On May 6, 2025, WeightWatchers filed for Chapter 11 bankruptcy protection in Delaware.

The company, now known as WW International, sought to eliminate approximately $1.15 billion in debt after years of financial decline accelerated by the rise of powerful prescription weight-loss drugs, such as Ozempic and Wegovy.

CEO Tara Comonte said the reorganization would allow WeightWatchers to emerge within about six weeks as a leaner, debt-reduced, publicly traded company.

Throughout the bankruptcy process, meetings, digital programs, and telehealth services would continue to operate normally.

Historic Origins

WeightWatchers started humbly in 1963. Jean Nidetch, a homemaker from Brooklyn who lost 72 pounds, began inviting friends over to discuss diet struggles and share support.

Her success proved the power of group accountability, leading to the creation of Weight Watchers International with partners Al and Felice Lippert. The business expanded rapidly and went public in 1968. By the early 1970s, WeightWatchers meetings were filling arenas, including a 1973 event at Madison Square Garden, which drew 16,000 attendees.

The company’s iconic points system became the foundation of modern diet culture, combining math and motivation into a single program millions could follow from living rooms and community centers around the world.

The GLP-1 Revolution

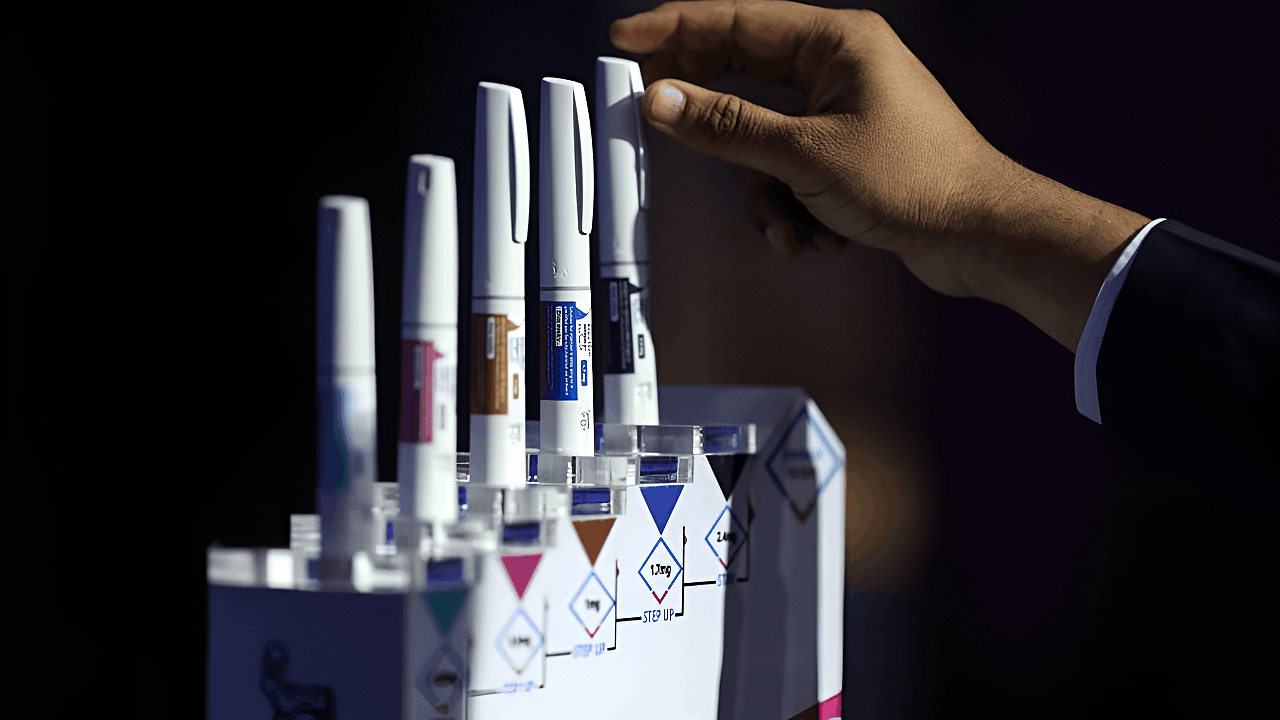

GLP-1 weight-loss medications, such as Ozempic, Wegovy, and Mounjaro, have disrupted the industry by mimicking gut hormones that reduce hunger and proving to be drastically more effective than traditional diet programs.

