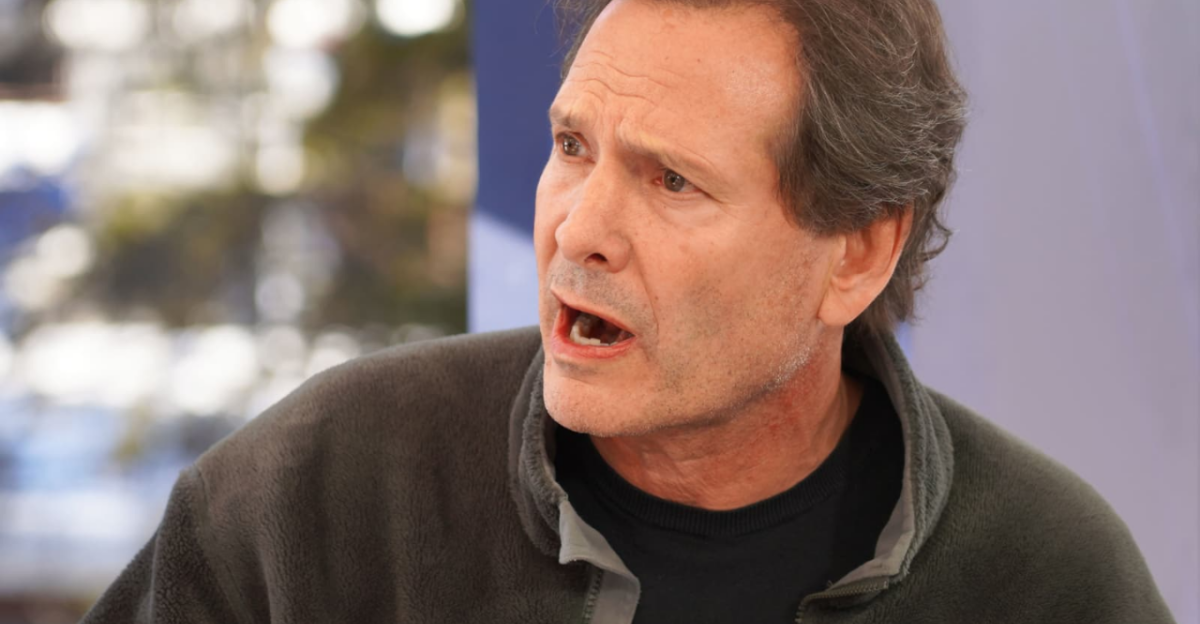

Verizon’s new chief executive Dan Schulman stunned employees in early December when he told an internal all‑hands meeting that the company had effectively priced itself into losing 500 to 700 basis points of market share over five years. He called much of the damage “self‑inflicted,” a rare admission in a sector where executives typically blame rivals or economic conditions. The comments capped a brutal year in which Verizon saw customer losses, falling satisfaction scores, and the largest layoffs in its history, forcing a sweeping overhaul of its strategy and cost structure.

Pricing Strategy Turns Into a Vicious Cycle

Schulman, who took over from Hans Vestberg in October 2025, quickly concluded that Verizon’s push to raise rates had alienated the very customers it depended on. He described a clear pattern: when prices went up, churn followed. After price increases, the company’s churn rate rose by 20 to 25 basis points, pushing already frustrated customers to leave.

The consequences became visible in the first quarter of 2025, when consumer postpaid phone churn climbed 7 basis points year over year after several pricing actions late in 2024. By Q3 2025, Verizon reported a loss of 7,000 postpaid phone subscribers, a sharp reversal from the 18,000 additions a year earlier. In Q1 2025, the situation worsened as the pricing backlash intensified and the company shed hundreds of thousands of customers across its base.

Monthly postpaid phone churn reached 0.91% in Q3 2025 and 0.90% in Q1 2025, the highest level in a decade. Schulman has framed these figures as evidence that a focus on extracting more revenue per user, without reinforcing the value delivered, pulled Verizon into a downward spiral of defections and shrinking market share.

Competitors Gain Ground as Verizon Stumbles

While Verizon wrestled with higher churn, competitors capitalized. In Q3 2025, T‑Mobile added 1 million new subscribers, and AT&T reported 405,000 net additions, widening the gap in growth trajectories. By the middle of 2025, T‑Mobile’s market valuation had climbed to roughly $274 billion, compared with Verizon’s $182 billion, reversing a long‑standing hierarchy in the U.S. wireless market.

