $7 billion this year to develop traditional gas-engine vehicles.

General Motors is at the forefront, with an investment of $4 billion dedicated to producing gas-powered SUVs and an additional $888 million earmarked for V8 engine manufacturing.

Past Promises

In the years leading up to the present, major automakers made significant commitments to electrification. General Motors announced its intention to shift to all-electric vehicle sales by 2035.

Meanwhile, Ford dedicated an impressive $50 billion to its electrification initiatives. During this period, President Biden reinforced these goals through investments in infrastructure and tax incentives designed to make electric vehicles more affordable for consumers.

Market Reality

In the second quarter of 2025, electric vehicle (EV) sales saw a notable decline, reaching only 7.4% of new car sales. According to CarEdge reports, the total number of EVs sold dropped to 310,839 units, despite the availability of 149 different models.

This slowdown in consumer demand can be attributed to several factors, including the insufficient development of charging infrastructure and the uncertainty surrounding purchase incentives due to shifting political landscapes across the country.

Policy Earthquake

President Trump announced the elimination of the $7,500 electric vehicle (EV) tax credit, which will take effect on September 30, 2025, seven years earlier than scheduled.

In addition, the administration has frozen $5 billion in federal funding allocated for charging station infrastructure and has instructed states to halt spending on green energy initiatives. This shift in regulatory policy has significantly impacted corporate strategies and planning across various industries.

State Battles

Fourteen states have taken legal action against the federal government in a bid to restore funding for EV charging infrastructure, with California at the forefront of this initiative.

In June, a federal judge issued a temporary injunction to halt the freeze on these funds; however, concerns about the future of state programs persist. For example, Pennsylvania had allocated $77 million towards 90 charging partnerships, which are currently on hold due to recent changes in federal policy.

Executive Voices

“Things I never thought would happen a year ago are happening now,” Scaringe told InsideEVs about new engine programs being announced.

Ford’s Farley stated his company is “investing in ICE segments where we’re dominant” as competitors shift focus. GM’s Barra noted the company would “happily ramp up production” if EV demand lessens.

Tesla Benefits

Tesla’s U.S. market share has risen to 46% despite declining sales volumes. This increase is partly due to competitors returning to the electric vehicle market.

In contrast, Chinese manufacturer BYD emerged as a global leader in 2024, delivering 4.27 million vehicles, surpassing Tesla in total sales. The evolving automotive landscape appears to benefit companies that specialize exclusively in electric vehicles, in contrast to traditional automakers that are diversifying their offerings.

Global Divide

China currently leads the global market, accounting for 60% of electric vehicle (EV) battery production and nearly half of all EV sales worldwide.

Notably, BYD, a major player in the industry, manufactures vehicles at a remarkable pace of one every 30 seconds at its facilities. In contrast, European markets are enforcing strict deadlines for the phase-out of combustion engines by 2035.

This approach highlights a significant difference from the United States, which has recently scaled back its commitments to electrification and manufacturing investments.

Job Dilemma

The recent surge in investment in gas vehicles is generating immediate job opportunities in manufacturing; however, this drive poses risks to long-term competitiveness as global markets increasingly transition to electric vehicles.

This situation creates a complex employment landscape, as over 115,000 direct automotive jobs are caught in the tension between short-term benefits and the need for strategic adaptation to evolving market conditions.

Internal Conflicts

A Kerrigan Advisors survey found that 72% of Stellantis dealers expressed no confidence in the company’s direction under former leadership. New executives questioned the previous CEO’s strategy after eliminating seven popular gas models that generated substantial revenue.

The company received overwhelming demand when announcing the return of Hemi-powered Ram pickups.

Leadership Changes

Antonio Filosa replaced Carlos Tavares at Stellantis with explicit mandates to restore muscle car production and V8 engines. The new leadership promised to bring back gasoline-powered models after previous cuts.

Ford’s Farley restructured operations by abandoning century-old production methods to compete with more efficient Chinese manufacturing standards.

Dual Strategies

General Motors invested $35 billion in EV development through 2025 while funding V8 engine production simultaneously.

Ford has committed billions to Kentucky EV plant improvements, even as it maintains significant combustion investments. This dual-track approach reflects corporate hedging against uncertain regulatory and market futures ahead.

Expert Warnings

Industry analysts warn that American automakers risk creating stranded assets as global markets accelerate electrification timelines. Detroit analyst Alan Baum notes GM’s all-EV 2035 goal is now considered more aspirational than strategic.

EY Global identifies a $660 billion transformation opportunity that American companies may forfeit through combustion investments.

Future Questions

Will American automakers find themselves excluded from rapidly electrifying global markets by 2030? The divergent strategies create fundamental questions about long-term competitiveness versus short-term profitability.

Scaringe warned that while reduced EV competition benefits pure-play companies, industry-wide retreats ultimately harm American automotive leadership globally.

Political Impact

The Trump administration’s aggressive rollback of EV policies reflects broader energy sector realignments favoring traditional fossil fuel industries.

Congressional Republicans actively pursue legislation eliminating EV incentives and emissions standards to accelerate electrification. These political shifts fundamentally alter decades of environmental policy consensus in Washington.

Global Consequences

European markets increasingly view American automotive manufacturers as technologically backward as they retreat from electrification leadership. BYD’s Hungarian factory will produce 300,000 European EVs annually by 2030, exemplifying Chinese manufacturers filling American market retreats.

The geopolitical implications extend beyond automotive trade into broader industrial competitiveness questions.

Climate Concerns

The carbon emissions implications of renewed combustion engine investments directly contradict international climate commitments and Paris Agreement targets.

Transportation accounts for significant greenhouse gas emissions, making automotive electrification crucial for climate goals. American automakers risk becoming environmental pariahs in increasingly climate-conscious global markets.

Cultural Clash

The return to muscle cars and V8 engines represents more than industrial strategy—it signals cultural resistance to environmental transformation.

Younger consumers increasingly prefer sustainable transportation options, creating generational divides within automotive markets. This cultural tension between traditional automotive identity and environmental responsibility shapes long-term brand positioning strategies.

Strategic Crossroads

America’s automotive industry faces its most consequential strategic decision since the Model T production line: embrace global electrification trends or double down on combustion technology.

Scaringe’s shock reflects broader recognition that this moment defines decades of competitive positioning. The industry’s choice between short-term profits and long-term relevance will determine America’s transportation future.