Clinical trials have shown that users can lose up to 20% of their body weight. In 2024 alone, sales of these medications totaled $26 billion, mainly from the U.S.

Analysts predict the global weight-loss drugs market could triple to $156 billion by 2030, with nearly one in ten Americans using them. In an environment where weekly injections delivered miracle-level results, traditional diet communities like WeightWatchers struggled to stay relevant.

Market Disruption

For decades, traditional programs such as Weight Watchers, Jenny Craig, and Noom have dominated the $76 billion weight-management industry, focusing on lifestyle changes.

Then came pharmaceutical disruption. Between 2023 and 2025, WeightWatchers lost over one million members as millions opted for medication instead of calorie tracking and point counting.

Membership fell from 3.8 million to 3.7 million, and the stock price collapsed by more than 99% from its 2018 peak. Americans were no longer seeking motivational meetings; they were seeking prescriptions.

The Bankruptcy Decision

When WeightWatchers entered bankruptcy in May 2025, its primary goal was survival. The plan aimed to wipe away 70% of its debt while allowing operations to continue.

Creditors supporting the move would take control, leaving shareholders with only a 9% ownership stake. CEO Tara Comonte assured members that all subscriptions would remain active and workshops would continue as usual.

The company’s reorganization plan was approved by mid-June, allowing it to exit bankruptcy officially by June 24.

Executives said the process provided an opportunity to rebuild and modernize its business around a hybrid model that blends digital tools, personal coaching, and medical partnerships.

Job Losses Mount

The decline wasn’t sudden; it unfolded over years of downsizing. Between 2020 and 2024, Weight Watchers underwent multiple waves of layoffs. In 2020, during the pandemic, roughly 4,500 employees were dismissed, many via mass Zoom calls.

In 2023, an additional 2,000 staff members lost their jobs, followed by cuts at the director and executive levels the following year. Between 2023 and 2024, the global workforce declined by nearly a quarter.

For decades, people viewed WeightWatchers as a purpose-driven organization; however, the company’s decision to cut thousands of life coaches, dietitians, and long-serving employees made many feel that it had lost its soul.

Regional Impact

Although WeightWatchers operates globally, people across the country felt the pain. The most significant losses came at the company headquarters in New York City and among coaches who hosted in-person meetings.

Those workshops, once the heart of WeightWatchers’ community approach, became less frequent after 2020. By the end of 2024, interest in them had dropped 20%, leaving many leaders out of work. Layoffs affected developers, researchers, and customer service personnel alike, illustrating the company’s profound impact at every operational level.

Many former employees said their greatest sadness wasn’t financial, but rather losing an organization devoted to improving lives.

CEO Turnover

Leadership instability compounded the crisis. CEO Sima Sistani, hired in 2022 after leading the social networking app Houseparty, resigned in September 2024 following the failure of her aggressive digital overhaul and telehealth push to reverse the company’s losses.

She had championed the $106 million acquisition of Sequence, a platform prescribing popular GLP-1 drugs. After she left, interim CEO Tara Comonte took the helm.

She guided the company through bankruptcy with a message of coexistence rather than competition with medications: “Behavioral support remains critical,” she said, “because drugs alone cannot teach sustainable habits.”

Oprah’s Exit

Another symbolic blow came in early 2024 when Oprah Winfrey, whose 2015 board involvement had revived the company, resigned.

Her departure, announced just before she hosted a special on weight-loss drugs, triggered a 25% stock drop in a single day and nearly 70% over the following month.

Winfrey explained she wanted to “speak freely” about GLP-1 medications without conflict of interest. She donated her entire 1.1 million shares to the National Museum of African American History and Culture.

Many observers saw her exit not just as a corporate decision, but as a cultural one — signaling the end of the motivational-diet era she had helped personify.

The Acquisition Gamble

In March 2023, Sistani had pinned the company’s turnaround hopes on acquiring Sequence, a telehealth startup that enables patients to access GLP-1 prescriptions online.