Analysts and executives pointed to T‑Mobile’s decision to keep prices lower while improving perceived value as a major factor. Verizon, by contrast, tried to support a premium pricing model without matching enhancements in customer experience. The result, Schulman acknowledged internally, was an erosion of value perception that allowed competitors to attract Verizon customers on both price and satisfaction.

Customer Sentiment and Structural Weaknesses

Independent surveys confirmed the reputational damage. J.D. Power data showed Verizon with a customer satisfaction score of 583, behind T‑Mobile’s 626 and only slightly ahead of AT&T’s 573. Schulman told employees that Verizon’s satisfaction scores were now worse than its main rivals, a striking shift for a brand long associated with superior service and network quality.

Internally, Schulman highlighted structural barriers that hampered efforts to keep customers from leaving. He said Verizon did not give frontline representatives enough financial flexibility to solve problems or offer compelling retention deals. At the same time, a maze of overlapping promotions created confusion rather than loyalty, making it harder for staff to present clear, competitive options when customers threatened to switch.

The strain extended beyond mobile. In Q3 2025, Verizon lost 70,000 Fios video subscribers, a 5.4% decline from the previous year, even as its broadband unit added 306,000 fixed wireless and fiber customers. The broader pattern, however, was one of market share slipping across key business lines.

Record Layoffs and a High‑Risk Turnaround Plan

Mounting financial pressure pushed Schulman to announce on November 20, 2025, that Verizon would cut more than 13,000 jobs, about 13% of its 99,600‑person workforce. It was the largest workforce reduction in company history and the heaviest monthly layoff total in the U.S. telecommunications sector since April 2020. In a memo to employees, Schulman said the cuts were intended to make Verizon “faster and more focused” and position it to deliver for customers while pursuing new growth.

In the December 5 all‑hands, he argued that smaller, incremental cuts would not free enough capital to rebuild Verizon’s value proposition. If the company lacked the funds to improve what it offered customers, he warned, it would “continue to shrink.” Executives have told investors that the layoffs are expected to generate roughly $1 billion in annual cost savings starting in 2026, money that can be redirected into network upgrades, simpler offers, and better service.

Schulman has outlined three main priorities for 2026: making operations more customer‑centric, simplifying complex processes and promotions, and deploying artificial intelligence to streamline support and internal workflows. He has rejected what he calls a “price without growth” approach and signaled plans to detail the new direction to Wall Street in upcoming earnings calls.

Balancing Restructuring With Workforce Support

Alongside the cuts, Verizon has created a $20 million Reskilling and Career Transition Fund aimed at helping affected employees adapt to an economy increasingly shaped by AI and automation. The fund will support professional training, digital skills development, and job placement assistance. Company leadership portrays the initiative as part of a broader recognition that technology‑driven change requires parallel investment in people, even as the immediate impact of job losses remains severe for many workers.

For the wider telecommunications sector, Verizon’s reversal offers a cautionary example of how aggressive pricing strategies, if not matched by perceived value and service quality, can undermine long‑term competitiveness. The company’s experience underscores how quickly market share can shift when dissatisfied customers see strong alternatives, and how those losses then restrict the financial room needed to fix the underlying issues.

Verizon now faces a pivotal period. Schulman’s unusually direct acknowledgment of past missteps and his decision to pursue far‑reaching changes rather than incremental adjustments set a clear break from previous leadership. Whether substantial layoffs, a renewed emphasis on customer experience, simpler offerings, and expanded use of AI can rebuild trust and growth—or only slow further erosion—will become clearer over the next several quarters as rivals T‑Mobile and AT&T continue to vie for advantage in a market where loyalty is increasingly fragile.

Sources:

“Verizon CEO reveals mistakes that led to over 13,000 layoffs.” TheStreet/MSN, December 8, 2025.

“Verizon’s smug stance crumbles after brutal Q3, and its new CEO admits to ‘self-inflicted’ wounds.” PhoneArena, October 28, 2025.

“Verizon names former PayPal boss Dan Schulman as new CEO.” USA Today, October 6, 2025.

“Verizon CEO tells employees about massive layoffs and transformation strategy.” Yahoo Finance, December 9, 2025.

“Why Verizon’s new CEO is cutting 13,000 jobs at the wireless company.” Morningstar/MarketWatch, November 20, 2025.

“How T-Mobile Overtakes Verizon: Focus on Core Business.” LinkedIn, August 26, 2025.Verizon CEO Brazenly Confesses ‘Self-Inflicted Wounds’ Behind Company’s Largest-Ever Layoff Wave