Volkswagen has suspended U.S. sales of its ID. Buzz electric van for the 2026 model year, just one year after its launch, amid a sharp drop in demand following the end of federal EV tax credits.

The retro-styled vehicle, priced around $60,000, saw 2,600 units pile up on dealer lots by November 2025, with sales falling 67-75% short of internal targets of 15,000-20,000 units annually. In the first nine months of 2025, only 4,934 units sold: under 2,000 in the first quarter, 564 in the second, and 2,469 in the third as buyers hurried to claim the $7,500 credit before its September 30 expiration.

Dismal Sales and Inventory Glut

Dealerships faced a crisis with over 200 days of supply—nearly four times the 54-day industry average—meaning more than six months to clear stock at prevailing rates. Volkswagen responded with $7,500 retail bonuses and $2,500 dealer cash, totaling $10,000 off sticker prices. Some outlets slashed deeper; Tynan’s Volkswagen in Aurora, Colorado, offered 2025 Pro S models for $36,695, a 41% reduction from $62,195. In Canada, discounts reached $21,000, or 25% off.

The tax credit’s end, part of the “One Big Beautiful Bill Act,” sparked a broader EV downturn. Weekly U.S. EV sales peaked at 22,997 units for September 22-28, then fell 74% to 5,929 by October 6-12. EV market share dropped from 11.3% in September to 5.1% in November, the lowest since April 2022.

Core Product Shortcomings

Starting at $61,545 for the base rear-wheel-drive Pro S, the ID. Buzz cost $20,000 more than a Toyota Sienna hybrid minivan and $10,000-$20,000 above a Honda Odyssey Elite. Fully loaded all-wheel-drive versions neared $70,000. Its EPA range of 234 miles for rear-drive and 231 for all-wheel-drive models fell below the 300-mile benchmark for broad appeal. Real-world cold-weather tests showed ranges dipping under 200 miles, with practical road-trip distance around 163 miles after charging stops.

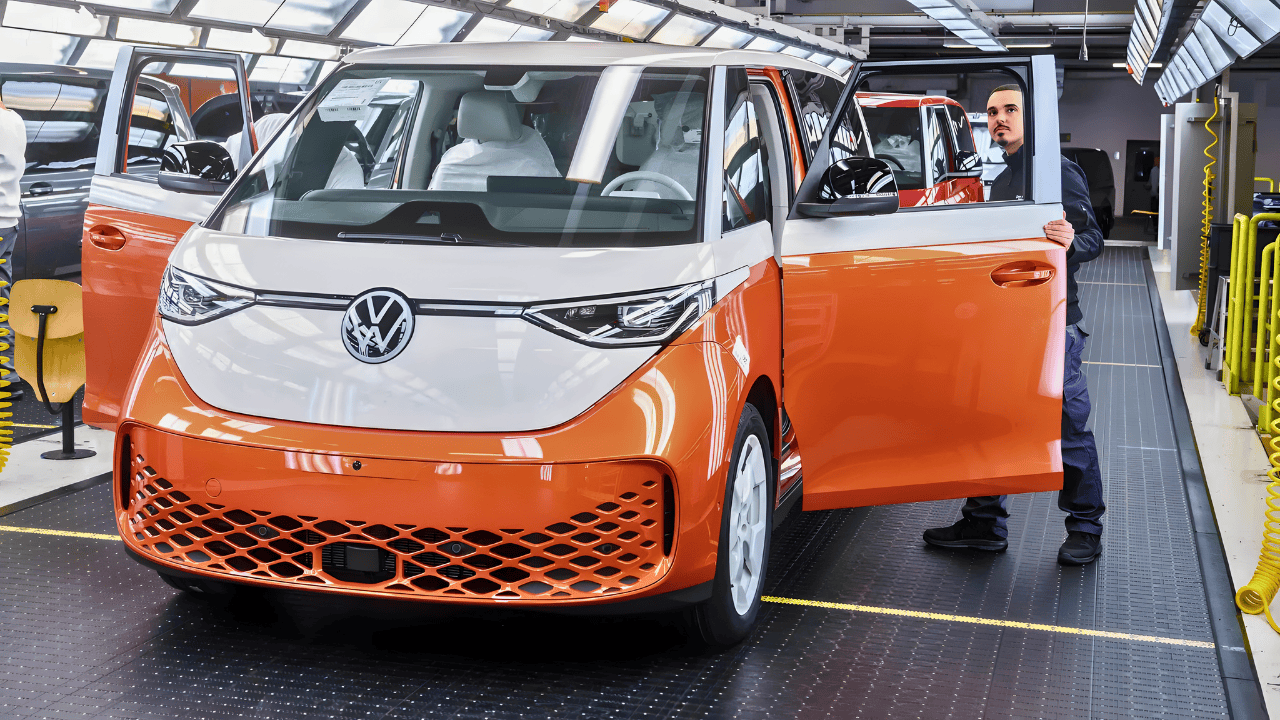

Built in Hanover, Germany, the van incurred higher U.S. import tariffs under President Trump’s second term. April 2025 duties rose to 25%, later adjusted to approximately 15% via an August accord—still adding thousands per unit over prior 2.5% rates.

Industry-Wide Pullback

The ID. Buzz pause echoes moves by rivals. Ford ended F-150 Lightning production after 2025 on December 15, booking a $19.5 billion charge amid $13 billion in EV losses since 2023. Nissan halted 2026 U.S. Ariya SUV production in September despite 24% sales growth, citing tariffs and pricing. Acura discontinued the ZDX after registrations fell 63% to 404 units in September.

Policy shifts under the Trump administration eliminated new and used EV credits, cut Corporate Average Fuel Economy standards to 34.5 mpg by 2031 from 50 mpg, and stopped charging infrastructure funds. Penalties for missing efficiency targets vanished in December 2025 revisions. General Motors took a $1.6 billion charge to shift capacity to hybrids and gas engines, investing $4 billion in retooling. Stellantis revived the Hemi V8, dropped base EV Charger models, and delayed the Ramcharger hybrid to late 2026.

Uncertain Path Ahead

Dealers bore heavy costs from the 2,600 unsold ID. Buzz units, worth $156-$182 million in floorplan debt. With dealer floorplan financing rates typically ranging from 4-10% in the current market, holding significant inventory meant substantial monthly carrying costs, forcing sales below cost. About 5,000 U.S. owners now hold a discontinued model with unclear parts and resale support. Volkswagen called the halt temporary to clear inventory and eyed a 2027 return but offered no details on specs, pricing, or production site.

The ID. Buzz, despite its 2025 North American Utility Vehicle of the Year award for nostalgic design, struggled in a mismatched market—too pricey for minivan shoppers seeking value and space, too limited for luxury EV buyers wanting superior range. PwC projects EVs at 19% of U.S. sales by 2030, favoring sub-$35,000 mass-market or over-$75,000 premium models. Policy swings clashing with 4-6 year development cycles left automakers with billions in stranded assets. Surviving EVs must excel in affordability or technology to navigate this volatile landscape.

Sources:

“VW confirms temporary US exit of the ID. Buzz.” Electrive, December 2025.

“Volkswagen ID. Buzz Skips U.S. Market for 2026.” Cars.com, December 2025.

“Ford scraps fully-electric F-150 Lightning as mounting losses.” ABC News/AP, December 2025.

“US electric vehicle sales crash after tax credit elimination.” EV Design and Manufacturing, October 2025.

“EV Market Monitor – November 2025.” Cox Automotive, December 2025.

“November 2025 new-vehicle sales decline as EV tax credit ends.” CBT News, December 2025.