Costing $106 million, it promised to modernize WeightWatchers, transforming it into a medical service provider. Initially, investors were enthusiastic about the plan, and stock prices doubled. But the optimism didn’t last. Integration missteps and unforeseen costs eroded profit margins.

By 2024, while the Sequence business grew rapidly, its higher operating costs failed to offset plunging revenue from traditional memberships. The move intended to save WeightWatchers ultimately accelerated its exposure to a rapidly shifting industry.

Compounded Drug Strategy

By October 2024, WeightWatchers had pivoted even further into medicine, selling compounded semaglutide — a cheaper, pharmacy-made version of drugs like Ozempic. Prices began at $129 a month.

Demand was enormous due to nationwide drug shortages, and the service proved to be an unexpected success.

However, in early 2025, the FDA tightened restrictions on compounding facilities, forcing WeightWatchers to discontinue its compounded offerings by May.

Without that revenue stream, its foray into the pharmaceutical niche faltered, illustrating how fragile its recovery strategy was.

Financial Hemorrhaging

By 2024, weight-loss drugs had inflicted severe financial damage. WeightWatchers’ annual revenue dropped to roughly $786 million while net losses ballooned to $346 million.

Revenue from traditional memberships declined sharply, as most consumers opted for GLP-1 alternatives or more affordable, app-based diet trackers.

Although cost-cutting improved profit margins slightly, it was unable to offset the decline in membership. By early 2025, the company reported another 10% drop, confirming it couldn’t sustain operations under its debt load.

Subscription Collapse

The collapse was worst in WeightWatchers’ workshops and hybrid subscriptions, down 23%. The total number of subscribers fell to 3.7 million in late 2024 and continued to decline into 2025.

By contrast, its clinical programs for users of GLP-1 medication grew 164% in a year, from a tiny base. The numbers told the story: even impressive clinic growth couldn’t counteract the massive losses from its old membership format.

Competitors like Noom, TikTok fitness influencers, and free calorie-tracking apps siphoned away its core customers, leaving WeightWatchers without its signature sense of community or brand loyalty.

Restructuring Response

Through bankruptcy filings, CEO Comonte insisted the company still had a unique identity worth saving. She argued that “lasting health comes from combining science with behavior change”, a balance neither pills nor pure motivation could achieve alone.

Post-bankruptcy, the company streamlined its subscription offerings: Digital at $23 per month, Workshops + Digital at $45, and the new WeightWatchers Clinic, starting at $84 for members who pair their medical prescriptions with coaching.

Management cited studies showing that members who attended at least three workshops per month lost twice as much weight, reinforcing the brand’s signature community-driven model.

Industry Precedent

WeightWatchers was not alone in its crisis. Jenny Craig shut down all operations in 2023, crushed by the same drug-fueled disruption. Gyms and wellness companies also adjusted.

Equinox launched “Fit While Medicated” programs for GLP-1 users seeking to manage muscle loss. At the same time, telehealth startups like Ro, Calibrate, and Hims dominated the pharmaceutical side with sleek digital-only models.

The entire industry was being rewritten around medication, leaving older diet programs to either partner with or perish before the new pharmaceutical giants.

Regulatory Landscape

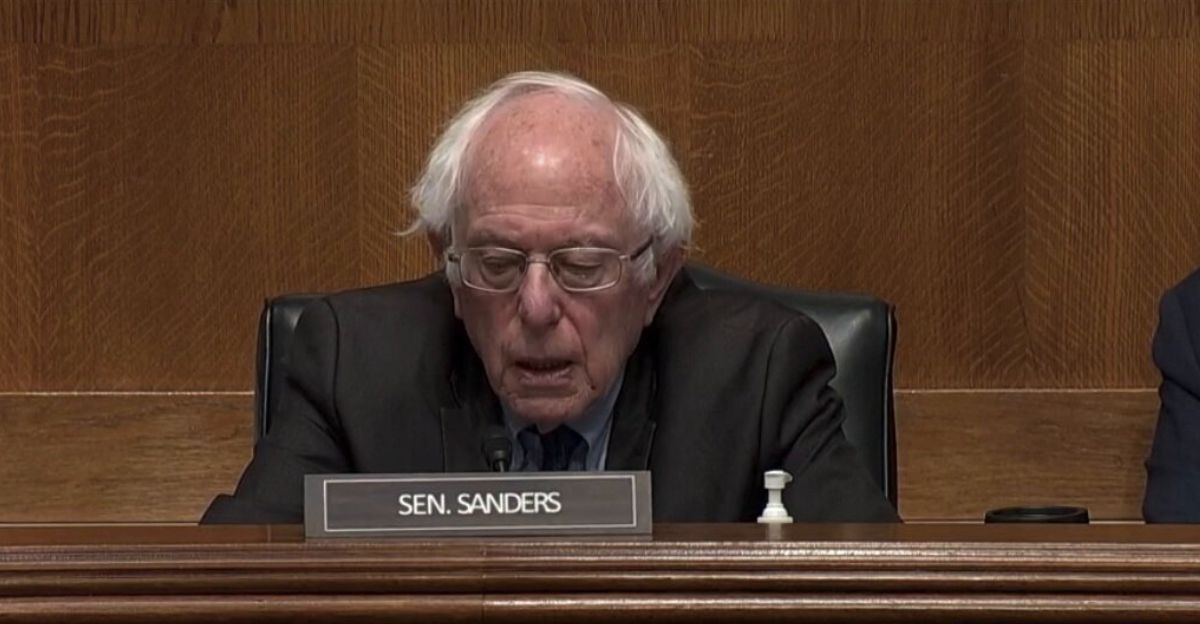

The government took notice when Senator Bernie Sanders warned in mid-2024 that soaring national GLP-1 use could overwhelm Medicare budgets unless companies lowered prices.

He argued publicly that these drugs, at $1,000–1,500 a month, might “bankrupt healthcare.” At the same time, the Biden administration proposed expanding Medicare and Medicaid coverage for obesity medications, potentially reaching millions more patients.

The FDA continued cracking down on unsafe compounded drugs, pushing companies like WeightWatchers to abandon their compounding operations entirely by May 2025. Legal and economic pressure surrounding the weight-loss industry was mounting fast.

Economic Ripple Effects

The popularity of these medications has already reshaped entire sectors of the economy. Food companies report slowing snack sales.

Alcohol consumption has dipped among regular users of Ozempic, as their appetite and cravings decline. Analysts project that the snack and beverage industries could lose billions in revenue as more people rely on appetite-suppressing drugs.

In Denmark, home to Ozempic maker Novo Nordisk, the economic boom resulting from the success of GLP-1 now accounts for a significant portion of the national GDP. The ripple effect is visible everywhere and shows no signs of slowing.

Public Perception Shift

Culturally, the conversation surrounding weight loss has undergone a significant transformation. Once associated with personal discipline, obesity is now increasingly seen as a chronic medical issue.

The hashtag #Ozempic has amassed billions of TikTok views, as doctors, celebrities, and influencers debate the ethics and side effects of medicalized weight loss.

Oprah Winfrey’s public advocacy for these drugs helped destigmatize a once-taboo topic. The result: weight loss is no longer portrayed as a struggle of willpower, but rather as a treatable condition, similar to diabetes.

Historical Parallels

Observers often compare WeightWatchers’ bankruptcy to other business collapses caused by technological disruption.

Blockbuster lost to Netflix. Kodak failed to adapt to digital cameras. WeightWatchers’ legacy model couldn’t compete with fast-acting medical solutions. Ironically, it tried to adapt by entering the very pharmaceutical market that destroyed its foundation.

Whether the post-bankruptcy WeightWatchers can survive as a support companion for GLP-1 users remains uncertain.

Final Chapter

After six decades, WeightWatchers’ bankruptcy marks the end of an era when losing weight meant joining a meeting instead of taking a shot.

The company that inspired millions through shared accountability and lifestyle change could not beat medications that deliver double-digit body weight loss without the same effort.

Yet supporters believe the redesigned WeightWatchers could pioneer a new role bridging behavioral science and pharmaceutical care. Still, it faces an uphill battle against faster, cheaper, and trendier alternatives.

Whether it thrives or fades will determine if motivation-based weight loss still has a place in a world defined by prescription solutions.